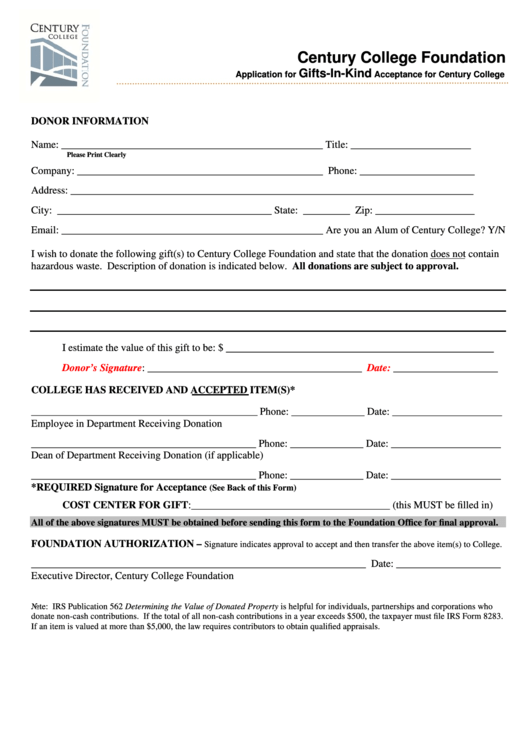

Application For Gifts-In-Kind Acceptance For Century College - Century College Foundation

ADVERTISEMENT

Century College Foundation

Gifts-In-Kind

Application for

Acceptance for Century College

DONOR INFORMATION

Name: __________________________________________________ Title: _______________________

Please Print Clearly

Company: _______________________________________________ Phone: ______________________

Address: _____________________________________________________________________________

City: _________________________________________ State: _________ Zip: ___________________

Email: __________________________________________________ Are you an Alum of Century College? Y/N

I wish to donate the following gift(s) to Century College Foundation and state that the donation does not contain

hazardous waste. Description of donation is indicated below. All donations are subject to approval.

____________________________________________

I estimate the value of this gift to be: $

Donor’s

Signature: _________________________________________

Date:

____________________

COLLEGE HAS RECEIVED AND ACCEPTED ITEM(S)*

Phone: ______________ Date: _____________________

____________________________________________________

Employee in Department Receiving Donation

___________________________________________ Phone: ______________ Date: _____________________

Dean of Department Receiving Donation (if applicable)

___________________________________________ Phone: ______________ Date: _____________________

*REQUIRED Signature for Acceptance

(See Back of this Form)

COST CENTER FOR GIFT:______________________________________ (this MUST be filled in)

All of the above signatures MUST be obtained before sending this form to the Foundation Office for final approval.

FOUNDATION AUTHORIZATION –

Signature indicates approval to accept and then transfer the above item(s) to College.

________________________________________________________________ Date: ____________________

Executive Director, Century College Foundation

Note: IRS Publication 562 Determining the Value of Donated Property is helpful for individuals, partnerships and corporations who

donate non-cash contributions. If the total of all non-cash contributions in a year exceeds $500, the taxpayer must file IRS Form 8283.

If an item is valued at more than $5,000, the law requires contributors to obtain qualified appraisals.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2