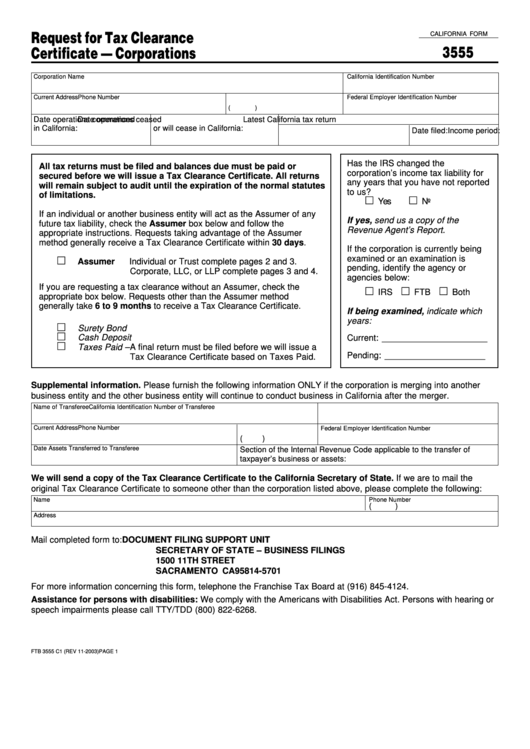

California Form 3555 - Request For Tax Clearance Certificate - Corporations - 2003

ADVERTISEMENT

Request for Tax Clearance

CALIFORNIA FORM

3555

Certificate — Corporations

Corporation Name

California Identification Number

Current Address

Phone Number

Federal Employer Identification Number

(

)

Date operations commenced

Date operations ceased

Latest California tax return

in California:

or will cease in California:

Income period:

Date filed:

Has the IRS changed the

All tax returns must be filed and balances due must be paid or

corporation’s income tax liability for

secured before we will issue a Tax Clearance Certificate. All returns

any years that you have not reported

will remain subject to audit until the expiration of the normal statutes

to us?

of limitations.

Yes

No

If an individual or another business entity will act as the Assumer of any

If yes, send us a copy of the

future tax liability, check the Assumer box below and follow the

Revenue Agent’s Report.

appropriate instructions. Requests taking advantage of the Assumer

method generally receive a Tax Clearance Certificate within 30 days.

If the corporation is currently being

examined or an examination is

Assumer

Individual or Trust complete pages 2 and 3.

pending, identify the agency or

Corporate, LLC, or LLP complete pages 3 and 4.

agencies below:

If you are requesting a tax clearance without an Assumer, check the

IRS

FTB

Both

appropriate box below. Requests other than the Assumer method

generally take 6 to 9 months to receive a Tax Clearance Certificate.

If being examined, indicate which

years:

Surety Bond

Cash Deposit

Current: ______________________

Taxes Paid – A final return must be filed before we will issue a

Pending: _____________________

Tax Clearance Certificate based on Taxes Paid.

Supplemental information. Please furnish the following information ONLY if the corporation is merging into another

business entity and the other business entity will continue to conduct business in California after the merger.

Name of Transferee

California Identification Number of Transferee

Current Address

Phone Number

Federal Employer Identification Number

(

)

Date Assets Transferred to Transferee

Section of the Internal Revenue Code applicable to the transfer of

taxpayer’s business or assets:

We will send a copy of the Tax Clearance Certificate to the California Secretary of State. If we are to mail the

original Tax Clearance Certificate to someone other than the corporation listed above, please complete the following:

Name

Phone Number

(

)

Address

Mail completed form to:

DOCUMENT FILING SUPPORT UNIT

SECRETARY OF STATE – BUSINESS FILINGS

1500 11TH STREET

SACRAMENTO CA 95814-5701

For more information concerning this form, telephone the Franchise Tax Board at (916) 845-4124.

Assistance for persons with disabilities: We comply with the Americans with Disabilities Act. Persons with hearing or

speech impairments please call TTY/TDD (800) 822-6268.

FTB 3555 C1 (REV 11-2003) PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4