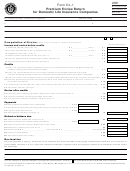

Schedule A. Income Apportionment

11a Mass. premiums (NAIC Annual Statement Schedule T, line 22, cols. 3, 4 & 5*) . . . . . . 1a

$

11b Premiums in jurisdictions where no insurance tax is paid (Schedule T, cols. 3, 4 & 5) 1b

12 Add lines 1a and 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

$

13 Total premiums (Schedule T, line 94, cols. 3, 4 & 5*) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Adjustments to total premiums (from Schedule T, cols. 3, 4 and 5)

a Dividends to purchase paid-up additions and annuities (line 91). . . . . . . . . . . . . . . . 4a

b Dividends to shorten endowment or premium paying period (line 92). . . . . . . . . . . . 4b

c Considerations waived under contract provisions (line 93) . . . . . . . . . . . . . . . . . . . . 4c

d Add lines 4a through 4c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4d

15 Adjusted total premiums. Subtract line 4d from line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Massachusetts premium apportionment percentage. Divide line 2 by line 5 . . . . $ ________________ × 9 = . . . . . . . . . . . 6

%

17 Massachusetts wages, salaries, commissions and other remuneration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Total wages, salaries, commissions and other remuneration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Massachusetts payroll apportionment percentage. Divide line 7 by line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

%

10 Total apportionment percentage. Add line 6 and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

%

11 Massachusetts apportionment percentage. Divide line 10 by 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

%

12 Applicable apportionment percentage (line 11 or .20, whichever is less). Enter here and in Schedule C, line 8 . . . . . . . . . . . 12

%

*Exclude premiums for company employees’ group plans, if included.

Schedule B. Dividends Deduction

**

11 Total dividends (Pro Forma 1120L, Schedule A, lines 2a through 2e, multiplied by Schedule C, line 3, Pro Forma 1120L). . . . 1

12 Dividends from Massachusetts corporate trusts included in line 1 (attach schedule) . . . 2

13 Dividends from non-wholly-owned DISCs included in line 1 (attach schedule) . . . . . . . . 3

14 Dividends, if less than 15% of voting stock owned, included in line 1:

a On common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

b On preferred stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b

15 Total taxable dividends. Add lines 2 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Dividends deduction.* Subtract line 5 from line 1. Enter here and in Schedule C, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

*Attach schedule showing payers, amounts and percentage of voting stock owned by class of stock.

**Include separate account amounts in each line, if separately stated on Pro Forma 1120L.

Schedule C. Taxable Investment Income

**

11 Taxable investment income as shown in Schedule C, line 12, Pro Forma 1120L* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 State and municipal bond interest not included in line 1 (Schedule C, line 8b, Pro Forma 1120L). . . . . . . . . . . . . . . . . . . . . . . 2

13 Foreign, state or local income, franchise, excise, capital stock or premium taxes deducted from Federal

investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Dividends received deduction (Schedule C, line 9f, Pro Forma 1120L) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿4

15 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Dividends deduction (Schedule B, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿6

17 Income subject to apportionment. Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿7

18 Income apportionment percentage (Schedule A, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿8

%

19 Massachusetts taxable investment income. Multiply line 7 by line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

*Companies to which Section 22D of Chapter 63 of the Massachusetts General Laws applies must attach a reconciliation if the amount shown on this line

differs from Schedule C, line 12, Pro Forma 1120L.

**Include separate account amounts in each line, if separately stated on Pro Forma 1120L.

Form DL-2

1

1 2

2