Instructions For Form 1139 - Corporation Application For Tentative Refund - Internal Revenue Service - 2000

ADVERTISEMENT

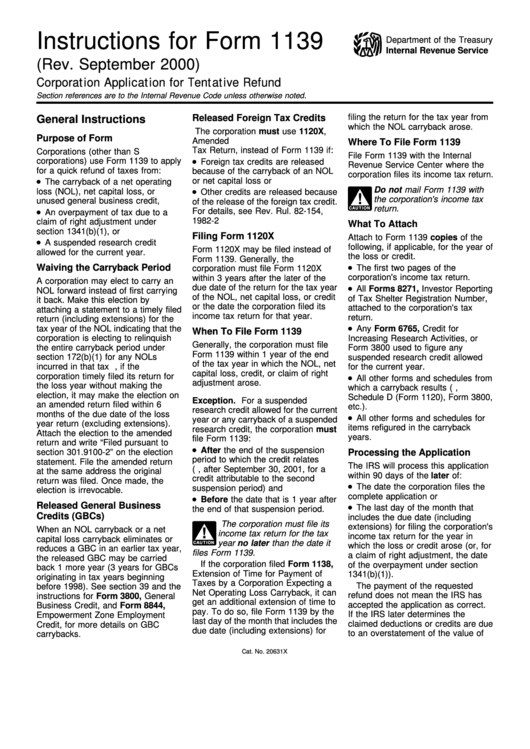

Instructions for Form 1139

Department of the Treasury

Internal Revenue Service

(Rev. September 2000)

Corporation Application for Tentative Refund

Section references are to the Internal Revenue Code unless otherwise noted.

filing the return for the tax year from

Released Foreign Tax Credits

General Instructions

which the NOL carryback arose.

The corporation must use 1120X,

Purpose of Form

Amended U.S. Corporation Income

Where To File Form 1139

Tax Return, instead of Form 1139 if:

Corporations (other than S

File Form 1139 with the Internal

corporations) use Form 1139 to apply

Foreign tax credits are released

Revenue Service Center where the

for a quick refund of taxes from:

because of the carryback of an NOL

corporation files its income tax return.

or net capital loss or

The carryback of a net operating

Do not mail Form 1139 with

loss (NOL), net capital loss, or

Other credits are released because

!

the corporation's income tax

unused general business credit,

of the release of the foreign tax credit.

return.

CAUTION

For details, see Rev. Rul. 82-154,

An overpayment of tax due to a

1982-2 C.B. 394.

claim of right adjustment under

What To Attach

section 1341(b)(1), or

Filing Form 1120X

Attach to Form 1139 copies of the

A suspended research credit

following, if applicable, for the year of

Form 1120X may be filed instead of

allowed for the current year.

the loss or credit.

Form 1139. Generally, the

Waiving the Carryback Period

The first two pages of the

corporation must file Form 1120X

corporation's income tax return.

within 3 years after the later of the

A corporation may elect to carry an

due date of the return for the tax year

All Forms 8271, Investor Reporting

NOL forward instead of first carrying

of the NOL, net capital loss, or credit

of Tax Shelter Registration Number,

it back. Make this election by

or the date the corporation filed its

attached to the corporation's tax

attaching a statement to a timely filed

income tax return for that year.

return.

return (including extensions) for the

tax year of the NOL indicating that the

Any Form 6765, Credit for

When To File Form 1139

corporation is electing to relinquish

Increasing Research Activities, or

Generally, the corporation must file

the entire carryback period under

Form 3800 used to figure any

Form 1139 within 1 year of the end

section 172(b)(1) for any NOLs

suspended research credit allowed

of the tax year in which the NOL, net

incurred in that tax year. Also, if the

for the current year.

capital loss, credit, or claim of right

corporation timely filed its return for

All other forms and schedules from

adjustment arose.

the loss year without making the

which a carryback results (e.g.,

election, it may make the election on

Schedule D (Form 1120), Form 3800,

Exception. For a suspended

an amended return filed within 6

etc.).

research credit allowed for the current

months of the due date of the loss

All other forms and schedules for

year or any carryback of a suspended

year return (excluding extensions).

items refigured in the carryback

research credit, the corporation must

Attach the election to the amended

years.

file Form 1139:

return and write “Filed pursuant to

After the end of the suspension

section 301.9100-2” on the election

Processing the Application

period to which the credit relates

statement. File the amended return

The IRS will process this application

(e.g., after September 30, 2001, for a

at the same address the original

within 90 days of the later of:

credit attributable to the second

return was filed. Once made, the

The date the corporation files the

suspension period) and

election is irrevocable.

complete application or

Before the date that is 1 year after

Released General Business

The last day of the month that

the end of that suspension period.

Credits (GBCs)

includes the due date (including

The corporation must file its

extensions) for filing the corporation's

When an NOL carryback or a net

!

income tax return for the tax

income tax return for the year in

capital loss carryback eliminates or

year no later than the date it

CAUTION

which the loss or credit arose (or, for

reduces a GBC in an earlier tax year,

files Form 1139.

a claim of right adjustment, the date

the released GBC may be carried

If the corporation filed Form 1138,

of the overpayment under section

back 1 more year (3 years for GBCs

Extension of Time for Payment of

1341(b)(1)).

originating in tax years beginning

Taxes by a Corporation Expecting a

The payment of the requested

before 1998). See section 39 and the

Net Operating Loss Carryback, it can

refund does not mean the IRS has

instructions for Form 3800, General

get an additional extension of time to

accepted the application as correct.

Business Credit, and Form 8844,

pay. To do so, file Form 1139 by the

If the IRS later determines the

Empowerment Zone Employment

last day of the month that includes the

claimed deductions or credits are due

Credit, for more details on GBC

due date (including extensions) for

to an overstatement of the value of

carrybacks.

Cat. No. 20631X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4