Form Boe-230-C - Exemption Certificate For Qualified Sales And Purchases Of Liquefied Petroleum Gas

ADVERTISEMENT

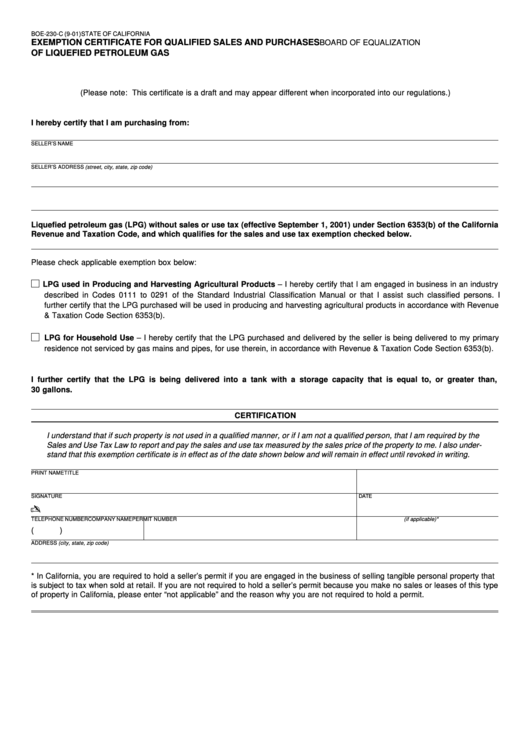

BOE-230-C (9-01)

STATE OF CALIFORNIA

EXEMPTION CERTIFICATE FOR QUALIFIED SALES AND PURCHASES

BOARD OF EQUALIZATION

OF LIQUEFIED PETROLEUM GAS

(Please note: This certificate is a draft and may appear different when incorporated into our regulations.)

I hereby certify that I am purchasing from:

SELLER’S NAME

SELLER’S ADDRESS (street, city, state, zip code)

Liquefied petroleum gas (LPG) without sales or use tax (effective September 1, 2001) under Section 6353(b) of the California

Revenue and Taxation Code, and which qualifies for the sales and use tax exemption checked below.

Please check applicable exemption box below:

LPG used in Producing and Harvesting Agricultural Products – I hereby certify that I am engaged in business in an industry

described in Codes 0111 to 0291 of the Standard Industrial Classification Manual or that I assist such classified persons. I

further certify that the LPG purchased will be used in producing and harvesting agricultural products in accordance with Revenue

& Taxation Code Section 6353(b).

LPG for Household Use – I hereby certify that the LPG purchased and delivered by the seller is being delivered to my primary

residence not serviced by gas mains and pipes, for use therein, in accordance with Revenue & Taxation Code Section 6353(b).

I further certify that the LPG is being delivered into a tank with a storage capacity that is equal to, or greater than,

30 gallons.

CERTIFICATION

I understand that if such property is not used in a qualified manner, or if I am not a qualified person, that I am required by the

Sales and Use Tax Law to report and pay the sales and use tax measured by the sales price of the property to me. I also under-

stand that this exemption certificate is in effect as of the date shown below and will remain in effect until revoked in writing.

PRINT NAME

TITLE

SIGNATURE

DATE

TELEPHONE NUMBER

COMPANY NAME

PERMIT NUMBER (if applicable)*

(

)

ADDRESS (city, state, zip code)

* In California, you are required to hold a seller’s permit if you are engaged in the business of selling tangible personal property that

is subject to tax when sold at retail. If you are not required to hold a seller’s permit because you make no sales or leases of this type

of property in California, please enter “not applicable” and the reason why you are not required to hold a permit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1