Form 104cr - Individual Credit Schedule - 2012 Page 2

ADVERTISEMENT

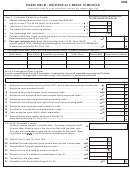

Part III — Enterprise Zone Credits (See publication FYI General 6 for information on these credits.)

NEW - In order to claim an Enterprise Zone credit, you must electronically file your return and the EZ Carryforward Schedule (DR

1366). For an electronic filing hardship exception, call 303-238-7378.

If credit is passed through from an S corporation or a partnership, give name, ownership percentage and Colorado account number of

the organization, and submit a copy of the corporation or partnership certification.

Name

Ownership %

Account Number

Column(a)

Column(b)

10. Enterprise zone investment credit

00

00

[Total of 10(b) and 11(b) cannot exceed $500,000 for 2012]

10

11. Enterprise zone commercial vehicle investment credit [Not available until the

Department of Revenue receives verification of the credit from the authorizing agency.

00

00

See on availability status.]

11

00

00

12. Enterprise zone new business facility employee credit

12

00

00

13. Enhanced rural enterprise zone new business facility employee credit

13

00

00

14. Enterprise zone agricultural employee processing credit

14

00

00

15. Enhanced rural enterprise zone agricultural employee processing credit

15

00

00

16. Enterprise zone employee health insurance credit

16

17. Contribution to enterprise zone administrator credit

Contribution type

Cash

In-Kind

Combination

Total amount of donation $________________ Submit a copy of the DR 0075

00

00

17

certification when claiming this credit if line 17(a) exceeds

$250.

18. Research and development enterprise zone credit

00

00

18

Submit a copy of the DR 0077 certification when claiming this credit.

19. Rehabilitation of vacant commercial buildings enterprise zone credit

00

00

19

Submit a copy of the DR 0076 certification when claiming this credit.

00

00

20. Job training program enterprise zone credit

20

21. Total enterprise zone credits, add lines 10 through 20, column (b)

21

00

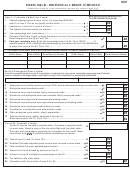

Part IV — Credit for Tax Paid to Another State

• Colorado nonresidents do not qualify for this credit. Part-year residents generally do not qualify for this credit.

• If you have income or losses from two or more states you must complete lines 22 through 29 for each state. You

must also complete lines 22 through 29 (enter “Combined” on line 22) to determine your credit limitation. If the return

cannot be electronically filed, each separate computation must be submitted on a separate 104CR form. A summary

schedule of the data is not acceptable.

• See publication FYI Income 17 for more information along with tips on the amount to enter on each line.

Submit a copy of the tax return for each other state when claiming this credit. The portion of the return submitted must

include the adjusted gross income calculation, any disallowed federal deductions by that state, and the tax calculation for

the other state.

22. Name of other state

23. Total of lines 19 and 20, Form 104

23

00

24. Modified Colorado adjusted gross income from sources in the other state

24

00

25. Total modified Colorado adjusted gross income

25

00

%

26. Amount on line 24 divided by amount on line 25

26

27. Amount on line 23 multiplied by the percentage on line 26

27

00

28. Tax liability to the other state

28

00

29. Allowable credit, the smaller of lines 27 or 28

29

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3