Annual Return To N. Smithfield Form - Ri Tax Assessor - 2016

ADVERTISEMENT

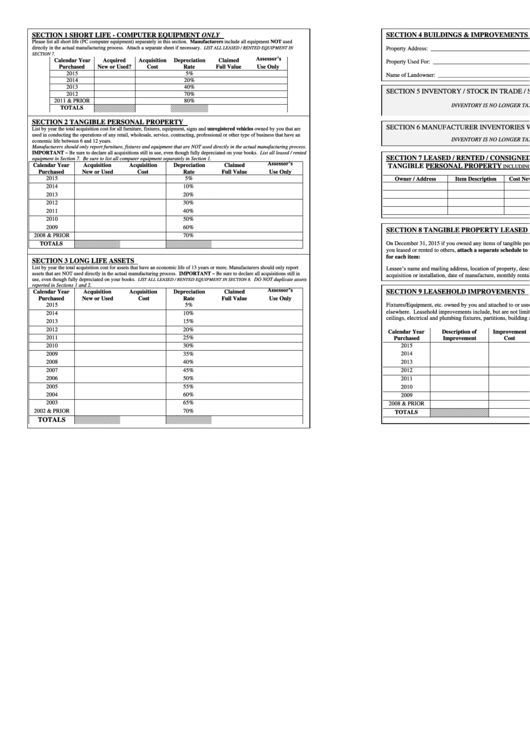

SECTION 1 SHORT LIFE - COMPUTER EQUIPMENT ONLY

SECTION 4 BUILDINGS & IMPROVEMENTS ON LEASED LAND

Please list all short life (PC computer equipment) separately in this section. Manufacturers include all equipment NOT used

directly in the actual manufacturing process. Attach a separate sheet if necessary.

LIST ALL LEASED / RENTED EQUIPMENT IN

Property Address:

______________________________________

PLAT ________

LOT________

SECTION 7

.

Assessor’s

Calendar Year

Acquired

Acquisition

Depreciation

Claimed

Property Used For:

______________________________________

CLAIMED FULL VALUE:

Purchased

New or Used?

Cost

Rate

Full Value

Use Only

2015

5%

Name of Landowner: ______________________________________

$ __________________________

2014

20%

2013

40%

Is Lease Recorded? YES ______ NO ______

Dates of Lease From: __________ to __________

SECTION 5 INVENTORY / STOCK IN TRADE / SUPPLIES

2012

70%

2011 & PRIOR

80%

INVENTORY IS NO LONGER TAXABLE IN RHODE ISLAND

TOTALS

SECTION 2 TANGIBLE PERSONAL PROPERTY

SECTION 6 MANUFACTURER INVENTORIES WHICH YOU CLAIM EXEMPT

List by year the total acquisition cost for all furniture, fixtures, equipment, signs and unregistered vehicles owned by you that are

used in conducting the operations of any retail, wholesale, service, contracting, professional or other type of business that have an

INVENTORY IS NO LONGER TAXABLE IN RHODE ISLAND

economic life between 6 and 12 years.

Manufacturers should only report furniture, fixtures and equipment that are NOT used directly in the actual manufacturing process.

IMPORTANT ~ Be sure to declare all acquisitions still in use, even though fully depreciated on your books. List all leased / rented

SECTION 7 LEASED / RENTED / CONSIGNED

equipment in Section 7. Be sure to list all computer equipment separately in Section 1.

This Section to be used by All Businesses

Assessor’s

Calendar Year

Acquisition

Acquisition

Depreciation

Claimed

TANGIBLE PERSONAL PROPERTY

INCLUDING MANUFACTURERS

Purchased

New or Used

Cost

Rate

Full Value

Use Only

2015

5%

Owner / Address

Item Description

Cost New

Lease Term

Monthly Rent

Lease #

2014

10%

2013

20%

2012

30%

2011

40%

2010

50%

2009

60%

SECTION 8 TANGIBLE PROPERTY LEASED OR RENTED TO OTHERS

2008 & PRIOR

70%

TOTALS

On December 31, 2015 if you owned any items of tangible personal property (except registered motor vehicles), which

you leased or rented to others, attach a separate schedule to this form and report all of the following information

for each item:

SECTION 3 LONG LIFE ASSETS

List by year the total acquisition cost for assets that have an economic life of 13 years or more. Manufacturers should only report

Lessee’s name and mailing address, location of property, description of property, your acquisition cost, date of

assets that are NOT used directly in the actual manufacturing process. IMPORTANT ~ Be sure to declare all acquisitions still in

acquisition or installation, date of manufacture, monthly rental or lease income, and dates of lease.

use, even though fully depreciated on your books.

LIST ALL LEASED / RENTED EQUIPMENT IN SECTION 8

. DO NOT duplicate assets

reported in Sections 1 and 2.

Assessor’s

SECTION 9 LEASEHOLD IMPROVEMENTS

Calendar Year

Acquisition

Acquisition

Depreciation

Claimed

Purchased

New or Used

Cost

Rate

Full Value

Use Only

2015

5%

Fixtures/Equipment, etc. owned by you and attached to or used in real estate owned by others and not reported

elsewhere. Leasehold improvements include, but are not limited to, wall paneling, carpeting, tile on wall and floors,

2014

10%

ceilings, electrical and plumbing fixtures, partitions, building additions and the like.

2013

15%

2012

20%

Assessor’s

Calendar Year

Description of

Improvement

Depreciation

Claimed

2011

25%

Purchased

Improvement

Cost

Rate

Full Value

Use Only

2015

5%

2010

30%

2009

35%

2014

10%

2008

40%

2013

20%

2007

45%

2012

30%

2006

50%

2011

40%

2005

55%

2010

50%

2004

60%

2009

60%

2003

65%

2008 & PRIOR

70%

2002 & PRIOR

70%

TOTALS

TOTALS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2