Form 306 - 2004 Military Reuse Zone Credit Instructions

ADVERTISEMENT

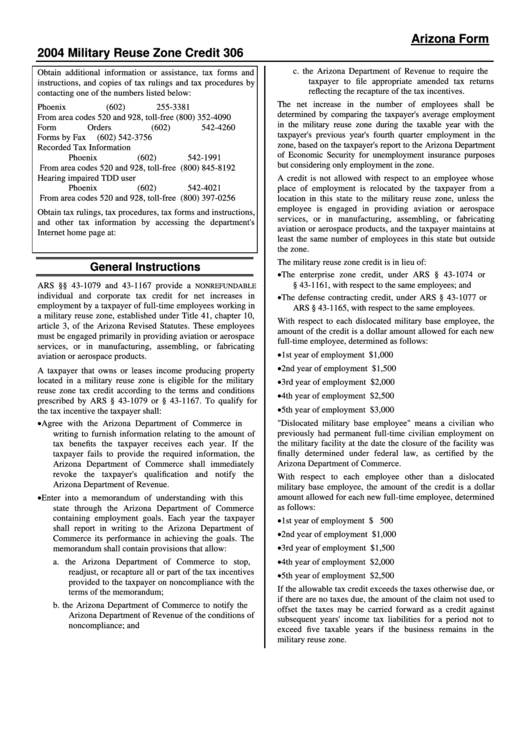

Arizona Form

2004 Military Reuse Zone Credit

306

c.

the Arizona Department of Revenue to require the

Obtain additional information or assistance, tax forms and

taxpayer to file appropriate amended tax returns

instructions, and copies of tax rulings and tax procedures by

reflecting the recapture of the tax incentives.

contacting one of the numbers listed below:

The net increase in the number of employees shall be

Phoenix

(602) 255-3381

determined by comparing the taxpayer's average employment

From area codes 520 and 928, toll-free

(800) 352-4090

in the military reuse zone during the taxable year with the

Form Orders

(602) 542-4260

taxpayer's previous year's fourth quarter employment in the

Forms by Fax

(602) 542-3756

zone, based on the taxpayer's report to the Arizona Department

Recorded Tax Information

of Economic Security for unemployment insurance purposes

Phoenix

(602) 542-1991

but considering only employment in the zone.

From area codes 520 and 928, toll-free

(800) 845-8192

Hearing impaired TDD user

A credit is not allowed with respect to an employee whose

Phoenix

(602) 542-4021

place of employment is relocated by the taxpayer from a

From area codes 520 and 928, toll-free

(800) 397-0256

location in this state to the military reuse zone, unless the

employee is engaged in providing aviation or aerospace

Obtain tax rulings, tax procedures, tax forms and instructions,

services, or in manufacturing, assembling, or fabricating

and other tax information by accessing the department's

aviation or aerospace products, and the taxpayer maintains at

Internet home page at:

least the same number of employees in this state but outside

the zone.

The military reuse zone credit is in lieu of:

General Instructions

•

The enterprise zone credit, under ARS § 43-1074 or

§ 43-1161, with respect to the same employees; and

ARS §§ 43-1079 and 43-1167 provide a

NONREFUNDABLE

•

individual and corporate tax credit for net increases in

The defense contracting credit, under ARS § 43-1077 or

employment by a taxpayer of full-time employees working in

ARS § 43-1165, with respect to the same employees.

a military reuse zone, established under Title 41, chapter 10,

With respect to each dislocated military base employee, the

article 3, of the Arizona Revised Statutes. These employees

amount of the credit is a dollar amount allowed for each new

must be engaged primarily in providing aviation or aerospace

full-time employee, determined as follows:

services, or in manufacturing, assembling, or fabricating

•

1st year of employment

$1,000

aviation or aerospace products.

•

2nd year of employment

$1,500

A taxpayer that owns or leases income producing property

•

located in a military reuse zone is eligible for the military

3rd year of employment

$2,000

reuse zone tax credit according to the terms and conditions

•

4th year of employment

$2,500

prescribed by ARS § 43-1079 or § 43-1167. To qualify for

•

5th year of employment

$3,000

the tax incentive the taxpayer shall:

•

"Dislocated military base employee" means a civilian who

Agree with the Arizona Department of Commerce in

previously had permanent full-time civilian employment on

writing to furnish information relating to the amount of

the military facility at the date the closure of the facility was

tax benefits the taxpayer receives each year. If the

finally determined under federal law, as certified by the

taxpayer fails to provide the required information, the

Arizona Department of Commerce.

Arizona Department of Commerce shall immediately

revoke the taxpayer's qualification and notify the

With respect to each employee other than a dislocated

Arizona Department of Revenue.

military base employee, the amount of the credit is a dollar

•

amount allowed for each new full-time employee, determined

Enter into a memorandum of understanding with this

as follows:

state through the Arizona Department of Commerce

•

containing employment goals. Each year the taxpayer

1st year of employment

$ 500

shall report in writing to the Arizona Department of

•

2nd year of employment

$1,000

Commerce its performance in achieving the goals. The

•

memorandum shall contain provisions that allow:

3rd year of employment

$1,500

•

a.

the Arizona Department of Commerce to stop,

4th year of employment

$2,000

readjust, or recapture all or part of the tax incentives

•

5th year of employment

$2,500

provided to the taxpayer on noncompliance with the

If the allowable tax credit exceeds the taxes otherwise due, or

terms of the memorandum;

if there are no taxes due, the amount of the claim not used to

b. the Arizona Department of Commerce to notify the

offset the taxes may be carried forward as a credit against

Arizona Department of Revenue of the conditions of

subsequent years' income tax liabilities for a period not to

noncompliance; and

exceed five taxable years if the business remains in the

military reuse zone.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7