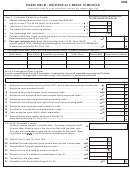

Part III - Enterprise Zone Credits

If credit is passed through from an S corporation or a partnership, give name, ownership percentage and Colorado

account number of the organization, and attach a copy of the corporation or partnership certification.

Ownership %

Name

Account Number

.00

34 Enterprise zone credits carried over from 2003, attach schedule and original certification . 34

.00

35 Enterprise zone investment credit ...................................................................................... 35

.00

36 Enterprise zone new business facility employee credit ...................................................... 36

.00

37 Enhanced rural enterprise zone new business facility employee credit ............................. 37

.00

38 Enterprise zone agricultural employee processing credit ................................................... 38

.00

39 Enhanced rural enterprise zone agricultural employee processing credit .......................... 39

.00

40 Enterprise zone employee health insurance credit ............................................................. 40

.00

41 Contribution to enterprise zone administrator credit ........................................................... 41

.00

42 Other enterprise zone credits, attach explanation .............................................................. 42

.00

43 Total enterprise zone credits, add lines 34 through 42. Enter here and on line 21, Form 104. .... 43

If the total of lines 29, 32, 33 and 43 on this Form 104CR exceeds the total of lines 14

and 15, Form 104, see the limitation at the bottom of this form.

Credits to be carried forward to 2005:

LIMITATION: The total credits you claim on lines 29, 32, 33 and 43 of this Form 104CR may not exceed the total tax on lines 14 and

15 of your income tax return, Form 104. If you have excess credits, you must choose which credits you are going to use against

your 2004 tax and enter those amounts on lines 18 through 21 of Form 104. Most unused 2004 credits may be carried forward and

claimed on your 2005 Colorado income tax return.

ATTACH THIS FORM TO YOUR COMPLETED INCOME TAX RETURN FORM 104

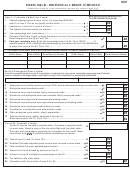

INSTRUCTIONS FOR FORM 104CR

5

Multiply the amount on line 3 by the percentage on line 4.

CHILD CARE CREDIT.

6

If you claimed a child care credit on line 5, enter the name,

If, during 2004, you were a Colorado resident, your federal

date of birth and social security number of your eligible

adjusted gross income was $60,000 or less, and you claim a

children in the space provided. Attach a schedule if

child care credit on your 2004 federal income tax return, you

additional space is needed.

may claim a Colorado child care credit. See

33.

Part-year residents must apportion their Colorado child care

credit by their Colorado percentage from line 34 of Form 104PN.

1 Enter the federal adjusted gross income from federal

The resulting credit can not exceed 100% of the credit on line 5.

Form 1040, line 36, or from federal Form 1040A, line 21.

2 Enter the federal tax from federal Form 1040, line 45, or

CREDIT FOR INCOME TAX PAID TO

from federal Form 1040A, line 28. If this amount is $0,

ANOTHER STATE

you do not qualify for the child care credit and you must

A Colorado resident may claim credit for income tax paid

enter $0 on line 5.

to another state on income from sources within that state.

3 Enter the child care credit you claimed on your 2004

(“State” includes the District of Columbia and territories

federal income tax return. This will be the smaller of the

or possessions of the United States.) Refer to publication

amounts on line 45 or 47 of your federal Form 1040, or the

17

for information on how to compute this

smaller of the amounts on line 28 or 29 of your federal

credit and on claiming the credit for a part-year resident.

Form 1040A.

Part-year residents may claim this credit only if the income

The Colorado child care credit is allowed only on ex-

taxed by the other state was (a) earned while they were a

penses incurred for the care of children under age 13.

Colorado resident and (b) is included in line 33 of Form

Colorado does not allow a credit for dependent care

104PN. A part-year resident can not claim this credit if the

expense. If your federal credit is a combined child care

income from the other state is not included in line 33 of Form

and dependent care credit, refer to FYI Income 33.

104PN because Form 104PN has already eliminated the

4 Enter the percentage from the following table:

Colorado tax on this income. A nonresident cannot claim

this credit.

Your Federal Adjusted Gross Income

Your Percentage

9 Enter that part of the modified Colorado adjusted gross

More Than:

But Not More Than:

income that is being taxed in the other state. Modified

$0

$25,000

50%

Colorado adjusted gross income means your federal

$25,000

$35,000

30%

adjusted gross income increased by the additions re-

ported on line 3 (excluding any charitable contribution

$35,000

$60,000

10%

adjustment) of Form 104, and decreased by the subtrac-

1

1 2

2