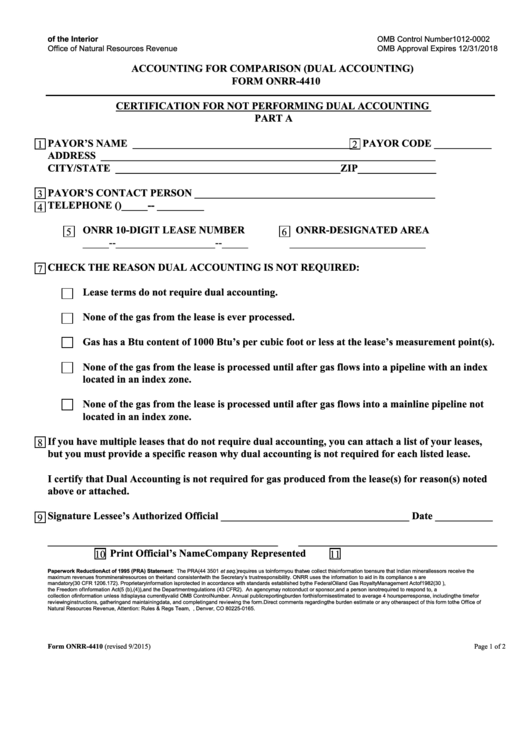

Form Onrr-4410 - Accounting For Comparison (Dual Accounting)

ADVERTISEMENT

U.S. Department of the Interior

OMB Control Number 1012-0002

Office of Natural Resources Revenue

OMB Approval Expires 12/31/2018

ACCOUNTING FOR COMPARISON (DUAL ACCOUNTING)

FORM ONRR-4410

CERTIFICATION FOR NOT PERFORMING DUAL ACCOUNTING

PART A

PAYOR’S NAME __________________________________________ PAYOR CODE ___________

1

2

ADDRESS ________________________________________________________________

CITY/STATE ___________________________________________ZIP_______________

PAYOR’S CONTACT PERSON ______________________________________________

3

TELEPHONE (

)_____-- _________

4

ONRR 10-DIGIT LEASE NUMBER

ONRR-DESIGNATED AREA

5

6

_____--___________________--_____

__________________________

CHECK THE REASON DUAL ACCOUNTING IS NOT REQUIRED:

7

Lease terms do not require dual accounting.

None of the gas from the lease is ever processed.

Gas has a Btu content of 1000 Btu’s per cubic foot or less at the lease’s measurement point(s).

None of the gas from the lease is processed until after gas flows into a pipeline with an index

located in an index zone.

None of the gas from the lease is processed until after gas flows into a mainline pipeline not

located in an index zone.

If you have multiple leases that do not require dual accounting, you can attach a list of your leases,

8

but you must provide a specific reason why dual accounting is not required for each listed lease.

I certify that Dual Accounting is not required for gas produced from the lease(s) for reason(s) noted

above or attached.

Signature Lessee’s Authorized Official ____________________________________ Date ___________

9

____________________________________________

______________________________________

Print Official’s Name

Company Represented

10

11

Paperwork Reduction Act of 1995 (PRA) Statement: The PRA (44 U.S.C. 3501 et seq.) requires us to inform you that we collect this information to ensure that Indian mineral lessors receive the

maximum revenues from mineral resources on their land consistent with the Secretary’s trust responsibility. ONRR uses the information to aid in its compliance efforts. Responses are

mandatory (30 CFR 1206.172). Proprietary information is protected in accordance with standards established by the Federal Oil and Gas Royalty Management Act of 1982 (30 U.S.C. 1733),

the Freedom of Information Act (5 U.S.C. 552(b), (4)), and the Department regulations (43 CFR 2). An agency may not conduct or sponsor, and a person is not required to respond to, a

collection of information unless it displays a currently valid OMB Control Number. Annual public reporting burden for this form is estimated to average 4 hours per response, including the time for

reviewing instructions, gathering and maintaining data, and completing and reviewing the form. Direct comments regarding the burden estimate or any other aspect of this form to the Office of

Natural Resources Revenue, Attention: Rules & Regs Team, P.O. Box 25165, Denver, CO 80225-0165.

Form ONRR-4410 (revised 9/2015)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4