Clergy Compensation Worksheet - 2016 Page 2

ADVERTISEMENT

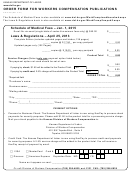

2016 CLERGY COMPENSATION WORKSHEET

NORTH CAROLINA CONFERENCE

THE UNITED METHODIST CHURCH

PASTOR'S PORTION (These items are to be withheld from the pastor’s monthly salary):

ALL FULL-TIME PASTORS: COMPREHENSIVE PROTECTION (CPP-P) ................... $_______________(12)

1. The Maximum Limit for this line item = 1% of 200% of the Denominational Average Compensation

(Calculated as: 1% X 200% X $67,333 = $1,346.66 per year or $112.22 per month.)

2.

Your actual amount for this line item = 1% of your Plan Compensation, Line 7. (To calculate

your actual amount complete this formula: 1% X the amount in Line 7 = $_____________ per year

or $__________ per month.)

3.

Enter on Line 12 the lesser of $1,346.66 or the annual amount calculated in step 2 above. The

monthly amount calculated in step 2 above should match to the CPP-P line item on the monthly bill

from the NC Conference Treasurer’s Office.

OPTIONAL for all pastors: UNITED METHODIST PERSONAL INVESTMENT PLAN (UMPIP) . $_______(13)

Although the Conference Board of Pension recommends a minimum contribution of 3% of Plan Compensation, an

individual may choose another percentage or dollar amount. A minimum contribution of 1% is required to earn the

church’s matching contributions. There are maximum limits. For help in calculating those limits, contact the General

Board of Pension and Health Benefits at 1-800-851-2201. Enter the same percentages or dollar amounts as on the

Contributions Agreement to the UMPIP:

Part 3 (for before-tax contributions) and Part 4 (for Roth contributions) and Part 5 (for after-tax contributions).

Before-tax Contribution:

% of Plan Compensation (line 7) = $_______ or $ ____ dollar amount

Roth Contribution:

% of Plan Compensation (line 7) = $_______ or $ ____ dollar amount

After tax contribution:

% of Plan Compensation (line 7) = $_______ or $ ____ dollar amount

Add the before-tax contribution, the Roth contribution and the after-tax contribution and enter the total on line 13.

1/12 of Line 13 = $_______ . This amount should match to the UMPIP-P line item on the monthly bill from the NC

Conference Treasurer’s Office.

OPTIONAL for full-time pastors: MINISTERS’ TRANSITION FUND (MTF) .............. $________________(14)

If you are currently a member of the MTF and want your annual contribution withheld from your salary on

1.

an after-tax basis and remitted to the NCCUMC on a monthly basis along with the church pension billing, then

calculate the amount to be entered on Line 14 as shown in step 2 below.

The amount in Line 1 above + 2016 Utilities Allowance (from both Line 3 and Line 4b) X 1% = $_______ per

2.

year or $_________ per month. This amount should match to the MTF line item on the monthly bill from the

NC Conference Treasurer’s Office.

3. If you are not a current member of the MTF, but would like information about enrolling, please contact JoAnna

Ezuka at 1-800-849-4433 ext. 225.

Page 2

Rev. July 23, 2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2