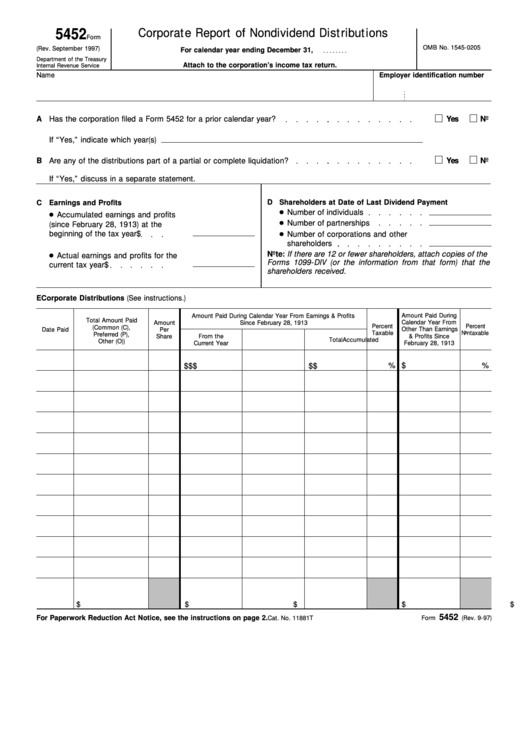

Form 5452 - Corporate Report Of Nondividend Distributions

ADVERTISEMENT

5452

Corporate Report of Nondividend Distributions

Form

OMB No. 1545-0205

(Rev. September 1997)

For calendar year ending December 31,

Department of the Treasury

Attach to the corporation’s income tax return.

Internal Revenue Service

Name

Employer identification number

A

Has the corporation filed a Form 5452 for a prior calendar year?

Yes

No

If “Yes,” indicate which year(s)

B

Are any of the distributions part of a partial or complete liquidation?

Yes

No

If “Yes,” discuss in a separate statement.

D

Shareholders at Date of Last Dividend Payment

C

Earnings and Profits

Number of individuals

Accumulated earnings and profits

Number of partnerships

(since February 28, 1913) at the

beginning of the tax year

$

Number of corporations and other

shareholders

Note: If there are 12 or fewer shareholders, attach copies of the

Actual earnings and profits for the

Forms 1099-DIV (or the information from that form) that the

current tax year

$

shareholders received.

E Corporate Distributions (See instructions.)

Amount Paid During

Amount Paid During Calendar Year From Earnings & Profits

Total Amount Paid

Calendar Year From

Amount

Since February 28, 1913

Percent

Percent

(Common (C),

Date Paid

Per

Other Than Earnings

Taxable

Nontaxable

Preferred (P),

From the

& Profits Since

Share

Accumulated

Total

Other (O))

Current Year

February 28, 1913

%

$

%

$

$

$

$

$

Totals

$

$

$

$

$

5452

For Paperwork Reduction Act Notice, see the instructions on page 2.

Cat. No. 11881T

Form

(Rev. 9-97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4