Reports Of Property Value Instructions - Texas Comptroller Of Public Accounts Page 16

ADVERTISEMENT

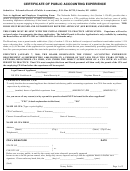

APPRAISAL DISTRICT

Report of Property Value—2007

Item-by-Item Explanation

Column (1): Number of Items. List the number of

items requested in each category. For several catego-

(Self-Reports)

ries, we request the number of properties or the num-

ber of accounts. For other categories, we request the

Please complete all sections of the report and submit the

number of vacant lots (C), parcels (E), companies (J)

original and one copy of each requested document.

and leases (G1).

Submit a certified recap that corresponds with the val-

Column (2): Total Value. This value should reflect

ue reported on this report and the Electronic Appraisal

the market value of the land, the improvement and the

Roll Submission. Recaps should include the break-

taxable personal property for the identified taxing unit

down of category values, the breakdown of exemptions

before the 10 percent cap is applied. Do not include

and losses, the breakdown of land classes, productiv-

property that is receiving a total exemption. Some

ity value schedule tax increment financing fund(s) and

examples are foreign trade zones, low-income hous-

deferred taxes/increasing homesteads. Required under

ing, religious organizations, income producing prop-

Property Tax Code Section 25.24 and 26.01.

erties and mineral interest properties less than $500.

Properties appraised by special procedures should

An item-by-item explanation of the information request-

be reported at the special value. No loss should be

ed on the Appraisal District Report of Property Value fol-

reported for properties (other than agricultural and

lows:

timber) appraised by special procedures.

Item 1. Special Taxing Unit(s). Report the jurisdiction

Uncertified Value. Report all uncertified market value

name and jurisdiction number for each special taxing unit

in the appropriate category before application of the

in your appraisal district.

cap is applied. Do not include totally exempt property.

Item 2. Total value. This value should reflect the market

Total (Bottom of Column II). Report the sum of the

value of the land, the improvement and the taxable per-

total category values.

sonal property for the identified taxing unit before the

10 percent cap is applied. Do not include property that

Item 6. Acreage breakdown of district. Please include a

is receiving a total exemption. Improvement values are

copy of the “Ag Recap” from your tax roll when you sub-

buildings or structures located on or attached to the land.

mit this completed report.

Personal property is all property that is not real property.

Report your column totals for the number of acres, market

It includes business equipment, machinery, furniture and

value and total productivity or taxable value. The column

so on. This value should equal the total category break-

totals reported should match the Agricultural Recap.

down and your certified recap total.

Column I: Total qualified acres under 1-d and 1-d-1.

Item 3. Taxable Value. This item should reflect the total

List the total acres in each land category for which your

taxable value in the taxing unit after all exemptions have

district grants productivity valuation. Round each to-

been deducted from the total value.

tal to the nearest whole acre. Do not report acreage

Item 4. Tax Rate. Report the tax rates and total taxes lev-

under “other agricultural land” unless it qualifies for

ied in 2007 for each special taxing unit in the district. The

productivity valuation and is not included in the item-

total tax rate is equal to the maintenance and operations

ized breakdown. Examples of “other agricultural land”

rate (M&O) plus the interest and sinking fund rate (I&S).

use are floriculture, horticulture or viticulture. If you

Please make copies of Page 1, if necessary, for additional

list any acreage under “other agriculture land, ” please

special taxing units in the district. (NOTE: Please notify

state the type of land or land use in the space provided.

PTD of any new or closed special taxing units.)

This column total should equal Category D1 acres on

Page 2.

Item 5. List the total value shown on the tax roll for each

category.

Reports of Property Value Instructions

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28