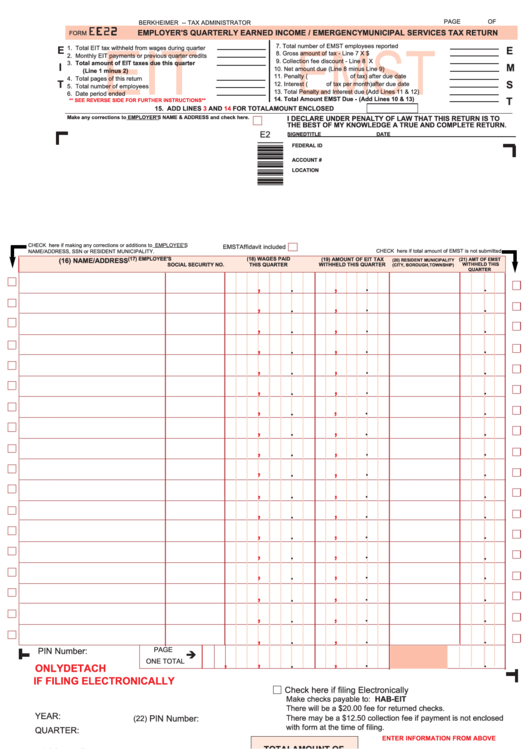

Form E2 - Employer'S Quarterly Earned Income / Emergency Municipal Services Tax Return - Berkheimer Tax Administrator

ADVERTISEMENT

PAGE

OF

BERKHEIMER -- TAX ADMINISTRATOR

E E 2 2

EMPLOYER'S QUARTERLY EARNED INCOME / EMERGENCY MUNICIPAL SERVICES TAX RETURN

FORM

7. Total number of EMST employees reported

1. Total EIT tax withheld from wages during quarter

E

E

EIT

EMST

8. Gross amount of tax - Line 7 X $

...........

2. Monthly EIT payments or previous quarter credits

9. Collection fee discount - Line 8 X

..........

3. Total amount of EIT taxes due this quarter

I

M

10. Net amount due (Line 8 minus Line 9) .......................

(Line 1 minus 2)

11. Penalty (

of tax) after due date ...............

4. Total pages of this return

T

S

12. Interest (

of tax per month)after due date

5. Total number of employees

13. Total Penalty and Interest due (Add Lines 11 & 12).......

6. Date period ended

14. Total Amount EMST Due - (Add Lines 10 & 13) .........

T

** SEE REVERSE SIDE FOR FURTHER INSTRUCTIONS**

15. ADD LINES

3

AND

14

FOR TOTAL AMOUNT ENCLOSED .............

Make any corrections to EMPLOYER'S NAME & ADDRESS and check here.

I DECLARE UNDER PENALTY OF LAW THAT THIS RETURN IS TO

THE BEST OF MY KNOWLEDGE A TRUE AND COMPLETE RETURN.

E2

SIGNED

TITLE

DATE

FEDERAL ID

ACCOUNT #

LOCATION

CHECK here if making any corrections or additions to EMPLOYEE'S

EMST Affidavit included

CHECK here if total amount of EMST is not submitted.

NAME/ADDRESS, SSN or RESIDENT MUNICIPALITY.

(17) EMPLOYEE'S

(18) WAGES PAID

(19) AMOUNT OF EIT TAX

(21) AMT OF EMST

(16) NAME/ADDRESS

(20) RESIDENT MUNICIPALITY

SOCIAL SECURITY NO.

THIS QUARTER

WITHHELD THIS QUARTER

WITHHELD THIS

(CITY, BOROUGH, TOWNSHIP)

QUARTER

.

.

.

,

,

.

.

,

.

,

.

.

.

,

,

.

.

,

.

,

.

.

.

,

,

.

.

.

,

,

.

.

.

,

,

.

.

.

,

,

.

.

.

,

,

.

,

.

.

,

.

.

.

,

,

.

.

.

,

,

.

.

.

,

,

.

.

,

.

,

.

.

.

,

,

.

.

,

.

,

.

.

.

,

,

.

.

.

,

,

PAGE

PIN Number:

.

.

,

.

,

ONE TOTAL

,

ONLY DETACH

IF FILING ELECTRONICALLY

Check here if filing Electronically

Make checks payable to: HAB-EIT

There will be a $20.00 fee for returned checks.

YEAR:

PIN Number:

There may be a $12.50 collection fee if payment is not enclosed

(22)

with form at the time of filing.

QUARTER:

ENTER INFORMATION FROM ABOVE

TOTAL AMOUNT OF

ACCOUNT #:

ENCLOSED CHECK

3.

(from Line 15)

9.

10.

13.

DO NOT WRITE BELOW THIS LINE

email:

e206.qxp

5/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1