Form 41a720-S54 Schedule Kbi-Sp Draft - Tax Computation Schedule - 2015 Page 2

ADVERTISEMENT

Page 2

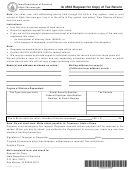

41A720–S54 (10–15)

INSTRUCTIONS–SCHEDULE KBI–SP

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

PURPOSE OF SCHEDULE—This schedule is used by any

method to determine the net income, Kentucky gross

pass–through entity which has entered into a tax incentive

receipts and Kentucky gross profits from the facility at which

agreement for a Kentucky Business Investment Program

the economic development project is located, the approved

(KBI) project to determine the credit allowed against the

company shall use an alternative method approved by

Kentucky income tax and LLET in accordance with KRS

the Department of Revenue. A copy of the letter from the

141.415 on the income and Kentucky gross receipts or

Department of Revenue approving the alternative method

Kentucky gross profits from the project.

must be attached to this schedule.

Pass–through entities should first complete Form 720S,

Separate Accounting—If the economic development project

765 or 765–GP to determine net income (loss), deductions,

is a totally separate facility, net income shall reflect only

etc., from the entire operations of the pass–through entity.

the gross income, deductions, expenses, gains and losses

The pass–through entity should then complete Schedule

allowed under this chapter directly attributable to the

KBI–SP to determine the KBI tax credit and the tax due, if

facility and overhead expenses apportioned to the facility;

any, from the KBI project. A pass–through entity is subject to

and Kentucky gross receipts or Kentucky gross profits shall

tax as provided by KRS 141.020 and KRS 141.0401 on the net

reflect only Kentucky gross receipts or Kentucky gross

income and the Kentucky gross receipts or Kentucky gross

profits directly attributable to the facility.

profits from the project and the KBI credit is applied against

the tax of the KBI project. Consequently, the pass–through

If the economic development project is an expansion to

entity must use Form 720S(K), Form 765(K) or Form 765–

a previously existing facility, net income of the entire

GP(K) in lieu of Schedule K (Form 720S), Schedule K (Form

facility shall reflect only the gross income, deductions,

765) or Schedule K (Form 765–GP) in order to exclude the

expenses, gains and losses allowed under this chapter

net income from the KBI project from the partners, members

directly attributable to the facility and overhead expenses

or shareholders’ distributive share income, and Schedule

apportioned to the facility; and Kentucky gross receipts and

LLET(K) in lieu of Schedule LLET in order to exclude the

Kentucky gross profits shall reflect only Kentucky gross

Kentucky gross receipts or the Kentucky gross profits of the

receipts and Kentucky gross profits directly attributable

KBI project from the LLET at the entity level.

to the facility. Net income, Kentucky gross receipts and

Kentucky gross profits of the entire facility attributable to

Multiple Projects—A pass–through entity with multiple

the economic development project shall be determined

economic development projec ts must complete an

by apportioning the net income, Kentucky gross receipts

applicable schedule (Schedule KREDA–SP, Schedule

and Kentucky gross profits by a formula approved by the

KIDA–SP, Schedule KEOZ–SP, Schedule KJRA–SP, Schedule

Department of Revenue.

KIRA–SP, Schedule KJDA–SP, Schedule KBI–SP, Schedule

KRA–SP or Schedule IEIA–SP) to determine the credit and

Line 2—Enter the net operating loss from the KBI project, if

net tax liability, if any, for each project.

any, being carried forward from previous years.

Line 1—If the pass–through entity’s only operation is the KBI

Note: Just as the income from a KBI project does not flow

project, the amount entered on Line 1 is the net income (loss)

through to partners, members or shareholders, neither

from Form 720S, 765 or 765–GP. If the pass–through entity

do the losses. The project’s net operating loss from prior

has operations other than the KBI project, a schedule must

years must be subtracted from the project income before

be attached reflecting the computation of the net income

calculating the KBI credit.

(loss) from the KBI project in accordance with the following

instructions, and such amount entered on Line 1.

General Partnership—Lines 5 and 6 of this schedule shall

not be completed by a general partnership as a general

Separate Facility—In accordance with KRS 141.415(6), if the

partnership is not subject to LLET.

project is a totally separate facility, net income, Kentucky

gross receipts, and Kentucky gross profits attributable to

Line 5—Using Schedule LLET, create a new Schedule LLET

the project shall be determined by a separate accounting

to compute the LLET of the KBI project using only the

method.

Kentucky gross receipts and Kentucky gross profits of the

project. Enter “KBI” at the top center of the Schedule LLET

Expansion of Existing Facility—In accordance with KRS

and attach it to the tax return.

141.415(7), if the KBI project is an expansion to a previously

existing facility, the net income, Kentucky gross receipts

Line 9—In lieu of the tax credit, the approved company

and Kentucky gross profits shall be determined under a

may elect, on an annual basis, to apply as an estimated

separate accounting method reflecting the entire facility,

tax payment an amount equal to the allowable tax credit.

and the net income, Kentucky gross receipts and Kentucky

Any estimated tax payment shall be in satisfaction of the

gross profits shall be determined by apportioning the net

tax liability of the partners, members or shareholders of

income, Kentucky gross receipts and Kentucky gross profits

the pass–through entity, and shall be paid on behalf of

of the entire facility to the economic development project by

the partners, members or shareholders. Enter an amount

a formula approved by the Department of Revenue. A copy

on either (a) or (b), but in no case shall there be an entry

of the letter from the Department of Revenue approving

on both (a) and (b). In accordance with KRS 141.415(5),

the percentage must be attached to the schedule.

this estimated tax payment is excluded in determining

each partner, member or shareholder’s distributive share

Alternative Methods—In accordance with KRS 141.415(8),

income or credit from a pass–through entity. Accordingly,

if the approved company can show that the nature of the

the partners, members or shareholders are not entitled to

operations and activities of the approved company are

claim any portion of this estimated tax payment against

such that it is not practical to use a separate accounting

their Kentucky income tax liability.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2