Print and Reset Form

Reset Form

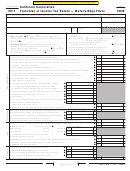

Schedule D California Capital Gains and Losses

Part I Short-Term Capital Gains and Losses – Assets Held One Year or Less. Use additional sheet(s) if necessary.

(f)

(a)

(b)

(c)

(d)

(e)

Gain (loss)

Kind of property and description

Date acquired

Date sold

Gross sales price

Cost or other basis

(d) less (e)

(Example, 100 shares of Z Co.)

(mo., day, yr.)

(mo., day, yr.)

plus expense of sale

1

2 Short-term capital gain from installment sales from form FTB 3805E, line 26 or line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Unused capital loss carryover from 2001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Net short-term capital gain (loss). Combine line 1 through line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Part II Long-Term Capital Gains and Losses – Assets Held More Than One Year. Use additional sheet(s) if necessary.

5

6 Enter gain from Schedule D-1, line 9 and/or any capital gain distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Long-term capital gain from installment sales from form FTB 3805E, line 26 or line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Net long-term capital gain (loss). Combine line 5 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Enter excess of net short-term capital gain (line 4) over net long-term capital loss (line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Net capital gain. Enter excess of net long-term capital gain (line 8) over net short-term capital loss (line 4) . . . . . . . . . . . . . . . .

10

11 Total lines 9 and 10. Enter here and on Form 100W, Side 1, line 5. Note: If losses exceed gains, carry forward losses to 2003

11

Schedule J Add-On Taxes and Recapture of Tax Credits. See instructions.

¼

1 LIFO recapture due to S corporation election, IRC Sec. 1363(d) deferral: $____________________ . . . . . . . . . . . . . . . . . .

1

¼

2 Interest computed under the look-back method for completed long-term contracts (Attach form FTB 3834) . . . . . . . . . . . .

2

¼

3 Interest on tax attributable to installment:

a Sales of certain timeshares and residential lots . . . . . . . . . . . . . . . . . . . . . . . .

3a

¼

b Method for nondealer installment obligations . . . . . . . . . . . . . . . . . . . . . . . . .

3b

¼

4 IRC Section 197(f)(9)(B)(ii) election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

¼

5 Credit recapture name:_____________________________________________________________________ . . . . . . .

5

6 Combine line 1 through line 5, revise Side 1, line 37 or line 38, whichever applies, by this amount. Write

¼

“Schedule J” to the left of line 37 or line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

N How many affiliates in the combined report are claiming

Questions (continued from Side 1)

¼

¼

immunity from taxation in California under Public Law 86-272?

_____________________

E Principal business activity code. (Do not leave blank): . . . .

¼

Business activity __________________________________________________________

O Corporation headquarters are:

(1)

Within California

(2)

Outside of California, within the U.S.

(3)

Outside of the U.S.

Product or service ________________________________________________________

¼

P Location of principal accounting records _________________________________________

F Date incorporated:_____________

Where: State

Country_____________

¼

Q Accounting method:

(1)

Cash

(2)

Accrual

(3)

Other

G Date business began in California or date income was first derived from

¼

California sources

______________________________________________________

R Did this corporation or one of its subsidiaries make a federal election

¼

to be treated as a foreign sales corporation (FSC) or a domestic

H First return?

Yes

No If “Yes” and this corporation is a successor to a

international sales corporation (DISC)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

previously existing business, check the appropriate box.

¼

¼

S Is this corporation or any of its subsidiaries a RIC ? . . . . . . . . . . . . . . . . . .

Yes

No

(1)

sole proprietorship (2)

partnership (3)

joint venture (4)

corporation

¼

T Is this corporation treated as a REMIC for California purposes? . . . . . . . .

Yes

No

(5)

other (attach statement showing name, address, and FEIN of previous business)

¼

¼

U Is this corporation a REIT for California purposes? . . . . . . . . . . . . . . . . . .

Yes

No

I

“Doing business as” name:

_____________________________________________

V Is this corporation an LLC or limited partnership electing to be taxed

J Did this corporation or its subsidiary(ies) have a change in control or ownership,

¼

¼

or acquire ownership or control of any other legal entity this year? . . . . . .

Yes

No

as a corporation for federal purposes? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

¼

W Is this corporation to be treated as a credit union? . . . . . . . . . . . . . . . . . .

Yes

No

K At any time during the taxable year, was more than 50% of the voting stock:

¼

X Is the corporation under audit by the IRS or

a Of the corporation owned by any single interest? . . . . . . . . . . . . . .

Yes

No

¼

¼

has it been audited by the IRS in a prior year? . . . . . . . . . . . . . . . . . . . . . .

Yes

No

b Of another corporation owned by this corporation? . . . . . . . . . . . .

Yes

No

c Of this and one or more other corporations owned or controlled,

Y Have all required information returns (e.g. federal Forms 1099, 5471,

¼

5472, 8300, 8865, etc.) been filed with the Franchise Tax Board? . . .

N/A

Yes

No

directly or indirectly, by the same interests? . . . . . . . . . . . . . . . . . .

Yes

No

¼ ______________

Z Were total receipts (see page 17 of the instructions) for the taxable year

If a or c is “Yes,” enter the country of the ultimate parent

and total assets at the end of the taxable year less than $250,000? . . . . . . .

Yes

No

If a, b, or c is “Yes,” furnish a statement of ownership indicating pertinent names,

addresses, and percentages of stock owned. If any owner is an individual, provide

If “Yes” the corporation is not required to complete Schedules L,

M-1, and M-2 on Side 4. Instead, enter here the total amount of cash

the SSN.

distributions and the book value of property distributions (other than

L Was 50% or more of the stock of this corporation owned directly by

¼

cash) made during the tax year. $ ______________________________________________

another corporation during this taxable year? . . . . . . . . . . . . . . . . . . . . .

Yes

No

¼

M Is this corporation apportioning income to California using Schedule R?

Yes

No

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

Please

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Signature

Here

¼

of officer

Title

Date

Telephone (

)

¼

Preparer’s SSN/PTIN

Date

Check if self-

Preparer’s

signature

employed

¼

Paid

FEIN

Preparer’s

-

Firm’s name (or yours,

Use Only

if self-employed)

and address

¼

Telephone (

)

Side 2 Form 100W

2002

100W02203

C1

For Privacy Act Notice, get form FTB 1131.

1

1 2

2 3

3 4

4