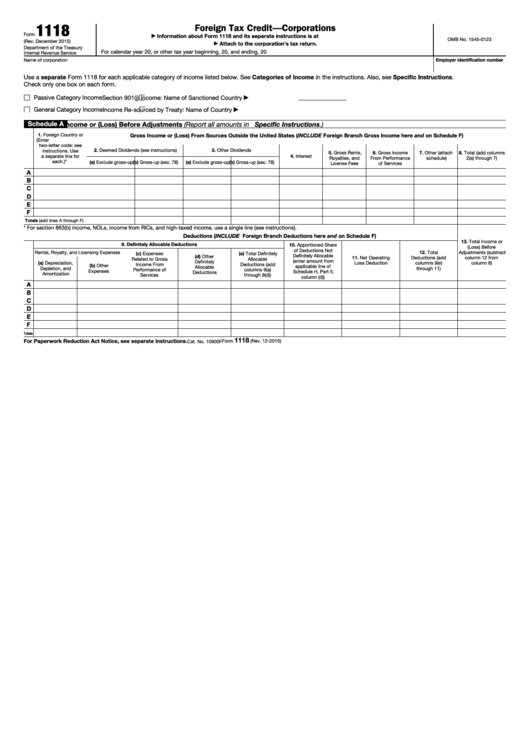

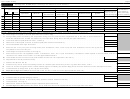

1118

Foreign Tax Credit—Corporations

Form

Information about Form 1118 and its separate instructions is at

▶

OMB No. 1545-0123

(Rev. December 2015)

Attach to the corporation's tax return.

▶

Department of the Treasury

For calendar year 20

, or other tax year beginning

, 20

, and ending

, 20

Internal Revenue Service

Name of corporation

Employer identification number

Use a separate Form 1118 for each applicable category of income listed below. See Categories of Income in the instructions. Also, see Specific Instructions.

Check only one box on each form.

Passive Category Income

Section 901(j) Income: Name of Sanctioned Country

▶

General Category Income

Income Re-sourced by Treaty: Name of Country

▶

Schedule A

Income or (Loss) Before Adjustments (Report all amounts in U.S. dollars. See Specific Instructions.)

1. Foreign Country or

Gross Income or (Loss) From Sources Outside the United States (INCLUDE Foreign Branch Gross Income here and on Schedule F)

U.S. Possession (Enter

two-letter code; see

2. Deemed Dividends (see instructions)

3. Other Dividends

instructions. Use

5. Gross Rents,

6. Gross Income

7. Other (attach

8. Total (add columns

a separate line for

4. Interest

Royalties, and

From Performance

schedule)

2(a) through 7)

each.) *

(a) Exclude gross-up (b) Gross-up (sec. 78)

(a) Exclude gross-up (b) Gross-up (sec. 78)

License Fees

of Services

A

B

C

D

E

F

Totals (add lines A through F)

* For section 863(b) income, NOLs, income from RICs, and high-taxed income, use a single line (see instructions).

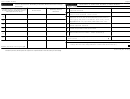

Deductions (INCLUDE Foreign Branch Deductions here and on Schedule F)

13. Total Income or

9. Definitely Allocable Deductions

10. Apportioned Share

(Loss) Before

of Deductions Not

Rental, Royalty, and Licensing Expenses

12. Total

Adjustments (subtract

(c) Expenses

(e) Total Definitely

Definitely Allocable

(d) Other

11. Net Operating

Deductions (add

column 12 from

Related to Gross

Allocable

(enter amount from

Definitely

(a) Depreciation,

Loss Deduction

columns 9(e)

column 8)

Income From

Deductions (add

(b) Other

applicable line of

Allocable

Depletion, and

through 11)

Performance of

columns 9(a)

Expenses

Schedule H, Part II,

Deductions

Amortization

Services

through 9(d))

column (d))

A

B

C

D

E

F

Totals

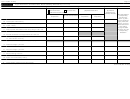

1118

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 12-2015)

Cat. No. 10900F

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11