Form Il-W-4 - Illinois Withholding Allowance Worksheet

ADVERTISEMENT

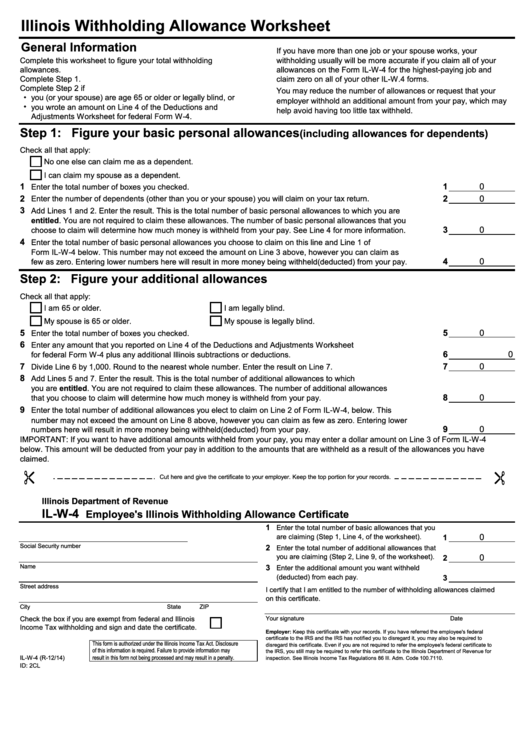

Illinois Withholding Allowance Worksheet

General Information

If you have more than one job or your spouse works, your

Complete this worksheet to figure your total withholding

withholding usually will be more accurate if you claim all of your

allowances.

allowances on the Form IL-W-4 for the highest-paying job and

Complete Step 1.

claim zero on all of your other IL-W.4 forms.

Complete Step 2 if

You may reduce the number of allowances or request that your

you (or your spouse) are age 65 or older or legally blind, or

employer withhold an additional amount from your pay, which may

you wrote an amount on Line 4 of the Deductions and

help avoid having too little tax withheld.

Adjustments Worksheet for federal Form W-4.

Step 1: Figure your basic personal allowances

(including allowances for dependents)

Check all that apply:

No one else can claim me as a dependent.

I can claim my spouse as a dependent.

1

1

0

Enter the total number of boxes you checked.

2

2

0

Enter the number of dependents (other than you or your spouse) you will claim on your tax return.

3

Add Lines 1 and 2. Enter the result. This is the total number of basic personal allowances to which you are

entitled. You are not required to claim these allowances. The number of basic personal allowances that you

3

0

choose to claim will determine how much money is withheld from your pay. See Line 4 for more information.

4

Enter the total number of basic personal allowances you choose to claim on this line and Line 1 of

Form IL-W-4 below. This number may not exceed the amount on Line 3 above, however you can claim as

4

0

few as zero. Entering lower numbers here will result in more money being withheld(deducted) from your pay.

Step 2: Figure your additional allowances

Check all that apply:

I am 65 or older.

I am legally blind.

My spouse is 65 or older.

My spouse is legally blind.

5

5

0

Enter the total number of boxes you checked.

6

Enter any amount that you reported on Line 4 of the Deductions and Adjustments Worksheet

6

0

for federal Form W-4 plus any additional Illinois subtractions or deductions.

7

7

0

Divide Line 6 by 1,000. Round to the nearest whole number. Enter the result on Line 7.

8

Add Lines 5 and 7. Enter the result. This is the total number of additional allowances to which

you are entitled. You are not required to claim these allowances. The number of additional allowances

8

0

that you choose to claim will determine how much money is withheld from your pay.

9

Enter the total number of additional allowances you elect to claim on Line 2 of Form IL-W-4, below. This

number may not exceed the amount on Line 8 above, however you can claim as few as zero. Entering lower

9

0

numbers here will result in more money being withheld(deducted) from your pay.

IMPORTANT: If you want to have additional amounts withheld from your pay, you may enter a dollar amount on Line 3 of Form IL-W-4

below. This amount will be deducted from your pay in addition to the amounts that are withheld as a result of the allowances you have

claimed.

3

2

Cut here and give the certificate to your employer. Keep the top portion for your records.

Illinois Department of Revenue

IL-W-4

Employee's Illinois Withholding Allowance Certificate

1

Enter the total number of basic allowances that you

are claiming (Step 1, Line 4, of the worksheet).

0

1

Social Security number

2

Enter the total number of additional allowances that

you are claiming (Step 2, Line 9, of the worksheet).

0

2

Name

3

Enter the additional amount you want withheld

(deducted) from each pay.

3

Street address

I certify that I am entitled to the number of withholding allowances claimed

on this certificate.

City

State

ZIP

Check the box if you are exempt from federal and Illinois

Your signature

Date

Income Tax withholding and sign and date the certificate.

Employer: Keep this certificate with your records. If you have referred the employee's federal

certificate to the IRS and the IRS has notified you to disregard it, you may also be required to

This form is authorized under the Illinois Income Tax Act. Disclosure

disregard this certificate. Even if you are not required to refer the employee's federal certificate to

of this information is required. Failure to provide information may

the IRS, you still may be required to refer this certificate to the Illinois Department of Revenue for

IL-W-4 (R-12/14)

result in this form not being processed and may result in a penalty.

inspection. See Illinois Income Tax Regulations 86 Ill. Adm. Code 100.7110.

ID: 2CL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1