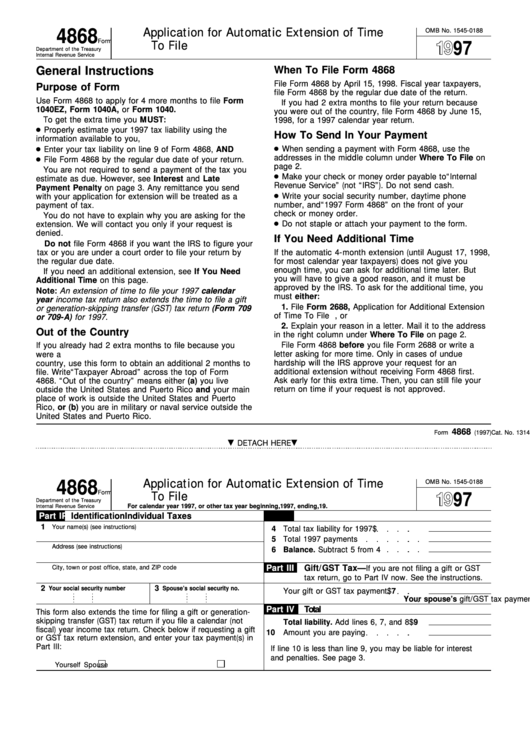

4868

OMB No. 1545-0188

Application for Automatic Extension of Time

Form

97

To File U.S. Individual Income Tax Return

Department of the Treasury

Internal Revenue Service

General Instructions

When To File Form 4868

File Form 4868 by April 15, 1998. Fiscal year taxpayers,

Purpose of Form

file Form 4868 by the regular due date of the return.

Use Form 4868 to apply for 4 more months to file Form

If you had 2 extra months to file your return because

1040EZ, Form 1040A, or Form 1040.

you were out of the country, file Form 4868 by June 15,

To get the extra time you MUST:

1998, for a 1997 calendar year return.

● Properly estimate your 1997 tax liability using the

How To Send In Your Payment

information available to you,

● When sending a payment with Form 4868, use the

● Enter your tax liability on line 9 of Form 4868, AND

● File Form 4868 by the regular due date of your return.

addresses in the middle column under Where To File on

page 2.

You are not required to send a payment of the tax you

● Make your check or money order payable to “Internal

estimate as due. However, see Interest and Late

Revenue Service” (not “IRS”). Do not send cash.

Payment Penalty on page 3. Any remittance you send

● Write your social security number, daytime phone

with your application for extension will be treated as a

number, and “1997 Form 4868” on the front of your

payment of tax.

check or money order.

You do not have to explain why you are asking for the

● Do not staple or attach your payment to the form.

extension. We will contact you only if your request is

denied.

If You Need Additional Time

Do not file Form 4868 if you want the IRS to figure your

tax or you are under a court order to file your return by

If the automatic 4-month extension (until August 17, 1998,

the regular due date.

for most calendar year taxpayers) does not give you

enough time, you can ask for additional time later. But

If you need an additional extension, see If You Need

you will have to give a good reason, and it must be

Additional Time on this page.

approved by the IRS. To ask for the additional time, you

Note: An extension of time to file your 1997 calendar

must either:

year income tax return also extends the time to file a gift

1. File Form 2688, Application for Additional Extension

or generation-skipping transfer (GST) tax return (Form 709

of Time To File U.S. Individual Income Tax Return, or

or 709-A) for 1997.

2. Explain your reason in a letter. Mail it to the address

Out of the Country

in the right column under Where To File on page 2.

File Form 4868 before you file Form 2688 or write a

If you already had 2 extra months to file because you

letter asking for more time. Only in cases of undue

were a U.S. citizen or resident and were out of the

country, use this form to obtain an additional 2 months to

hardship will the IRS approve your request for an

additional extension without receiving Form 4868 first.

file. Write “Taxpayer Abroad” across the top of Form

Ask early for this extra time. Then, you can still file your

4868. “Out of the country” means either (a) you live

return on time if your request is not approved.

outside the United States and Puerto Rico and your main

place of work is outside the United States and Puerto

Rico, or (b) you are in military or naval service outside the

United States and Puerto Rico.

4868

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 13141W

Form

(1997)

DETACH HERE

4868

Application for Automatic Extension of Time

OMB No. 1545-0188

Form

97

To File U.S. Individual Income Tax Return

Department of the Treasury

For calendar year 1997, or other tax year beginning

,1997, ending

,19

.

Internal Revenue Service

Part I

Identification

Part II

Individual Taxes

1

Your name(s) (see instructions)

4 Total tax liability for 1997

$

5

Total 1997 payments

Address (see instructions)

6

Balance. Subtract 5 from 4

Part III

Gift/GST Tax—

City, town or post office, state, and ZIP code

If you are not filing a gift or GST

tax return, go to Part IV now. See the instructions.

2

3

Your social security number

Spouse’s social security no.

7

Your gift or GST tax payment

$

8

Your spouse’s gift/GST tax payment

Part IV

Total

This form also extends the time for filing a gift or generation-

skipping transfer (GST) tax return if you file a calendar (not

9

Total liability. Add lines 6, 7, and 8 $

fiscal) year income tax return. Check below if requesting a gift

10

Amount you are paying

or GST tax return extension, and enter your tax payment(s) in

Part III:

If line 10 is less than line 9, you may be liable for interest

and penalties. See page 3.

Yourself

Spouse

1

1 2

2 3

3 4

4