C-8000MC, Page 4

FEIN or TR Number

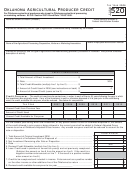

RENAISSANCE ZONE CREDIT WORKSHEET

.00

1. Tax liability before Renaissance Zone Credit. Enter the amount from C-8000MC, line 82 ........................ 1.

______________

Enter the street address of the property or parcel number and the name of the zone or subzone that the

property is included in: ________________________________________________________________________________________

Business Activity Factor:

2. Enter the average value of property located within the zone ......................................................................... 2.

______________

.00

3. Multiply rentals within the zone by 8 and enter the result ............................................................................. 3.

______________

.00

4. Total property value within the zone. Add lines 2 and 3 ............................................................................... 4.

______________

.00

5. Enter the average value of all Michigan property .......................................................................................... 5.

______________

.00

.00

6. Multiply Michigan rentals by 8 and enter the result ....................................................................................... 6.

______________

7. Add lines 5 and 6 ........................................................................................................................................... 7.

______________

.00

8. Divide line 4 by line 7 ..................................................................................................................................... 8.

______________

%

.00

9. Enter total payroll for services performed within the zone ............................................................................ 9.

______________

10. Enter total Michigan payroll ........................................................................................................................... 10. ______________

.00

11. Divide line 9 by line 10 .................................................................................................................................. 11. ______________

%

12. Add lines 8 and 11 ......................................................................................................................................... 12. ______________

%

13. Business Activity Factor. Divide line 12 by 2. If there is only one factor, enter the amount from line 12 ..... 13. ______________

%

14. Credit based on the Business Activity Factor. Multiply line 13 by line 1 ....................................................... 14. ______________

.00

Adjusted services performed in the Renaissance Zone:

.00

15. Enter the amount on line 9 ........................................................................................

15. ______________

16. Enter the depreciation added to tax base for property exempt under MCL 211.7ff. Claim

property exempt in the tax year; claim new property* that will be exempt in the immediately

.00

following tax year ....................................................................................................... 16. ______________

17. Add lines 15 and 16 ...................................................................................................................................... 17. ______________

.00

18. Partnerships, LLCs, S Corporations and individuals only:

.00

A. Enter business income .................................................. 18A. ________________

%

B. Enter apportionment factor ............................................. 18B. ________________

%

C. Enter amount from line 13 .............................................. 18C. _______________

.00

D. Multiply line 18A by line 18B by line 18C ........................ 18D. _______________

.00

E. Add lines 17 and 18D ...................................................... 18E. ________________

19. Adjusted Services:

A. Enter the amount from line 17, or, if taxpayer is a Partnership, LLC, S Corp or

.00

Individual, amount from line 18E ........................................................................ 19A. _______________

.00

B. Multiply line 19A by 10% (.10) ............................................................................. 19B. _______________

20. Credit for businesses first located within a Renaissance Zone after November 30, 2002. Enter lesser of

line 14 or line 19B .......................................................................................................................................... 20. ______________

.00

Renaissance Zone Credit for Businesses first located within a Renaissance Zone before December 1, 2002 ONLY

.00

21 A. Enter Renaissance Zone Credit allowed in 2002 ................................................. 21A. ______________

.00

B. Total payroll for services performed within the Zone in 2002 ............................... 21B. ______________

.00

C. Depreciation for property exempt under MCL 211.7ff claimed in 2002 ............... 21C. ______________

.00

D. Add lines 21B and 21C ........................................................................................ 21D. ______________

.00

E. Subtract line 21D from line 17. If less than zero, enter zero ............................... 21E. ______________

.00

F. Multiply line 21E by 2% (.02) ................................................................................. 21F. ______________

.00

G. Add lines 21A and 21F .......................................................................................... 21G. ______________

22. Enter the lesser of line 14 or line 21G .......................................................................................................... 22. ______________

.00

23. Enter the amount from line 20 ...................................................................................................................... 23. ______________

.00

24 A. Renaissance Zone Credit. Enter the greater of lines 22 or 23 here ..................................................... 24A. ______________

.00

B. Reduced Renaissance Zone Credit. Use the Reduced Credit Table below to find the reduced credit

.00

percentage. Multiply line 24A by _____%. .................................................................................................. 24B. ______________

Enter line 24A or 24B, whichever applies, on C8000MC, line 84.

Reduced Credit Table. During the last three years of a zone’s designation, the credit must be reduced. The reduced credit is:

• 75 percent for the tax year that is two years before the final year of designation as a renaissance zone.

• 50 percent for the tax year immediately preceding the final year of the designation as a renaissance zone.

• 25 percent for the tax year that is in the final year of designation as a renaissance zone.

* i.e., property that has not been subject to, or exempt from the collection of taxes under the General Property Tax Act and has not been subject to, or

exempt from ad valorem property taxes levied in another state, except that receiving an exemption as inventory property does not disqualify property.

1

1 2

2 3

3 4

4