Print

Clear

501X

Page 2

Georgia Form

Amended Fiduciary Income Tax Return

TAXPAYER’S FEIN

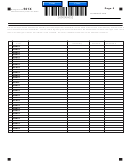

Schedule 1- Computation of Tax (continued)

12.

12. Previous refund(s), if any, shown on previous return(s)...................................................

13. Net (Line 11d minus Line 12)...........................................................................................

13.

14. Balance of tax due. If Line 10 exceeds Line 13, enter Line 10 less Line 13..................

14.

15.

15. Overpayment. If Line 13 exceeds Line 10, enter Line 13 less Line 10...........................

16. Amount from Line 15 to be credited to next year’s estimated tax....................................

16.

17. Interest............................................................................................................................

17.

18. Late payment penalty ...................................................................................................

18.

19. Late filing penalty .........................................................................................................

19.

20 .

20.

Penalty for underpayment of estimated tax (UET) .........................................................

21.

21 .

(If you owe) Add Lines 14, 17 thru 20. Make check payable to Georgia Department of Revenue.

(If you are due a refund) Subtract Lines 16 and 20 from Line 15. This is your refund................

22.

22.

Direct Deposit Options

22a

Routing

.

Direct Deposit

(For U.S. Accounts Only)

Type:

Checking

Number

See Instructions in the IT-511 booklet for further

Account

details. If you do not select Direct Deposit, a paper

Savings

Number

check will be issued.

DECLARATION:I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of my/our

knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has

knowledge. Georgia Public Revenue Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United States, free of any expense to the State of Georgia.

EXPLANATIONS OF CHANGES: Provide an explanation of changes below. Attach any supporting documents and schedules.

SIGNATURE OF FIDUCIARY

DATE

PHONE NUMBER

SIGNATURE OF PREPARER OTHER THAN FIDUCIARY

DATE

PREPARER’S IDENTIFICATION NUMBER

NAME OF PREPARER OTHER THAN FIDUCIARY

PHONE NUMBER

Department Use Only

I authorize Georgia Department of Revenue to electroni-

cally notify me at the below email address regarding any

updates to my account(s).

FIDUCIARY EMAIL ADDRESS

THE FIDUCIARY MUST ATTACH TO THIS RETURN A COPY OF ITS FEDERAL RETURN AND SUPPORTING SCHEDULES

1

1 2

2 3

3 4

4 5

5