AB CD

*1210000W041726*

Be sure to print and sign your return.

12-100

b

b.

RESET FORM

PRINT FORM

(Rev.4-17/26)

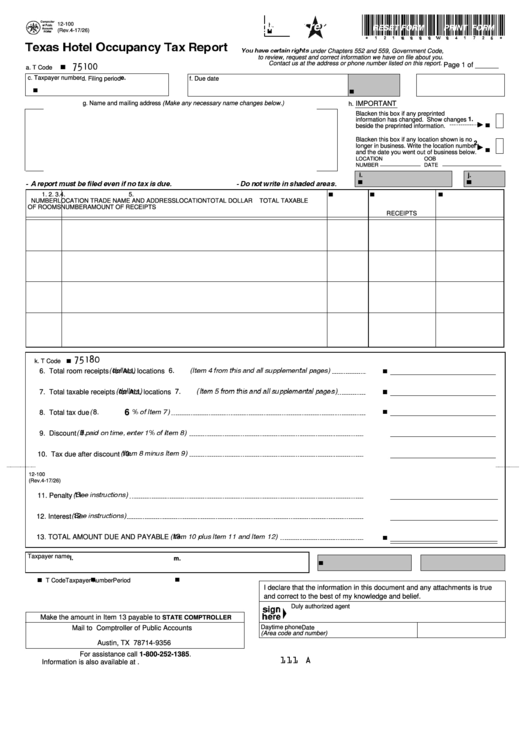

Texas Hotel Occupancy Tax Report

under Chapters 552 and 559, Government Code,

You have certain rights

to review, request and correct information we have on file about you.

b

75100

Contact us at the address or phone number listed on this report.

Page 1 of ______

a. T Code

c. Taxpayer number

e.

d. Filing period

f. Due date

b

b

g. Name and mailing address (Make any necessary name changes below.)

IMPORTANT

h.

Blacken this box if any preprinted

R b

1.

information has changed. Show changes

beside the preprinted information.

Blacken this box if any location shown is no

R

2.

b

longer in business. Write the location number

and the date you went out of business below.

LOCATION

OOB

NUMBER

DATE

i.

j.

b

b

- A report must be filed even if no tax is due.

- Do not write in shaded areas.

b

b

b

1.

2.

3.

4.

5.

NUMBER

LOCATION TRADE NAME AND ADDRESS

LOCATION

TOTAL TAXABLE

TOTAL DOLLAR

OF ROOMS

NUMBER

AMOUNT OF

RECEIPTS

RECEIPTS

b

75180

k. T Code

b

(dollars)

(Item 4 from this and all supplemental pages)

6.

6. Total room receipts

for ALL locations

b

(dollars)

(Item 5 from this and all supplemental pages)

7.

7. Total taxable receipts

for ALL locations

b

(

% of Item 7)

6

8.

8. Total tax due

(If paid on time, enter 1% of Item 8)

9.

9. Discount

(Item 8 minus Item 9)

10.

10. Tax due after discount

12-100

(Rev.4-17/26)

(See instructions)

11.

11. Penalty

(See instructions)

12.

12. Interest

b

(Item 10 plus Item 11 and Item 12)

13.

13. TOTAL AMOUNT DUE AND PAYABLE

Taxpayer name

b

l.

m.

AB

b

b

b

T Code

Taxpayer number

Period

I declare that the information in this document and any attachments is true

and correct to the best of my knowledge and belief.

Duly authorized agent

Make the amount in Item 13 payable to

STATE COMPTROLLER

Daytime phone

Mail to Comptroller of Public Accounts

Date

(Area code and number)

P.O. Box 149356

Austin, TX 78714-9356

For assistance call 1-800-252-1385 .

111 A

Information is also available at

1

1 2

2