Form Rc-44 C - Cigarette Use Tax Return

ADVERTISEMENT

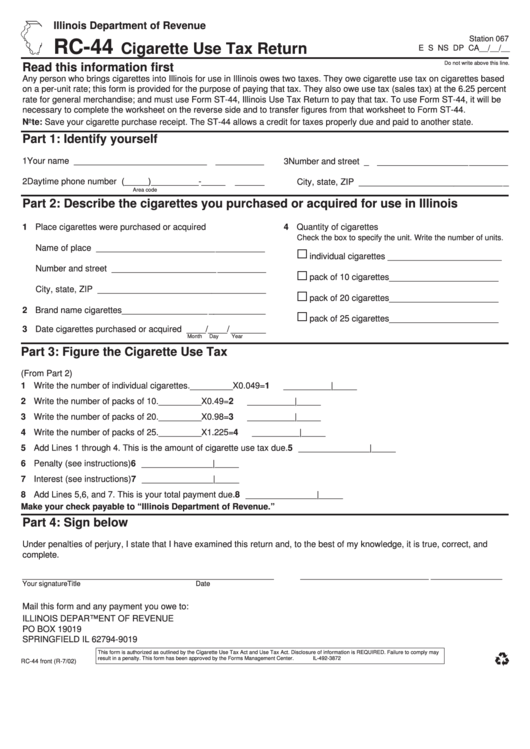

Illinois Department of Revenue

Station 067

RC-44

Cigarette Use Tax Return

E S NS DP CA__/__/__

Do not write above this line.

Read this information first

Any person who brings cigarettes into Illinois for use in Illinois owes two taxes. They owe cigarette use tax on cigarettes based

on a per-unit rate; this form is provided for the purpose of paying that tax. They also owe use tax (sales tax) at the 6.25 percent

rate for general merchandise; and must use Form ST-44, Illinois Use Tax Return to pay that tax. To use Form ST-44, it will be

necessary to complete the worksheet on the reverse side and to transfer figures from that worksheet to Form ST-44.

Note: Save your cigarette purchase receipt. The ST-44 allows a credit for taxes properly due and paid to another state.

Part 1: Identify yourself

1 Your name ______________________________________

3 Number and street ____________________________

2 Daytime phone number (_____)__________-___________

City, state, ZIP _______________________________

Area code

Part 2: Describe the cigarettes you purchased or acquired for use in Illinois

1 Place cigarettes were purchased or acquired

4 Quantity of cigarettes

Check the box to specify the unit. Write the number of units.

Name of place ___________________________________

individual cigarettes ________________________

Number and street ________________________________

pack of 10 cigarettes _______________________

City, state, ZIP ___________________________________

pack of 20 cigarettes _______________________

2 Brand name cigarettes_____________________________

pack of 25 cigarettes _______________________

3 Date cigarettes purchased or acquired ____/____/_______

Month

Day

Year

Part 3: Figure the Cigarette Use Tax

(From Part 2)

1 Write the number of individual cigarettes. _________ X 0.049 = 1

__________|_____

2 Write the number of packs of 10.

_________ X 0.49

= 2

__________|_____

3 Write the number of packs of 20.

_________ X 0.98

= 3

__________|_____

4 Write the number of packs of 25.

_________ X 1.225 = 4

__________|_____

5 Add Lines 1 through 4. This is the amount of cigarette use tax due.

5 _______________|_____

6 Penalty (see instructions)

6 _______________|_____

7 Interest (see instructions)

7 _______________|_____

8 Add Lines 5,6, and 7. This is your total payment due.

8 _______________|_____

Make your check payable to “Illinois Department of Revenue.”

Part 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and

complete.

_____________________________________________________

___________________________ _______________

Your signature

Title

Date

Mail this form and any payment you owe to:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

This form is authorized as outlined by the Cigarette Use Tax Act and Use Tax Act. Disclosure of information is REQUIRED. Failure to comply may

result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3872

RC-44 front (R-7/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1