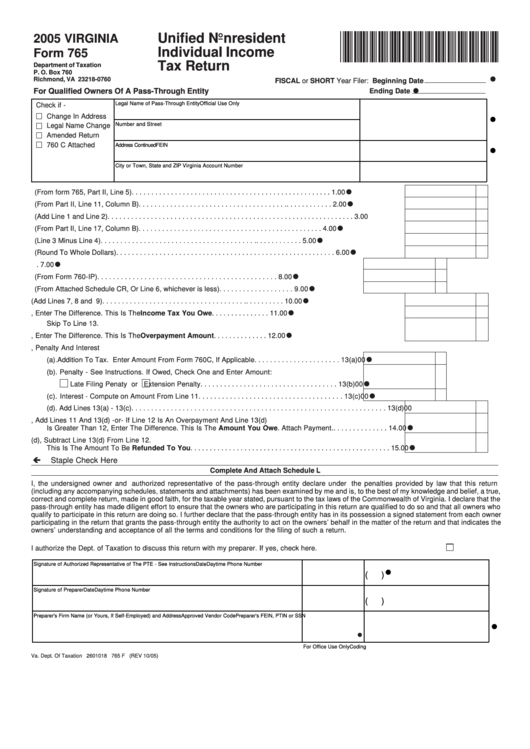

Form 765 - Unified Nonresident Individual Income Tax Return - 2005

ADVERTISEMENT

*VA0765105000*

Unified Nonresident

2005 VIRGINIA

Individual Income

Form 765

Tax Return

Department of Taxation

P. O. Box 760

w

Richmond, VA 23218-0760

FISCAL or SHORT Year Filer: Beginning Date

w

For Qualified Owners Of A Pass-Through Entity

Ending Date

Legal Name of Pass-Through Entity

Official Use Only

Check if -

Change In Address

w

Number and Street

Legal Name Change

Amended Return

760 C Attached

Address Continued

FEIN

w

City or Town, State and ZIP

Virginia Account Number

w

1. Virginia Income (From form 765, Part II, Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

00

w

2. Total Additions (From Part II, Line 11, Column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

00

3. Subtotal (Add Line 1 and Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

00

w

4. Total Subtractions (From Part II, Line 17, Column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

00

w

5. Virginia Taxable Income (Line 3 Minus Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

00

w

6. Amount Of Tax (Round To Whole Dollars) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

00

w

7. Estimated Tax Paid For Taxable Year 2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

00

w

8. Extension Payment (From Form 760-IP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

00

w

9. Total Credits (From Attached Schedule CR, Or Line 6, whichever is less) . . . . . . . . . . . . . . . . . . . 9.

00

w

10. Total Payments and Credits (Add Lines 7, 8 and 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

00

w

11. If Line 6 Is Greater Than Line 10, Enter The Difference. This Is The Income Tax You Owe . . . . . . . . . . . . . . . 11.

00

Skip To Line 13.

w

12. If Line 10 Is Greater Than Line 6, Enter The Difference. This Is The Overpayment Amount . . . . . . . . . . . . . . 12.

00

13. Addition To Tax, Penalty And Interest

w

(a). Addition To Tax. Enter Amount From Form 760C, If Applicable . . . . . . . . . . . . . . . . . . . . . . 13(a)

00

(b). Penalty - See Instructions. If Owed, Check One and Enter Amount:

w

Late Filing Penaty or

Extension Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13(b)

00

w

(c). Interest - Compute on Amount From Line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13(c)

00

(d). Add Lines 13(a) - 13(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13(d)

00

14. If You Owe Tax On Line 11, Add Lines 11 And 13(d) -or- If Line 12 Is An Overpayment And Line 13(d)

w

Is Greater Than 12, Enter The Difference. This Is The Amount You Owe. Attach Payment. . . . . . . . . . . . . . . 14.

00

15. If Line 12 Is Greater Than Line 13(d), Subtract Line 13(d) From Line 12.

w

This Is The Amount To Be Refunded To You . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

00

Staple Check Here

Complete And Attach Schedule L

I, the undersigned owner and authorized representative of the pass-through entity declare under the penalties provided by law that this return

(including any accompanying schedules, statements and attachments) has been examined by me and is, to the best of my knowledge and belief, a true,

correct and complete return, made in good faith, for the taxable year stated, pursuant to the tax laws of the Commonwealth of Virginia. I declare that the

pass-through entity has made diligent effort to ensure that the owners who are participating in this return are qualified to do so and that all owners who

qualify to participate in this return are doing so. I further declare that the pass-through entity has in its possession a signed statement from each owner

participating in the return that grants the pass-through entity the authority to act on the owners’ behalf in the matter of the return and that indicates the

owners’ understanding and acceptance of all the terms and conditions for the filing of such a return.

I authorize the Dept. of Taxation to discuss this return with my preparer. If yes, check here.

Signature of Authorized Representative of The PTE - See Instructions

Date

Daytime Phone Number

w

(

)

Signature of Preparer

Date

Daytime Phone Number

(

)

Preparer's Firm Name (or Yours, If Self-Employed) and Address

Approved Vendor Code

Preparer's FEIN, PTIN or SSN

w

w

For Office Use Only

Coding

Va. Dept. Of Taxation 2601018 765 F (REV 10/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3