Estimated Income Tax Instructions & Worksheet For Form D-1 & Aq-1 - Income Tax Division - 2008

ADVERTISEMENT

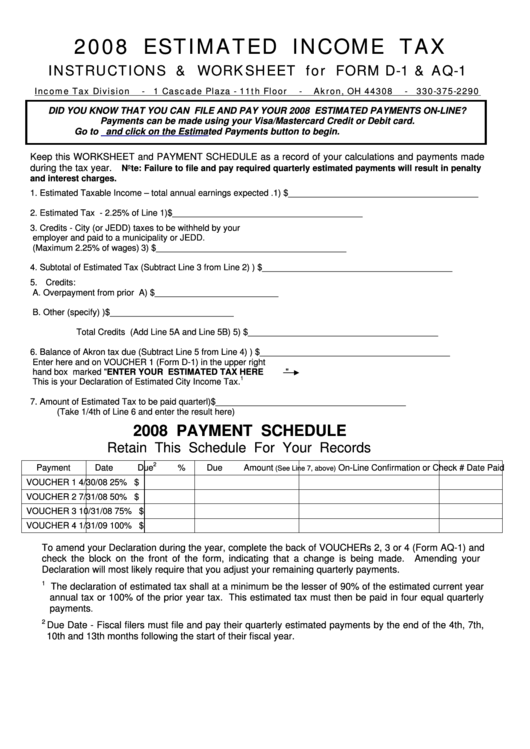

2008 ESTIMATED INCOME TAX

INSTRUCTIONS & WORKSHEET for FORM D-1 & AQ-1

Income Tax Division

- 1 Cascade Plaza - 11th Floor

-

Akron, OH 44308

- 330-375-2290

DID YOU KNOW THAT YOU CAN FILE AND PAY YOUR 2008 ESTIMATED PAYMENTS ON-LINE?

Payments can be made using your Visa/Mastercard Credit or Debit card.

Go to

and click on the Estimated Payments button to begin.

Keep this WORKSHEET and PAYMENT SCHEDULE as a record of your calculations and payments made

during the tax year.

Note: Failure to file and pay required quarterly estimated payments will result in penalty

and interest charges.

1. Estimated Taxable Income – total annual earnings expected . 1) $________________________________________

2. Estimated Tax - 2.25% of Line 1.............................................. 2) $________________________________________

3. Credits - City (or JEDD) taxes to be withheld by your

employer and paid to a municipality or JEDD.

(Maximum 2.25% of wages)...................................................... 3) $________________________________________

4. Subtotal of Estimated Tax (Subtract Line 3 from Line 2) .......... 4) $________________________________________

5. Credits:

A. Overpayment from prior year......................... A) $ __________________________

B. Other (specify) ............................................... B) $ __________________________

Total Credits (Add Line 5A and Line 5B) ............... 5) $________________________________________

6. Balance of Akron tax due (Subtract Line 5 from Line 4) ........... 6) $________________________________________

Enter here and on VOUCHER 1 (Form D-1) in the upper right

hand box marked "ENTER YOUR ESTIMATED TAX HERE

"

1

This is your Declaration of Estimated City Income Tax.

7. Amount of Estimated Tax to be paid quarterly.......................... 7) $________________________________________

(Take 1/4th of Line 6 and enter the result here)

2008 PAYMENT SCHEDULE

Retain This Schedule For Your Records

2

Payment

Date Due

% Due

Amount

On-Line Confirmation or Check #

Date Paid

(See Line 7, above)

VOUCHER 1

4/30/08

25%

$

VOUCHER 2

7/31/08

50%

$

VOUCHER 3

10/31/08

75%

$

VOUCHER 4

1/31/09

100%

$

To amend your Declaration during the year, complete the back of VOUCHERs 2, 3 or 4 (Form AQ-1) and

check the block on the front of the form, indicating that a change is being made.

Amending your

Declaration will most likely require that you adjust your remaining quarterly payments.

1

The declaration of estimated tax shall at a minimum be the lesser of 90% of the estimated current year

annual tax or 100% of the prior year tax. This estimated tax must then be paid in four equal quarterly

payments

.

2

Due Date - Fiscal filers must file and pay their quarterly estimated payments by the end of the 4th, 7th,

10th and 13th months following the start of their fiscal year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1