Reports Of Property Value Instructions - Texas Comptroller Of Public Accounts Page 24

ADVERTISEMENT

CITY

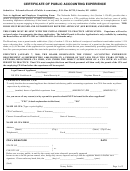

Report of Property Value—2007

Item-by-Item Explanation

not include property that is receiving a total exemption.

Improvement values are buildings or structures located on

(Self-Reports)

or attached to the land. Personal property is all property

that is not real property. It includes business equipment,

Please complete all sections of the report and submit the

machinery, furniture and so on. This value should equal

original and one copy of each requested document.

the total category breakdown on Page 4 and your certified

recap total.

Submit a certified recap that corresponds with the val-

ue reported on this report and the Electronic Appraisal

NOTE: Cities do not grant a state-mandated exemption or

Roll Submission. Recaps should include the break-

a flat amount of deduction as an exemption. They can only

down of category values, the breakdown of exemptions

grant a local optional age 65 or older or disabled exemp-

and losses, the breakdown of land classes, productivity

tion or a local optional percentage homestead exemption.

value schedule, tax increment financing fund(s) and

The taxing unit adopts a percentage up to 20 percent, not

deferred taxes/increasing homesteads. Required under

a set dollar amount.

Property Tax Code Sec. 25.24 and 26.01.

Item 4. Total value lost to local optional age 65 or older

An item-by-item explanation of the information request-

or disabled homestead exemptions. Any person who is

ed on the City Report of Property Value follows:

65 or older or is disabled is entitled to a local optional ex-

emption on a portion of the appraised value of his or her

Item 1. Total market value before the 10 percent cap

residence homestead if the city grants such an exemp-

on residence homesteads (Tax Code Section 23.23) is

tion. The exemption amount is $3,000 of the appraised

applied. Include the total market value of all uncerti-

value of the residence homestead, unless a larger amount

fied and Section 26.01[d] property (Tax Code Section

is specified either by the governing body authorizing the

26.01[d]). Use figures based on the appropriate submis-

exemption or by a favorable vote of a majority of the tax-

sion date, or if not available, your most current tax roll.

ing unit’s qualified voters (Tax Code Section 11.13[d]

Report the total market value of all property in your city.

and [e]). To calculate the maximum value allowed, add

Market value is the value before the application of the cap.

the number granted for those over 65 to the number

Include the value of totally exempt property and the mar-

granted for the disabled, then multiply the number of

ket value of property receiving productivity valuation in

individuals granted this exemption times the exemption

the total shown.

amount adopted. Please do not exceed this maximum

value. Report the number granted for those over 65, the

Item 2. Totally exempt property value. Report the full

number granted for the disabled and the value the city

market value of any property completely excluded from

lost due to this exemption.

taxation that is included in total market value above.

Even though totally exempt property is not taxable, it may

Item 5. Total value lost to local optional percentage

be valued and placed on the appraisal roll. The value of

homestead exemptions. Each homeowner is entitled to

the totally exempt property should be deducted from the

a local optional exemption on a portion of the appraised

appropriate category on Page 4 for reporting purposes.

value of his or her residence homestead if the city grants

Some examples of totally exempt properties are foreign

such an exemption as provided by law (Tax Code Section

trade zones, low-income housing, transitional and habitat

11.13[n]). The taxing unit adopts a percentage up to 20

housing, religious organizations, federal or state govern-

percent, not a set dollar amount. If the percentage set by

ments, etc.

the voters produces an exemption in a tax year of less than

$5,000, when applied to a particular residence homestead,

Item 3. Total Value (Item 1 minus Item 2 above). This

the individual is entitled to an exemption of $5,000 of the

value should reflect the market value of the land, the im-

appraised value. Report the number granted for the over

provement and the taxable personal property for the iden-

65, the number granted for the disabled and the value the

tified taxing unit before the 10 percent cap is applied. Do

city lost due to this exemption.

Reports of Property Value Instructions

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28