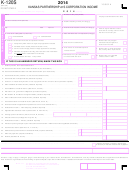

PART I - ADDITIONAL INFORMATION

4. Has your corporation been involved in any reorganization during the

1. Did the corporation file a Kansas Income Tax return under the same name

period covered by this return? _____ Yes ____ No If “yes”, enclose

for the preceding year? ___ Yes ___ No If “no”, enter previous name

and EIN.

a detailed explanation.

________________________________________________________

5. If your federal taxable income has been redetermined for any prior

years that have not previously been reported to Kansas, check the

________________________________________________________

applicable box(es) below and state the calendar, fiscal, or short period

2. Enter the address of the corporation’s principal location in Kansas.

year ending date. You are required to submit, under separate cover,

________________________________________________________

the federal Forms 1139, 1120X, or Revenue Agent’s Report along with

the Kansas amended return.

________________________________________________________

3. The corporation’s books are in care of:

Revenue Agent’s Report

Name ___________________________________________________

Net Operating Loss

Address ________________________________________________

Net Operating Loss

_______________________________________________________

Years ended __________________________________________

Telephone _______________________________________________

PART II - PARTNER’S OR SHAREHOLDER’S DISTRIBUTION OF INCOME

This schedule is to be completed for all partners or shareholders. If there are more than 12 partners or shareholders, you must complete a schedule similar

to the schedule below and submit it with your return. Individual partners or shareholders complete columns 1 through 8. All other partners and shareholders

complete columns 1 through 5.

(1)

(2)

(3)

(4)

Name and address of partner or shareholder

Social Security Number or

Partner’s or

Partner’s profit percent

Check box if

Employer Identification

shareholder’s percent

or shareholder’s

nonresident

Number (EIN)

of ownership

applicable percentage

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

PART II (cont’d)

See instructions for Nonresident Partner’s or Shareholder’s Computation of Columns 6, 7 and 8.

(6)

(5)

(7)

(8)

Partner’s or shareholder’s portion of

Partner’s or shareholder’s portion

Partner’s or shareholder’s

Income from Kansas sources.

federal ordinary and other income

of total Kansas income.

modification.

Kansas resident individuals: Multiply column 4 by line 12.

(losses) and deductions.

Nonresident individuals: If income is earned only from Kansas

Multiply the percentage in column 4 by

See instructions. Enter result in

sources multiply column 4 by line 12. If earned inside and outside

Multiply the percentage in column 4

line 12, page 1.

Part A of Schedule S, Form K-40.

Kansas, multiply column 4 by the sum of lines 16 and 17.

by line 3, page 1.

All other partners or shareholders: Multiply column 4 by the

sum of lines 16 and 17.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

1

1 2

2