Form Ia 1040 - Iowa Individual Income Tax Long Form - 1999

ADVERTISEMENT

FOR OFFICE USE ONLY

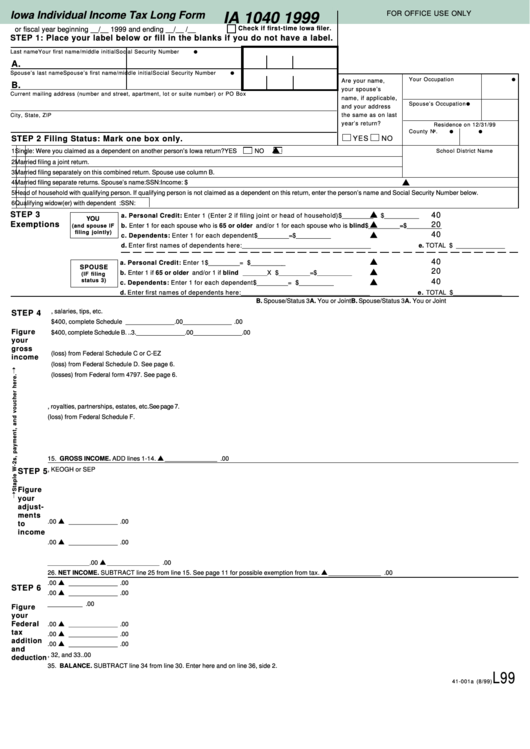

Iowa Individual Income Tax Long Form

IA 1040 1999

Check if first-time Iowa filer.

or fiscal year beginning __/__ 1999 and ending __/__ /__

STEP 1: Place your label below or fill in the blanks if you do not have a label.

•

Last name

Your first name/middle initial

Social Security Number

A.

•

Spouse’s last name

Spouse’s first name/middle initial

Social Security Number

•

Your Occupation

Are your name,

B.

your spouse’s

Current mailing address (number and street, apartment, lot or suite number) or PO Box

name, if applicable,

•

Spouse’s Occupation

and your address

City, State, ZIP

the same as on last

year’s return?

Residence on 12/31/99

•

•

County No.

Sch.Dist.No.

STEP 2 Filing Status: Mark one box only.

YES

NO

1

Single: Were you claimed as a dependent on another person’s Iowa return?

YES

NO

N

ONNO

School District Name

2

Married filing a joint return.

3

Married filing separately on this combined return. Spouse use column B.

4

Married filing separate returns. Spouse’s name:

SSN:

Income: $

5

Head of household with qualifying person. If qualifying person is not claimed as a dependent on this return, enter the person’s name and Social Security Number below.

6

Qualifying widow(er) with dependent child. Name:

SSN:

STEP 3

40

a. Personal Credit: Enter 1 (Enter 2 if filing joint or head of household) .................... _______

X $ _________ = $ __________

YOU

Exemptions

20

b. Enter 1 for each spouse who is 65 or older and/or 1 for each spouse who is blind .... _______

X $ _________ = $ __________

(and spouse IF

filing jointly)

40

c. Dependents: Enter 1 for each dependent ..................................................................... _______

X $ _________ = $ __________

d. Enter first names of dependents here: _____________________________________

e. TOTAL $ ______________

40

a. Personal Credit: Enter 1 ................................................................................................. _______

X $ _________ = $ __________

SPOUSE

20

b. Enter 1 if 65 or older and/or 1 if blind ............................................................................. _______

X $ _________ = $ __________

(IF filing

40

status 3)

c. Dependents: Enter 1 for each dependent ..................................................................... _______

X $ _________ = $ __________

d. Enter first names of dependents here: _____________________________________

e. TOTAL $ ______________

B. Spouse/Status 3

A. You or Joint

B. Spouse/Status 3

A. You or Joint

1. Wages, salaries, tips, etc. ................................................................. 1. ______________ .00

______________ .00

STEP 4

2. Taxable interest income. If more than $400, complete Schedule B. .. 2. ______________ .00

______________ .00

Figure

3. Ordinary dividend income. If more than $400, complete Schedule B. .. 3. ______________ .00

______________ .00

your

4. Alimony received ............................................................................... 4. ______________ .00

______________ .00

gross

5. Business income/(loss) from Federal Schedule C or C-EZ ............. 5. ______________ .00

______________ .00

income

6. Capital gain/(loss) from Federal Schedule D. See page 6. .............. 6. ______________ .00

______________ .00

7. Other gains/(losses) from Federal form 4797. See page 6. ............. 7. ______________ .00

______________ .00

8. Taxable IRA distributions. ................................................................. 8. ______________ .00

______________ .00

9. Taxable pensions and annuities. See page 6. .................................. 9. ______________ .00

______________ .00

10. Rents, royalties, partnerships, estates, etc. See page 7. .................. 10. ______________ .00

______________ .00

11. Farm income/(loss) from Federal Schedule F. ................................. 11. ______________ .00

______________ .00

12. Unemployment compensation .......................................................... 12. ______________ .00

______________ .00

13. Taxable Social Security benefits. See page 7. ................................. 13. ______________ .00

______________ .00

14. Other income. See page 8. ............................................................... 14. ______________ .00

______________ .00

15. GROSS INCOME. ADD lines 1-14. ........................................................................................................................... 15. _______________ .00

_______________ .00

16. Payments to an IRA, KEOGH or SEP .............................................. 16. ______________ .00

______________ .00

STEP 5

17. One-half of self-employment tax ...................................................... 17. ______________ .00

______________ .00

Figure

18. Health insurance deduction. See page 8. ........................................ 18. ______________ .00

______________ .00

your

19. Penalty on early withdrawal of savings ............................................ 19. ______________ .00

______________ .00

adjust-

20. Alimony paid ..................................................................................... 20. ______________ .00

______________ .00

ments

21. Pension/retirement income exclusion. See page 9. ......................... 21. ______________ .00

______________ .00

to

income

22. Moving expense deduction from Federal form 3903 ........................ 22. ______________ .00

______________ .00

23. Iowa capital gains deduction. See page 9. ....................................... 23. ______________ .00

______________ .00

24. Other adjustments. See page 10. ..................................................... 24. ______________ .00

______________ .00

25. Total adjustments. ADD lines 16-24. ......................................................................................................................... 25. _______________ .00

_______________ .00

26. NET INCOME. SUBTRACT line 25 from line 15. See page 11 for possible exemption from tax. ........................... 26. _______________ .00

_______________ .00

27. Federal income tax refund received in 1999. ................................... 27. ______________ .00

______________ .00

STEP 6

28. Self-employment/household employment taxes. .............................. 28. ______________ .00

______________ .00

29. Addition for Federal taxes. ADD lines 27 and 28. ..................................................................................................... 29. _______________ .00

_______________ .00

Figure

30. Total. ADD lines 26 and 29. ....................................................................................................................................... 30. _______________ .00

_______________ .00

your

Federal

31. Federal tax withheld. ......................................................................... 31. ______________ .00

______________ .00

tax

32. Federal estimated tax payments made in 1999. .............................. 32. ______________ .00

______________ .00

addition

33. Additional Federal tax paid in 1999 for 1998 and prior years. ......... 33. ______________ .00

______________ .00

and

34. Deduction for Federal taxes. ADD lines 31, 32, and 33. ........................................................................................... 34. _______________ .00

_______________ .00

deduction

35. BALANCE. SUBTRACT line 34 from line 30. Enter here and on line 36, side 2. .................................................... 35. _______________ .00

_______________ .00

L99

41-001a (8/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2