Instructions For Declaration Of Estimated Tax - City Of Springfield Income Tax Division - 2008

ADVERTISEMENT

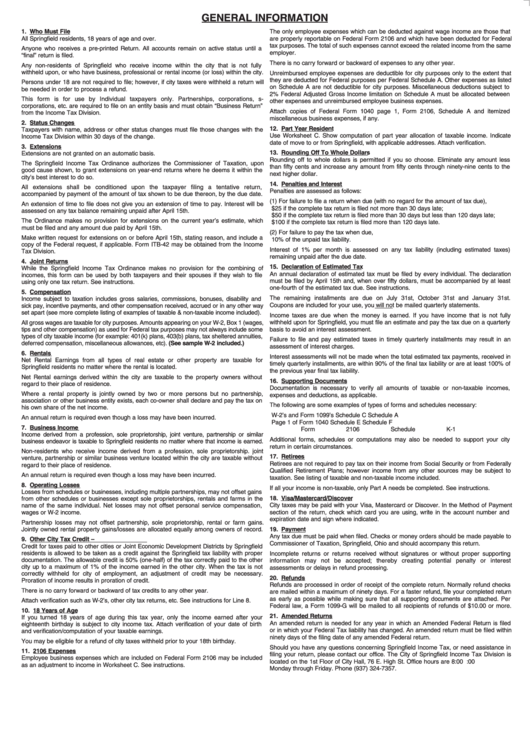

GENERAL INFORMATION

1. Who Must File

The only employee expenses which can be deducted against wage income are those that

All Springfield residents, 18 years of age and over.

are properly reportable on Federal Form 2106 and which have been deducted for Federal

tax purposes. The total of such expenses cannot exceed the related income from the same

Anyone who receives a pre-printed Return. All accounts remain on active status until a

employer.

“final” return is filed.

There is no carry forward or backward of expenses to any other year.

Any non-residents of Springfield who receive income within the city that is not fully

withheld upon, or who have business, professional or rental income (or loss) within the city.

Unreimbursed employee expenses are deductible for city purposes only to the extent that

they are deducted for Federal purposes per Federal Schedule A. Other expenses as listed

Persons under 18 are not required to file; however, if city taxes were withheld a return will

on Schedule A are not deductible for city purposes. Miscellaneous deductions subject to

be needed in order to process a refund.

2% Federal Adjusted Gross Income limitation on Schedule A must be allocated between

This form is for use by Individual taxpayers only. Partnerships, corporations, s-

other expenses and unreimbursed employee business expenses.

corporations, etc. are required to file on an entity basis and must obtain “Business Return”

Attach copies of Federal Form 1040 page 1, Form 2106, Schedule A and itemized

from the Income Tax Division.

miscellaneous business expenses, if any.

2. Status Changes

12. Part Year Resident

Taxpayers with name, address or other status changes must file those changes with the

Use Worksheet C. Show computation of part year allocation of taxable income. Indicate

Income Tax Division within 30 days of the change.

date of move to or from Springfield, with applicable addresses. Attach verification.

3. Extensions

13. Rounding Off To Whole Dollars

Extensions are not granted on an automatic basis.

Rounding off to whole dollars is permitted if you so choose. Eliminate any amount less

The Springfield Income Tax Ordinance authorizes the Commissioner of Taxation, upon

than fifty cents and increase any amount from fifty cents through ninety-nine cents to the

good cause shown, to grant extensions on year-end returns where he deems it within the

next higher dollar.

city’s best interest to do so.

14. Penalties and Interest

All extensions shall be conditioned upon the taxpayer filing a tentative return,

Penalties are assessed as follows:

accompanied by payment of the amount of tax shown to be due thereon, by the due date.

(1) For failure to file a return when due (with no regard for the amount of tax due),

An extension of time to file does not give you an extension of time to pay. Interest will be

$25 if the complete tax return is filed not more than 30 days late;

assessed on any tax balance remaining unpaid after April 15th.

$50 if the complete tax return is filed more than 30 days but less than 120 days late;

The Ordinance makes no provision for extensions on the current year’s estimate, which

$100 if the complete tax return is filed more than 120 days late.

must be filed and any amount due paid by April 15th.

(2) For failure to pay the tax when due,

Make written request for extensions on or before April 15th, stating reason, and include a

10% of the unpaid tax liability.

copy of the Federal request, if applicable. Form ITB-42 may be obtained from the Income

Interest of 1% per month is assessed on any tax liability (including estimated taxes)

Tax Division.

remaining unpaid after the due date.

4. Joint Returns

15. Declaration of Estimated Tax

While the Springfield Income Tax Ordinance makes no provision for the combining of

An annual declaration of estimated tax must be filed by every individual. The declaration

incomes, this form can be used by both taxpayers and their spouses if they wish to file

must be filed by April 15th and, when over fifty dollars, must be accompanied by at least

using only one tax return. See instructions.

one-fourth of the estimated tax due. See instructions.

5. Compensation

The remaining installments are due on July 31st, October 31st and January 31st.

Income subject to taxation includes gross salaries, commissions, bonuses, disability and

Coupons are included for your use, you will not be mailed quarterly statements.

sick pay, incentive payments, and other compensation received, accrued or in any other way

set apart (see more complete listing of examples of taxable & non-taxable income included).

Income taxes are due when the money is earned. If you have income that is not fully

withheld upon for Springfield, you must file an estimate and pay the tax due on a quarterly

All gross wages are taxable for city purposes. Amounts appearing on your W-2, Box 1 (wages,

tips and other compensation) as used for Federal tax purposes may not always include some

basis to avoid an interest assessment.

types of city taxable income (for example: 401(k) plans, 403(b) plans, tax sheltered annuities,

Failure to file and pay estimated taxes in timely quarterly installments may result in an

deferred compensation, miscellaneous allowances, etc). (See sample W-2 included.)

assessment of interest charges.

6. Rentals

Interest assessments will not be made when the total estimated tax payments, received in

Net Rental Earnings from all types of real estate or other property are taxable for

timely quarterly installments, are within 90% of the final tax liability or are at least 100% of

Springfield residents no matter where the rental is located.

the previous year final tax liability.

Net Rental earnings derived within the city are taxable to the property owners without

16. Supporting Documents

regard to their place of residence.

Documentation is necessary to verify all amounts of taxable or non-taxable incomes,

Where a rental property is jointly owned by two or more persons but no partnership,

expenses and deductions, as applicable.

association or other business entity exists, each co-owner shall declare and pay the tax on

The following are some examples of types of forms and schedules necessary:

his own share of the net income.

W-2’s and Form 1099’s

Schedule C

Schedule A

An annual return is required even though a loss may have been incurred.

Page 1 of Form 1040

Schedule E

Schedule F

7. Business Income

Form 2106

Schedule K-1

Income derived from a profession, sole proprietorship, joint venture, partnership or similar

Additional forms, schedules or computations may also be needed to support your city

business endeavor is taxable to Springfield residents no matter where that income is earned.

return in certain circumstances.

Non-residents who receive income derived from a profession, sole proprietorship. joint

17. Retirees

venture, partnership or similar business venture located within the city are taxable without

Retirees are not required to pay tax on their income from Social Security or from Federally

regard to their place of residence.

Qualified Retirement Plans; however income from any other sources may be subject to

An annual return is required even though a loss may have been incurred.

taxation. See listing of taxable and non-taxable income included.

8. Operating Losses

If all your income is non-taxable, only Part A needs be completed. See instructions.

Losses from schedules or businesses, including multiple partnerships, may not offset gains

18. Visa/Mastercard/Discover

from other schedules or businesses except sole proprietorships, rentals and farms in the

City taxes may be paid with your Visa, Mastercard or Discover. In the Method of Payment

name of the same individual. Net losses may not offset personal service compensation,

section of the return, check which card you are using, write in the account number and

wages or W-2 income.

expiration date and sign where indicated.

Partnership losses may not offset partnership, sole proprietorship, rental or farm gains.

Jointly owned rental property gains/losses are allocated equally among owners of record.

19. Payment

Any tax due must be paid when filed. Checks or money orders should be made payable to

9. Other City Tax Credit – J.E.D.D. Tax Credit

Commissioner of Taxation, Springfield, Ohio and should accompany this return.

Credit for taxes paid to other cities or Joint Economic Development Districts by Springfield

residents is allowed to be taken as a credit against the Springfield tax liability with proper

Incomplete returns or returns received without signatures or without proper supporting

documentation. The allowable credit is 50% (one-half) of the tax correctly paid to the other

information may not be accepted; thereby creating potential penalty or interest

city up to a maximum of 1% of the income earned in the other city. When the tax is not

assessments or delays in refund processing.

correctly withheld for city of employment, an adjustment of credit may be necessary.

20. Refunds

Proration of income results in proration of credit.

Refunds are processed in order of receipt of the complete return. Normally refund checks

There is no carry forward or backward of tax credits to any other year.

are mailed within a maximum of ninety days. For a faster refund, file your completed return

as early as possible while making sure that all supporting documents are attached. Per

Attach verification such as W-2’s, other city tax returns, etc. See instructions for Line 8.

Federal law, a Form 1099-G will be mailed to all recipients of refunds of $10.00 or more.

10. 18 Years of Age

21. Amended Returns

If you turned 18 years of age during this tax year, only the income earned after your

An amended return is needed for any year in which an Amended Federal Return is filed

eighteenth birthday is subject to city income tax. Attach verification of your date of birth

or in which your Federal Tax liability has changed. An amended return must be filed within

and verification/computation of your taxable earnings.

ninety days of the filing date of any amended Federal return.

You may be eligible for a refund of city taxes withheld prior to your 18th birthday.

Should you have any questions concerning Springfield Income Tax, or need assistance in

11. 2106 Expenses

filing your return, please contact our office. The City of Springfield Income Tax Division is

Employee business expenses which are included on Federal Form 2106 may be included

located on the 1st Floor of City Hall, 76 E. High St. Office hours are 8:00 A.M. to 5:00 P.M.

as an adjustment to income in Worksheet C. See instructions.

Monday through Friday. Phone (937) 324-7357.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2