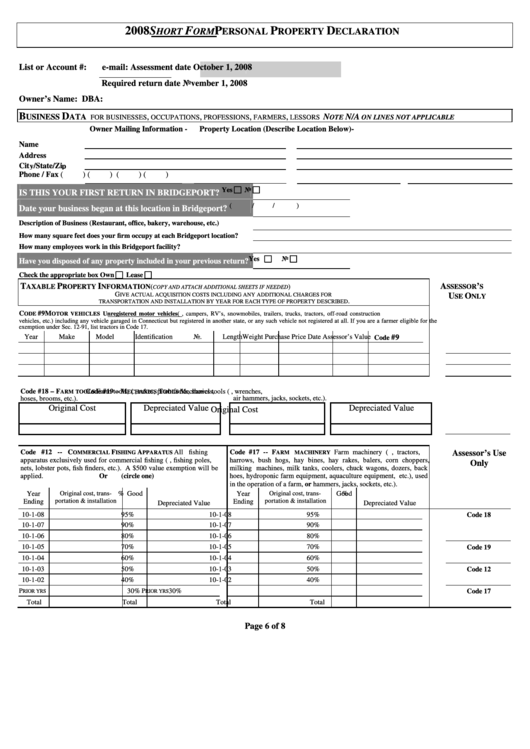

Short Form Personal Property Declaration - 2008

ADVERTISEMENT

2008 S

F

P

P

D

HORT

ORM

ERSONAL

ROPERTY

ECLARATION

List or Account #:

e-mail:

Assessment date October 1, 2008

Required return date November 1, 2008

Owner’s Name:

DBA:

B

D

,

,

,

,

N

N/A

USINESS

ATA

FOR BUSINESSES

OCCUPATIONS

PROFESSIONS

FARMERS

LESSORS

OTE

ON LINES NOT APPLICABLE

Owner Mailing Information -

Property Location (Describe Location Below)-

Name

Address

City/State/Zip

(

)

(

)

(

)

(

)

Phone / Fax

Yes

No

IS THIS YOUR FIRST RETURN IN BRIDGEPORT?

(

/

/

)

Date your business began at this location in Bridgeport?

Description of Business (Restaurant, office, bakery, warehouse, etc.)

How many square feet does your firm occupy at each Bridgeport location?

How many employees work in this Bridgeport facility?

Yes

No

Have you disposed of any property included in your previous return?

Check the appropriate box

Own

Lease

T

P

I

A

’

AXABLE

ROPERTY

NFORMATION (

)

SSESSOR

S

COPY AND ATTACH ADDITIONAL SHEETS IF NEEDED

G

IVE ACTUAL ACQUISITION COSTS INCLUDING ANY ADDITIONAL CHARGES FOR

U

O

SE

NLY

.

TRANSPORTATION AND INSTALLATION BY YEAR FOR EACH TYPE OF PROPERTY DESCRIBED

C

#9 M

Unregistered motor vehicles (e.g. passenger cars, campers, RV’s, snowmobiles, trailers, trucks, tractors, off-road construction

ODE

OTOR VEHICLES

vehicles, etc.) including any vehicle garaged in Connecticut but registered in another state, or any such vehicle not registered at all. If you are a farmer eligible for the

exemption under Sec. 12-91, list tractors in Code 17.

Year

Make

Model

Identification No.

Length

Weight

Purchase Price

Date

Assessor’s Value

#9

Code

Code #18 – F

Farm tools, (e.g., rakes, pitch forks, shovels,

Code #19 – M

T

Mechanics tools (e.g., wrenches,

ARM TOOLS

ECHANICS

OOLS

hoses, brooms, etc.).

air hammers, jacks, sockets, etc.).

Depreciated Value

Depreciated Value

Original Cost

Original Cost

Code #12 -- C

F

A

All fishing

Code #17 -- F

Farm machinery (e.g., tractors,

Assessor’s Use

OMMERCIAL

ISHING

PPARATUS

ARM

MACHINERY

apparatus exclusively used for commercial fishing (e.g., fishing poles,

harrows, bush hogs, hay bines, hay rakes, balers, corn choppers,

Only

nets, lobster pots, fish finders, etc.). A $500 value exemption will be

milking machines, milk tanks, coolers, chuck wagons, dozers, back

applied.

Or

(circle one)

hoes, hydroponic farm equipment, aquaculture equipment, etc.), used

in the operation of a farm, or hammers, jacks, sockets, etc.).

Original cost, trans-

Original cost, trans-

Year

%

Year

%

portation & installation

portation & installation

Ending

Good

Ending

Good

Depreciated Value

Depreciated Value

10-1-08

95%

10-1-08

95%

Code 18

10-1-07

90%

10-1-07

90%

10-1-06

80%

10-1-06

80%

10-1-05

70%

10-1-05

70%

Code 19

10-1-04

60%

10-1-04

60%

10-1-03

50%

10-1-03

50%

Code 12

10-1-02

40%

10-1-02

40%

P

30%

P

30%

Code 17

RIOR YRS

RIOR YRS

Total

Total

Total

Total

Page 6 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2