Form Boe-663-Ah - Purchase Order For Assessors' Handbook Sections

ADVERTISEMENT

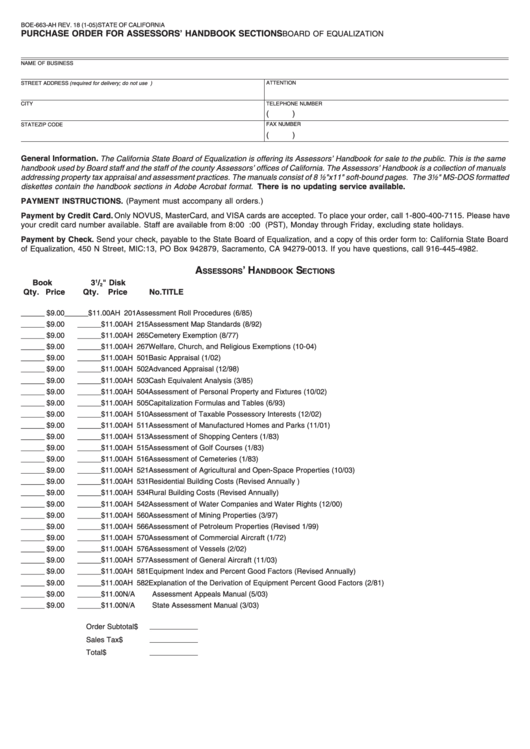

BOE-663-AH REV. 18 (1-05)

STATE OF CALIFORNIA

PURCHASE ORDER FOR ASSESSORS’ HANDBOOK SECTIONS

BOARD OF EQUALIZATION

NAME OF BUSINESS

STREET ADDRESS (required for delivery; do not use P.O. Box)

ATTENTION

CITY

TELEPHONE NUMBER

(

)

FAX NUMBER

STATE

ZIP CODE

(

)

General Information. The California State Board of Equalization is offering its Assessors’ Handbook for sale to the public. This is the same

handbook used by Board staff and the staff of the county Assessors’ offices of California. The Assessors’ Handbook is a collection of manuals

addressing property tax appraisal and assessment practices. The manuals consist of 8 ½" x 11" soft-bound pages. The 3½" MS-DOS formatted

diskettes contain the handbook sections in Adobe Acrobat format. There is no updating service available.

PAYMENT INSTRUCTIONS. (Payment must accompany all orders.)

Payment by Credit Card. Only NOVUS, MasterCard, and VISA cards are accepted. To place your order, call 1-800-400-7115. Please have

your credit card number available. Staff are available from 8:00 a.m. to 5:00 p.m. (PST), Monday through Friday, excluding state holidays.

Payment by Check. Send your check, payable to the State Board of Equalization, and a copy of this order form to: California State Board

of Equalization, 450 N Street, MIC:13, PO Box 942879, Sacramento, CA 94279-0013. If you have questions, call 916-445-4982.

A

’ H

S

SSESSORS

ANDBOOK

ECTIONS

Book

3

1

/

" Disk

2

Qty. Price

Qty.

Price

No.

TITLE

______ $9.00

______$11.00

AH 201

Assessment Roll Procedures (6/85)

______ $9.00

______$11.00

AH 215

Assessment Map Standards (8/92)

______ $9.00

______$11.00

AH 265

Cemetery Exemption (8/77)

______ $9.00

______$11.00

AH 267

Welfare, Church, and Religious Exemptions (10-04)

______ $9.00

______$11.00

AH 501

Basic Appraisal (1/02)

______ $9.00

______$11.00

AH 502

Advanced Appraisal (12/98)

______ $9.00

______$11.00

AH 503

Cash Equivalent Analysis (3/85)

______ $9.00

______$11.00

AH 504

Assessment of Personal Property and Fixtures (10/02)

______ $9.00

______$11.00

AH 505

Capitalization Formulas and Tables (6/93)

______ $9.00

______$11.00

AH 510

Assessment of Taxable Possessory Interests (12/02)

______ $9.00

______$11.00

AH 511

Assessment of Manufactured Homes and Parks (11/01)

______ $9.00

______$11.00

AH 513

Assessment of Shopping Centers (1/83)

______ $9.00

______$11.00

AH 515

Assessment of Golf Courses (1/83)

______ $9.00

______$11.00

AH 516

Assessment of Cemeteries (1/83)

______ $9.00

______$11.00

AH 521

Assessment of Agricultural and Open-Space Properties (10/03)

______ $9.00

______$11.00

AH 531

Residential Building Costs (Revised Annually )

______ $9.00

______$11.00

AH 534

Rural Building Costs (Revised Annually)

______ $9.00

______$11.00

AH 542

Assessment of Water Companies and Water Rights (12/00)

______ $9.00

______$11.00

AH 560

Assessment of Mining Properties (3/97)

______ $9.00

______$11.00

AH 566

Assessment of Petroleum Properties (Revised 1/99)

______ $9.00

______$11.00

AH 570

Assessment of Commercial Aircraft (1/72)

______ $9.00

______$11.00

AH 576

Assessment of Vessels (2/02)

______ $9.00

______$11.00

AH 577

Assessment of General Aircraft (11/03)

______ $9.00

______$11.00

AH 581

Equipment Index and Percent Good Factors (Revised Annually)

______ $9.00

______$11.00

AH 582

Explanation of the Derivation of Equipment Percent Good Factors (2/81)

______ $9.00

______$11.00

N/A

Assessment Appeals Manual (5/03)

______ $9.00

______$11.00

N/A

State Assessment Manual (3/03)

Order Subtotal

$

Sales Tax

$

Total

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1