Form 1041me-Ext - Extension Payment Voucher For Fiduciary Income Tax - 2002

ADVERTISEMENT

SCHEDULE A INSTRUCTIONS, continued

A credit is available for contributors to family development

Attach a copy of the certificate when claiming this credit. For

matching fund accounts. The credit per tax return is equal to the

questions about quality child care and the certification process,

lesser of $25,000 or 50% of the amount contributed. The credit is

call DHS, Office of Child Care and Head Start at (207) 287-5099.

limited to the tax liability on the return and must be taken after the

allowance of all other credits. Maine itemized deductions must

Line 23. ALLOWABLE CREDITS. These credits are not refundable.

exclude any contributions claimed for this credit. The aggregate

The total credits claimed cannot exceed the Maine Fiduciary

allowable credit amount in a state fiscal year is limited to $200,000.

Income Tax otherwise due for the taxable year.

The Finance Authority of Maine is required to certify the allowable

credit for each contributor. The credit applies to tax years beginning

*

Complete the worksheets at

on or after January 1, 2000. 36 M.R.S.A. § 5216-C.

when claiming any of these credits. Attach the worksheet(s) to

the Maine return.

Line 20. QUALITY CHILD-CARE INVESTMENT TAX CREDIT*.

Corporations and partnerships making certified quality child-care

investments qualify for a credit equal to 30% of up to $30,000 of

eligible expenditures. Individual taxpayers making certified quality

child care investments of no less than $10,000 qualify for a credit

equal to $1,000 each year for 10 years, plus $10,000 at the end of

the 10-year period. The credit is nonrefundable; however, unused

credit amounts may be carried forward until exhausted. The Maine

Department of Human Services (“DHS”), Office of Child Care and

Head Start certifies eligible investments.

SCHEDULE NR INSTRUCTIONS

Schedule NR is used to determine the Maine taxable income of a

Lines 1a - 1g. Enter in column A income, gain or loss as reported

nonresident estate or trust. Generally, Maine taxable income of a

on federal Form 1041. Enter in column B amounts derived from

nonresident estate or trust is the Maine-source portion of its federal

or connected with sources in Maine (see 36 M.R.S.A. § 5142

taxable income. The nonresident beneficiaries are taxed on their

[nonresident taxable income] and MRS Rule 806 [nonresident

share of the Maine-source distributable net income. Resident

individual income tax]). Enter non-Maine source income in column C.

beneficiaries are taxed on their entire share of the trust or estate

income as though the trust or estate were resident.

Step 1. Complete Schedule NR, lines 1-5.

Step 2. Complete Schedule 2 on Form 1041ME, page 2.

Step 3. Complete Schedule NR, lines 6 and 7.

Step 4. Complete Form 1041ME, page 1.

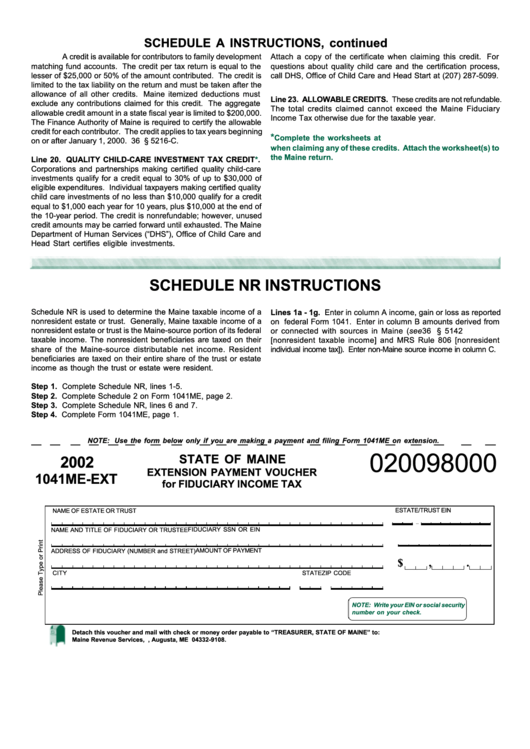

NOTE: Use the form below only if you are making a payment and filing Form 1041ME on extension.

020098000

STATE OF MAINE

2002

EXTENSION PAYMENT VOUCHER

1041ME-EXT

for FIDUCIARY INCOME TAX

ESTATE/TRUST EIN

NAME OF ESTATE OR TRUST

-

FIDUCIARY SSN OR EIN

NAME AND TITLE OF FIDUCIARY OR TRUSTEE

AMOUNT OF PAYMENT

ADDRESS OF FIDUCIARY (NUMBER and STREET)

$

,

.

CITY

STATE

ZIP CODE

NOTE: Write your EIN or social security

number on your check.

Detach this voucher and mail with check or money order payable to “TREASURER, STATE OF MAINE” to:

Maine Revenue Services, P.O. Box 9108, Augusta, ME 04332-9108.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1