2

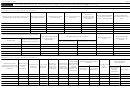

Form 1118 (Rev. 12-2015)

Page

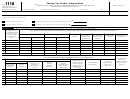

Schedule B

Foreign Tax Credit (Report all foreign tax amounts in U.S. dollars.)

Part I—Foreign Taxes Paid, Accrued, and Deemed Paid (see instructions)

1. Credit is Claimed

2. Foreign Taxes Paid or Accrued (attach schedule showing amounts in foreign currency and conversion rate(s) used)

3. Tax Deemed Paid

for Taxes (check one):

(from Schedule C—

Tax Withheld at Source on:

Other Foreign Taxes Paid or Accrued on:

(h) Total Foreign Taxes

Part I, column 12,

Paid

Accrued

Paid or Accrued (add

Part II, column 8(b),

(c) Rents, Royalties,

(d) Section

(e) Foreign

(a) Dividends

(b) Interest

(f) Services Income

(g) Other

columns 2(a) through 2(g))

and Part III, column 8)

and License Fees

863(b) Income

Branch Income

Date Paid

Date Accrued

A

B

C

D

E

F

Totals (add lines A through F)

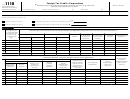

Part II—Separate Foreign Tax Credit (Complete a separate Part II for each applicable category of income.)

1a Total foreign taxes paid or accrued (total from Part I, column 2(h)) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Foreign taxes paid or accrued by the corporation during prior tax years that were suspended due to the rules of section 909 and for

which the related income is taken into account by the corporation during the current tax year (see instructions) .

.

.

.

.

.

.

.

2

Total taxes deemed paid (total from Part I, column 3)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Reductions of taxes paid, accrued, or deemed paid (enter total from Schedule G) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(

)

4

Taxes reclassified under high-tax kickout

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Enter the sum of any carryover of foreign taxes (from Schedule K, line 3, column (xiv) and from Schedule I, Part III, line 3) plus any

carrybacks to the current tax year .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Total foreign taxes (combine lines 1a through 5) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Enter the amount from the applicable column of Schedule J, Part I, line 11 (see instructions). If Schedule J is not required to be completed, enter the

result from the “Totals” line of column 13 of the applicable Schedule A

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8a Total taxable income from all sources (enter taxable income from the corporation’s tax return) .

.

.

.

.

.

.

.

.

.

.

.

.

.

b Adjustments to line 8a (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Subtract line 8b from line 8a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

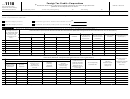

9

Divide line 7 by line 8c. Enter the resulting fraction as a decimal (see instructions). If line 7 is greater than line 8c, enter 1 .

.

.

.

.

.

.

.

.

.

.

10

Total U.S. income tax against which credit is allowed (regular tax liability (see section 26(b)) minus American Samoa economic development credit) .

.

11

Credit limitation (multiply line 9 by line 10) (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

Separate foreign tax credit (enter the smaller of line 6 or line 11 here and on the appropriate line of Part III) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

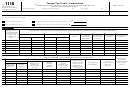

Part III—Summary of Separate Credits

countries.)

(Enter amounts from Part II, line 12 for each applicable category of income. Do not include taxes paid to sanctioned

1

Credit for taxes on passive category income

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

Credit for taxes on general category income

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Credit for taxes on income re-sourced by treaty (combine all such credits on this line)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Total (add lines 1 through 3) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Reduction in credit for international boycott operations (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Total foreign tax credit (subtract line 5 from line 4). Enter here and on the appropriate line of the corporation’s tax return

.

.

.

.

.

.

.

.

.

.

1118

Form

(Rev. 12-2015)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11