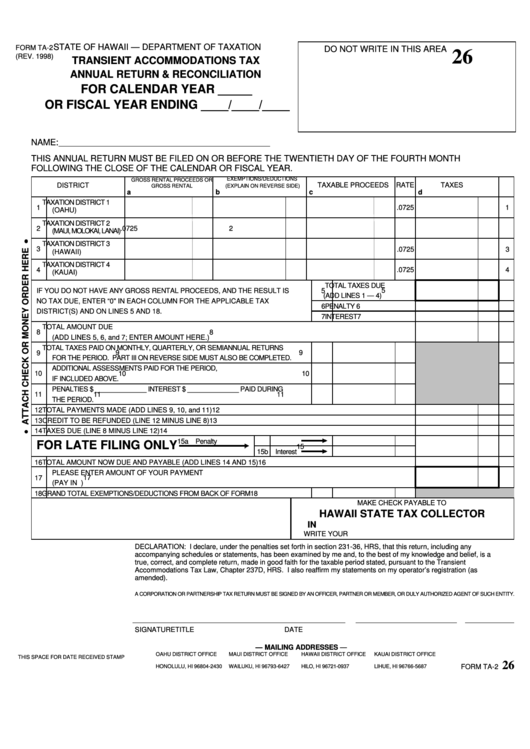

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM TA-2

DO NOT WRITE IN THIS AREA

26

(REV. 1998)

TRANSIENT ACCOMMODATIONS TAX

ANNUAL RETURN & RECONCILIATION

FOR CALENDAR YEAR _____

OR FISCAL YEAR ENDING ____/____/____

T.A. REG. NO. __ __ __ __ __ __ __ __

NAME:

THIS ANNUAL RETURN MUST BE FILED ON OR BEFORE THE TWENTIETH DAY OF THE FOURTH MONTH

FOLLOWING THE CLOSE OF THE CALENDAR OR FISCAL YEAR.

GROSS RENTAL PROCEEDS OR

EXEMPTIONS/DEDUCTIONS

DISTRICT

TAXABLE PROCEEDS

RATE

TAXES

GROSS RENTAL

(EXPLAIN ON REVERSE SIDE)

a

b

c

d

TAXATION DISTRICT 1

1

.0725

1

(OAHU)

TAXATION DISTRICT 2

2

.0725

2

(MAUI, MOLOKAI, LANAI)

TAXATION DISTRICT 3

3

.0725

3

(HAWAII)

TAXATION DISTRICT 4

4

.0725

4

(KAUAI)

TOTAL TAXES DUE

IF YOU DO NOT HAVE ANY GROSS RENTAL PROCEEDS, AND THE RESULT IS

5

5

(ADD LINES 1 — 4)

NO TAX DUE, ENTER “0" IN EACH COLUMN FOR THE APPLICABLE TAX

6

PENALTY

6

DISTRICT(S) AND ON LINES 5 AND 18.

7

INTEREST

7

TOTAL AMOUNT DUE

8

8

(ADD LINES 5, 6, and 7; ENTER AMOUNT HERE.)

TOTAL TAXES PAID ON MONTHLY, QUARTERLY, OR SEMIANNUAL RETURNS

9

9

9

FOR THE PERIOD. PART III ON REVERSE SIDE MUST ALSO BE COMPLETED.

ADDITIONAL ASSESSMENTS PAID FOR THE PERIOD,

10

10

10

IF INCLUDED ABOVE.

PENALTIES $ ______________ INTEREST $ ______________ PAID DURING

11

11

11

THE PERIOD.

12

TOTAL PAYMENTS MADE (ADD LINES 9, 10, and 11)

12

13

CREDIT TO BE REFUNDED (LINE 12 MINUS LINE 8)

13

14

TAXES DUE (LINE 8 MINUS LINE 12)

14

15a Penalty

FOR LATE FILING ONLY

15

15b Interest

16

TOTAL AMOUNT NOW DUE AND PAYABLE (ADD LINES 14 AND 15)

16

PLEASE ENTER AMOUNT OF YOUR PAYMENT

17

17

(PAY IN U.S. DOLLARS ONLY)

18

GRAND TOTAL EXEMPTIONS/DEDUCTIONS FROM BACK OF FORM

18

MAKE CHECK PAYABLE TO

HAWAII STATE TAX COLLECTOR

IN U.S. DOLLARS DRAWN ON ANY U.S. BANK

WRITE YOUR T.A. REGISTRATION NUMBER ON THE CHECK

DECLARATION: I declare, under the penalties set forth in section 231-36, HRS, that this return, including any

accompanying schedules or statements, has been examined by me and, to the best of my knowledge and belief, is a

true, correct, and complete return, made in good faith for the taxable period stated, pursuant to the Transient

Accommodations Tax Law, Chapter 237D, HRS. I also reaffirm my statements on my operator’s registration (as

amended).

A CORPORATION OR PARTNERSHIP TAX RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT OF SUCH ENTITY.

SIGNATURE

TITLE

DATE

— MAILING ADDRESSES —

OAHU DISTRICT OFFICE

MAUI DISTRICT OFFICE

HAWAII DISTRICT OFFICE

KAUAI DISTRICT OFFICE

THIS SPACE FOR DATE RECEIVED STAMP

P.O. BOX 2430

P.O. BOX 1427

P.O. BOX 937

P.O. BOX 1687

26

HONOLULU, HI 96804-2430

WAILUKU, HI 96793-6427

HILO, HI 96721-0937

LIHUE, HI 96766-5687

FORM TA-2

1

1 2

2