Form 8911 - Instructions - Alternative Fuel Vehicle Refueling Property Credit - 2015

ADVERTISEMENT

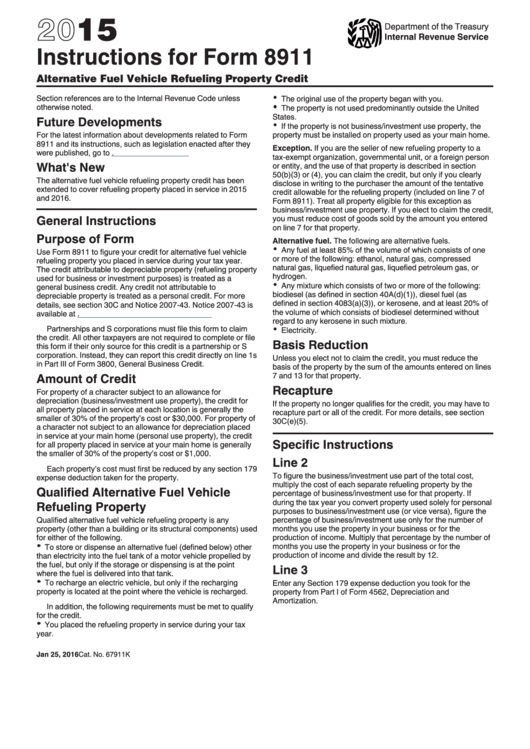

2015

Department of the Treasury

Internal Revenue Service

Instructions for Form 8911

Alternative Fuel Vehicle Refueling Property Credit

Section references are to the Internal Revenue Code unless

The original use of the property began with you.

otherwise noted.

The property is not used predominantly outside the United

States.

Future Developments

If the property is not business/investment use property, the

For the latest information about developments related to Form

property must be installed on property used as your main home.

8911 and its instructions, such as legislation enacted after they

Exception. If you are the seller of new refueling property to a

were published, go to

tax-exempt organization, governmental unit, or a foreign person

What's New

or entity, and the use of that property is described in section

50(b)(3) or (4), you can claim the credit, but only if you clearly

The alternative fuel vehicle refueling property credit has been

disclose in writing to the purchaser the amount of the tentative

extended to cover refueling property placed in service in 2015

credit allowable for the refueling property (included on line 7 of

and 2016.

Form 8911). Treat all property eligible for this exception as

business/investment use property. If you elect to claim the credit,

General Instructions

you must reduce cost of goods sold by the amount you entered

on line 7 for that property.

Purpose of Form

Alternative fuel. The following are alternative fuels.

Any fuel at least 85% of the volume of which consists of one

Use Form 8911 to figure your credit for alternative fuel vehicle

or more of the following: ethanol, natural gas, compressed

refueling property you placed in service during your tax year.

natural gas, liquefied natural gas, liquefied petroleum gas, or

The credit attributable to depreciable property (refueling property

hydrogen.

used for business or investment purposes) is treated as a

Any mixture which consists of two or more of the following:

general business credit. Any credit not attributable to

biodiesel (as defined in section 40A(d)(1)), diesel fuel (as

depreciable property is treated as a personal credit. For more

defined in section 4083(a)(3)), or kerosene, and at least 20% of

details, see section 30C and Notice 2007-43. Notice 2007-43 is

the volume of which consists of biodiesel determined without

available at

regard to any kerosene in such mixture.

Partnerships and S corporations must file this form to claim

Electricity.

the credit. All other taxpayers are not required to complete or file

Basis Reduction

this form if their only source for this credit is a partnership or S

corporation. Instead, they can report this credit directly on line 1s

Unless you elect not to claim the credit, you must reduce the

in Part III of Form 3800, General Business Credit.

basis of the property by the sum of the amounts entered on lines

Amount of Credit

7 and 13 for that property.

Recapture

For property of a character subject to an allowance for

depreciation (business/investment use property), the credit for

If the property no longer qualifies for the credit, you may have to

all property placed in service at each location is generally the

recapture part or all of the credit. For more details, see section

smaller of 30% of the property’s cost or $30,000. For property of

30C(e)(5).

a character not subject to an allowance for depreciation placed

in service at your main home (personal use property), the credit

Specific Instructions

for all property placed in service at your main home is generally

the smaller of 30% of the property’s cost or $1,000.

Line 2

Each property’s cost must first be reduced by any section 179

To figure the business/investment use part of the total cost,

expense deduction taken for the property.

multiply the cost of each separate refueling property by the

Qualified Alternative Fuel Vehicle

percentage of business/investment use for that property. If

during the tax year you convert property used solely for personal

Refueling Property

purposes to business/investment use (or vice versa), figure the

percentage of business/investment use only for the number of

Qualified alternative fuel vehicle refueling property is any

months you use the property in your business or for the

property (other than a building or its structural components) used

production of income. Multiply that percentage by the number of

for either of the following.

months you use the property in your business or for the

To store or dispense an alternative fuel (defined below) other

production of income and divide the result by 12.

than electricity into the fuel tank of a motor vehicle propelled by

the fuel, but only if the storage or dispensing is at the point

Line 3

where the fuel is delivered into that tank.

To recharge an electric vehicle, but only if the recharging

Enter any Section 179 expense deduction you took for the

property is located at the point where the vehicle is recharged.

property from Part I of Form 4562, Depreciation and

Amortization.

In addition, the following requirements must be met to qualify

for the credit.

You placed the refueling property in service during your tax

year.

Jan 25, 2016

Cat. No. 67911K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2