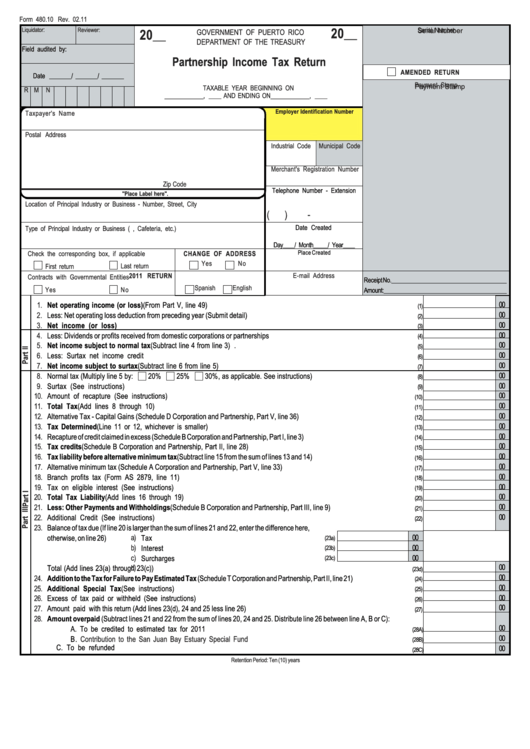

Form 480.10 - Partnership Income Tax Return - 2011

ADVERTISEMENT

Form 480.10 Rev. 02.11

:

20__

Liquidator

Reviewer:

Serial Number

Serial Number

20__

GOVERNMENT OF PUERTO RICO

DEPARTMENT OF THE TREASURY

Field audited by:

Partnership Income Tax Return

AMENDED RETURN

Date _______/ _______/ _______

Payment Stamp

Payment Stamp

TAXABLE YEAR BEGINNING ON

R

M

N

__________

__________

, ____ AND ENDING ON

, ____

Employer Identification Number

Taxpayer's Name

Postal Address

Industrial Code

Municipal Code

Merchant's Registration Number

Zip Code

Telephone Number - Extension

"Place Label here".

Location of Principal Industry or Business - Number, Street, City

(

)

-

Date Created

Type of Principal Industry or Business (i.e. Hardware, Cafeteria, etc.)

Day____/ Month_____/ Year____

Check the corresponding box, if applicable

CHANGE OF ADDRESS

Place Created

Yes

No

Last return

First return

E-mail Address

2011 RETURN

Contracts with Governmental Entities

__________________________________

Receipt No.

Spanish

English

_____________________________________

Yes

No

Amount:

00

1.

Net operating income (or loss) (From Part V, line 49) .............................................................................................................

(1)

00

2.

Less: Net operating loss deduction from preceding year (Submit detail) .........................................................................................

(2)

00

3.

Net income (or loss) .......................................................................................................................................................

(3)

00

4.

Less: Dividends or profits received from domestic corporations or partnerships .............................................................................

(4)

00

5.

Net income subject to normal tax (Subtract line 4 from line 3) .................................................................................................

(5)

00

6.

Less: Surtax net income credit ............................................................................................................................................

(6)

00

7.

Net income subject to surtax (Subtract line 6 from line 5) .......................................................................................................

(7)

00

8.

Normal tax (Multiply line 5 by:

20%

25%

30%, as applicable. See instructions) .......................................................

(8)

00

9.

Surtax (See instructions)....................................................................................................................................................

(9)

00

10.

Amount of recapture (See instructions)..................................................................................................................................

(10)

00

11.

Total Tax (Add lines 8 through 10) .......................................................................................................................................

(11)

00

12.

Alternative Tax - Capital Gains (Schedule D Corporation and Partnership, Part V, line 36) .............................................................

(12)

00

13.

Tax Determined (Line 11 or 12, whichever is smaller) ............................................................................................................

(13)

00

14.

Recapture of credit claimed in excess (Schedule B Corporation and Partnership, Part I, line 3) ...........................................................

(14)

00

15.

Tax credits (Schedule B Corporation and Partnership, Part II, line 28) .......................................................................................

(15)

00

16.

Tax liability before alternative minimum tax (Subtract line 15 from the sum of lines 13 and 14)......................................................

(16)

00

17.

Alternative minimum tax (Schedule A Corporation and Partnership, Part V, line 33) ......................................................................

(17)

00

18.

Branch profits tax (Form AS 2879, line 11) .............................................................................................................................

(18)

00

19.

Tax on eligible interest (See instructions) ................................................................................................................................

(19)

00

20.

Total Tax Liability (Add lines 16 through 19) .........................................................................................................................

(20)

00

21.

Less: Other Payments and Withholdings (Schedule B Corporation and Partnership, Part III, line 9) ...........................................

(21)

00

22.

Additional Credit (See instructions) .......................................................................................................................................

(22)

23.

Balance of tax due (If line 20 is larger than the sum of lines 21 and 22, enter the difference here,

00

otherwise, on line 26)

a)

Tax ......................................................................................

(23a)

b)

00

Interest .................................................................................

(23b)

c)

Surcharges ...........................................................................

00

(23c)

00

d)

Total (Add lines 23(a) through 23(c)) ........................................................................................

(23d)

00

24.

Addition to the Tax for Failure to Pay Estimated Tax (Schedule T Corporation and Partnership, Part II, line 21) ................................

(24)

00

25.

Additional Special Tax (See instructions) ...........................................................................................................................

(25)

00

26.

Excess of tax paid or withheld (See instructions) ....................................................................................................................

(26)

00

27.

Amount paid with this return (Add lines 23(d), 24 and 25 less line 26) ..........................................................................................

(27)

28.

Amount overpaid (Subtract lines 21 and 22 from the sum of lines 20, 24 and 25. Distribute line 26 between line A, B or C):

00

A. To be credited to estimated tax for 2011 .............................................................................................................

(28A)

00

B.

Contribution to the San Juan Bay Estuary Special Fund ......................................................................................

(28B)

00

C. To be refunded .....................................................................................................................................................

(28C)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4