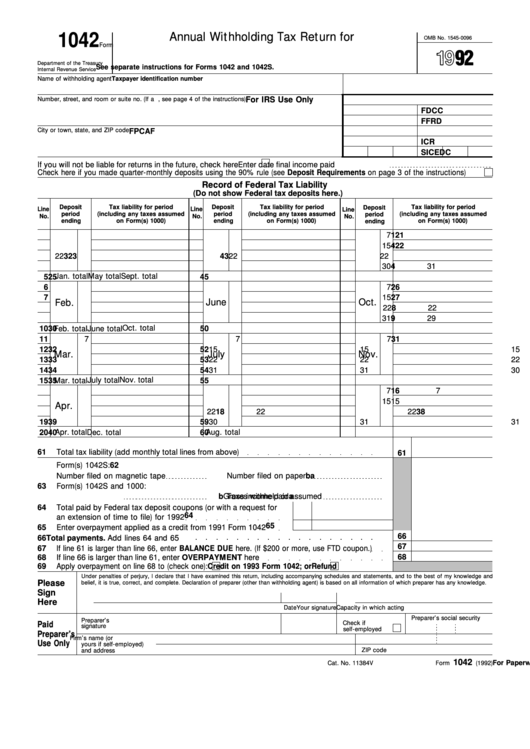

Form 1042 - Annual Withholding Tax Return For U.s. Source Income Of Foreign Persons - 1992

ADVERTISEMENT

1042

Annual Withholding Tax Return for

OMB No. 1545-0096

Form

U.S. Source Income of Foreign Persons

Department of the Treasury

See separate instructions for Forms 1042 and 1042S.

Internal Revenue Service

Name of withholding agent

Taxpayer identification number

For IRS Use Only

Number, street, and room or suite no. (If a P.O. box, see page 4 of the instructions)

CC

FD

RD

FF

City or town, state, and ZIP code

CAF

FP

CR

I

EDC

SIC

If you will not be liable for returns in the future, check here

Enter date final income paid

Check here if you made quarter-monthly deposits using the 90% rule (see Deposit Requirements on page 3 of the instructions)

Record of Federal Tax Liability

(Do not show Federal tax deposits here.)

Deposit

Tax liability for period

Deposit

Tax liability for period

Deposit

Tax liability for period

Line

Line

Line

period

(including any taxes assumed

period

(including any taxes assumed

(including any taxes assumed

period

No.

No.

No.

ending

on Form(s) 1000)

ending

on Form(s) 1000)

on Form(s) 1000)

ending

1

7

21

7

41

7

2

15

22

15

42

15

Jan.

May

Sept.

3

22

23

22

43

22

4

31

24

31

44

30

Jan. total

May total

Sept. total

5

25

45

6

7

26

7

46

7

7

15

27

15

47

15

June

Oct.

Feb.

8

22

28

22

48

22

9

29

29

30

49

31

Oct. total

10

Feb. total

30

June total

50

11

7

31

7

51

7

12

15

32

15

52

15

Mar.

July

Nov.

13

22

33

22

53

22

14

31

34

31

54

30

Nov. total

July total

15

Mar. total

35

55

16

7

36

7

56

7

17

15

37

15

57

15

Apr.

Aug.

Dec.

18

22

38

22

58

22

19

30

39

31

59

31

Apr. total

Aug. total

20

40

60

Dec. total

61

Total tax liability (add monthly total lines from above)

61

62

Form(s) 1042S:

a

Number filed on magnetic tape

b

Number filed on paper

63

Form(s) 1042S and 1000:

a

Gross income paid

b

Taxes withheld or assumed

64

Total paid by Federal tax deposit coupons (or with a request for

64

an extension of time to file) for 1992

65

65

Enter overpayment applied as a credit from 1991 Form 1042

66

66

Total payments. Add lines 64 and 65

67

67

If line 61 is larger than line 66, enter BALANCE DUE here. (If $200 or more, use FTD coupon.)

68

68

If line 66 is larger than line 61, enter OVERPAYMENT here

69

Apply overpayment on line 68 to (check one):

Credit on 1993 Form 1042; or

Refund

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

Please

belief, it is true, correct, and complete. Declaration of preparer (other than withholding agent) is based on all information of which preparer has any knowledge.

Sign

Here

Your signature

Date

Capacity in which acting

Date

Preparer’s social security no.

Preparer’s

Paid

Check if

signature

self-employed

Preparer’s

Firm’s name (or

E.I. No.

Use Only

yours if self-employed)

ZIP code

and address

1042

For Paperwork Reduction Act Notice, see page 1 of the instructions.

Cat. No. 11384V

Form

(1992)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1