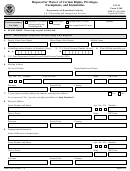

What is your gross monthly pay, before any payroll deductions?

If your income changes each month, the amounts you report should be an average for the past twelve

months.

Enter the number of persons living in your home who depend on you in whole or in part for support, or on

whom you depend in whole or in part for support. List their name, age, relationship to you, and their monthly

income in A through F.

List all other money you get each month. Specify the source and amount. Include spousal support, child

support, parental support, support from outside the home, scholarships, retirement or pensions, social

security, disability, workers’ compensation, unemployment, military basic allowance for quarters (BAQ),

veterans payments, dividends, interest or royalty, trust income, annuities, net business income, net rental

income, reimbursement of job-related expenses, and net gambling or lottery winnings.

Add

A through F to find your total other income each month.

Add

(your gross monthly income) plus

(your total other income) to find your total monthly income.

Add

(your gross monthly income), plus

A through F (other household members’ income) and

(your

total other income) to find your total gross monthly household income.

List all your payroll deductions. Payroll deductions include items like state and federal taxes, social security

(FICA), Medicare, health insurance and retirement contributions

Add

A through H to determine your total monthly payroll deductions.

Subtract

(total payroll deductions) from

(gross monthly pay) to find your take home pay.

Add

(your take home pay) to

(your total other income) to find your net monthly income.

List all the property you own or have an interest in. If you have other personal property such as jewelry,

furniture, furs, stocks, or bonds, list them separately on another piece of paper.

List all your monthly expenses. Use additional paper if needed. In J specify what your installment payments

are for, such as a credit card or bank loan. In K specify what the wage assignment, earnings withholding, or

garnishment is for.

Add

A through M to determine your monthly expenses.

If you answer yes to this question, make sure that your name or your claim number is on each sheet you

attach.

Sign and date the form in this space.

Mail this form to: Government Claims Program, P.O. Box 989052, MS 414, West Sacramento, CA

95789-9052. Forms can also be delivered to the Office of Risk and Insurance Management, 707 3rd street,

1st Floor ORIM, West Sacramento, CA 95605. Call the Government Claims Program at 1-800-955-0045 if

you have any questions.

1

1 2

2 3

3 4

4