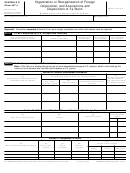

Form TD F 90-22.1

Continuation Page

This side can be copied as many times as necessary in order to provide information on all accounts.

3

Taxpayer Identification Number

Page Number

1

Filing for Calendar Year

4 Filer Last Name or Business Name

Y

Y

Y

Y

OF

2 Type of Filer

21 Type of Account

22 Maximum Value of Account

a

Individual

c

Corporation

a

Bank

Under $10,000

c

$100,000 to $1,000,000

c

Other

a

b

Partnership

d

Fiduciary

b

Securities

b

Over $1,000,000

$10,000 to $99,999

d

24 Name of Financial Institution with which account is held

23 Account Number or other designation

25 Country in which account is held

26 Does the filer have a financial interest

27 Last Name or Organization Name of Account Owner

in this account?

a

Yes

b

No

If no, complete boxes 27-35.

28 First Name

31 Address (Number, Street, and Apt. or Suite No.)

30

29 Middle Initial

Taxpayer Identification Number

32 City

33 State

34 Zip/Postal Code

35 Country

2 Type of Filer

21 Type of Account

22 Maximum Value of Account

a

Individual

c

Corporation

a

Bank

Under $10,000

c

$100,000 to $1,000,000

c

Other

a

b

Partnership

d

Fiduciary

b

Securities

b

Over $1,000,000

$10,000 to $99,999

d

24 Name of Financial Institution with which account is held

23 Account Number or other designation

25 Country in which account is held

26 Does the filer have a financial interest

27 Last Name or Organization Name of Account Owner

in this account?

a

Yes

b

No

If no, complete boxes 27-35.

28 First Name

31 Address (Number, Street, and Apt. or Suite No.)

30

29 Middle Initial

Taxpayer Identification Number

32 City

33 State

34 Zip/Postal Code

35 Country

2 Type of Filer

21 Type of Account

22 Maximum Value of Account

a

Individual

c

Corporation

a

Bank

Under $10,000

c

$100,000 to $1,000,000

c

Other

a

b

Partnership

d

Fiduciary

b

Securities

b

Over $1,000,000

$10,000 to $99,999

d

24 Name of Financial Institution with which account is held

23 Account Number or other designation

25 Country in which account is held

26 Does the filer have a financial interest

27 Last Name or Organization Name of Account Owner

in this account?

a

Yes

b

No

If no, complete boxes 27-35.

28 First Name

31 Address (Number, Street, and Apt. or Suite No.)

30

29 Middle Initial

Taxpayer Identification Number

32 City

33 State

34 Zip/Postal Code

35 Country

This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign

countries, as required by the Department of the Treasury Regulations (31 CFR 103). No report is required if the aggregate value of the accounts did

not exceed $10,000. SEE INSTRUCTIONS FOR DEFINITION. File this form with:

U.S. Department of the Treasury, P.O. Box 32621, Detroit, MI 48232-0621

.

Paperwork Reduction Act. The estimated average burden associated with this collection of information is 10 minutes per respondent or

recordkeeper, depending on individual circumstances. Comments regarding the accuracy of this burden estimate, and suggestions for reducing

the burden should be directed to the Department of the Treasury, Financial Crimes Enforcement Network, Suite 200, 2070 Chain Bridge Road,

Vienna VA 22182-2536.

1

1 2

2