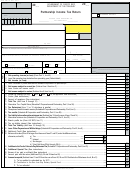

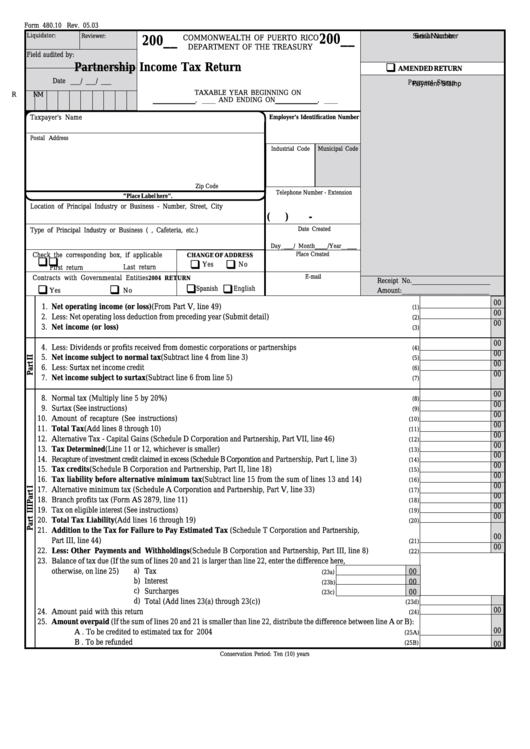

Form 480.10 - Partnership Income Tax Return

ADVERTISEMENT

Form 480.10 Rev. 05.03

:

Liquidator

Reviewer:

Serial Number

Serial Number

200__

COMMONWEALTH OF PUERTO RICO

200__

DEPARTMENT OF THE TREASURY

Field audited by:

q

Partnership Income Tax Return

AMENDED RETURN

Date ___/ ___/ ___

Payment Stamp

Payment Stamp

TAXABLE YEAR BEGINNING ON

R

M

N

__________

__________

, ____ AND ENDING ON

, ____

Taxpayer's Name

Employer's Identification Number

Postal Address

Industrial Code

Municipal Code

Zip Code

Telephone Number - Extension

"Place Label here".

Location of Principal Industry or Business - Number, Street, City

(

)

-

Date Created

Type of Principal Industry or Business (i.e. Hardware, Cafeteria, etc.)

Day____/ Month____/Year_____

Place Created

Check the corresponding box, if applicable

CHANGE OF ADDRESS

q

q

q

q

Yes

No

Last return

First return

E-mail

Contracts with Governmental Entities

2004 RETURN

____________________

Receipt No.

q

q

q

q

Spanish

English

______________________

Yes

No

Amount:

00

1.

Net operating income (or loss) (From Part V, line 49) .................................................................................................

(1)

00

2.

Less: Net operating loss deduction from preceding year (Submit detail) ..........................................................................

(2)

00

3.

Net income (or loss) .......................................................................................................................................................

(3)

00

4.

Less: Dividends or profits received from domestic corporations or partnerships ............................................................

(4)

00

5.

Net income subject to normal tax (Subtract line 4 from line 3) ...................................................................................

(5)

00

6.

Less: Surtax net income credit ..........................................................................................................................................

(6)

00

7.

Net income subject to surtax (Subtract line 6 from line 5) ...........................................................................................

(7)

00

8.

Normal tax (Multiply line 5 by 20%)...............................................................................................................................

(8)

00

9.

Surtax (See instructions)....................................................................................................................................................

(9)

00

10.

Amount of recapture (See instructions)..........................................................................................................................

(10)

00

11.

Total Tax (Add lines 8 through 10) ................................................................................................................................

(11)

00

12.

Alternative Tax - Capital Gains (Schedule D Corporation and Partnership, Part VII, line 46) ........................................

(12)

00

13.

Tax Determined (Line 11 or 12, whichever is smaller) .................................................................................................

(13)

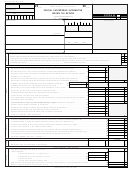

00

14.

Recapture of investment credit claimed in excess (Schedule B Corporation and Partnership, Part I, line 3) ...........................

(14)

00

15.

Tax credits (Schedule B Corporation and Partnership, Part II, line 18) .....................................................................

(15)

00

16.

Tax liability before alternative minimum tax (Subtract line 15 from the sum of lines 13 and 14) .......................

(16)

00

17.

Alternative minimum tax (Schedule A Corporation and Partnership, Part V, line 33) ................................................

(17)

00

18.

Branch profits tax (Form AS 2879, line 11) .................................................................................................................

(18)

00

19.

Tax on eligible interest (See instructions) .......................................................................................................................

(19)

00

20.

Total Tax Liability (Add lines 16 through 19) ..............................................................................................................

(20)

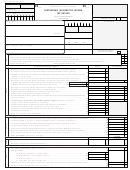

21.

Addition to the Tax for Failure to Pay Estimated Tax (Schedule T Corporation and Partnership,

00

Part III, line 44) ................................................................................................................................................................

(21)

00

22.

Less: Other Payments and Withholdings (Schedule B Corporation and Partnership, Part III, line 8) ....................

(22)

23.

Balance of tax due (If the sum of lines 20 and 21 is larger than line 22, enter the difference here,

a)

otherwise, on line 25)

Tax ..................................................................................

00

(23a)

b)

Interest ...........................................................................

00

(23b)

c)

Surcharges ......................................................................

00

(23c)

d)

Total (Add lines 23(a) through 23(c)) ...........................................................................

(23d)

00

24.

Amount paid with this return .........................................................................................................................................

(24)

25.

Amount overpaid (If the sum of lines 20 and 21 is smaller than line 22, distribute the difference between line A or B):

00

A . To be credited to estimated tax for 2004 ...................................................................................................

(25A)

B . To be refunded ............................................................................................................................................

(25B)

00

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4