Form Cg-15 - Cigarette Use Tax Return - New York State Department Of Taxation And Finance

ADVERTISEMENT

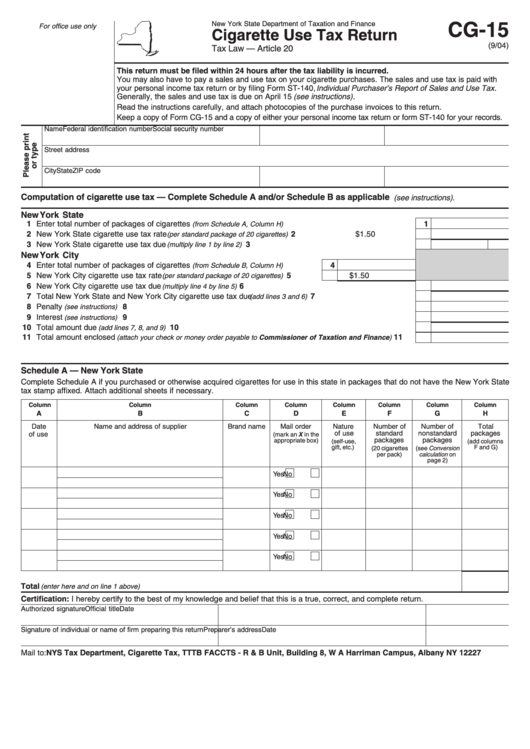

New York State Department of Taxation and Finance

CG-15

For office use only

Cigarette Use Tax Return

(9/04)

Tax Law — Article 20

This return must be filed within 24 hours after the tax liability is incurred.

You may also have to pay a sales and use tax on your cigarette purchases. The sales and use tax is paid with

your personal income tax return or by filing Form ST-140, Individual Purchaser’s Report of Sales and Use Tax.

Generally, the sales and use tax is due on April 15 (see instructions) .

Read the instructions carefully, and attach photocopies of the purchase invoices to this return.

Keep a copy of Form CG-15 and a copy of either your personal income tax return or form ST-140 for your records.

Name

Federal identification number

Social security number

Street address

City

State

ZIP code

Computation of cigarette use tax — Complete Schedule A and/or Schedule B as applicable

(see instructions).

New York State

1 Enter total number of packages of cigarettes

1

(from Schedule A, Column H) ...................................................................

2 New York State cigarette use tax rate

.........................................................

2

$1.50

(per standard package of 20 cigarettes)

3 New York State cigarette use tax due

..............................................................................

3

(multiply line 1 by line 2)

New York City

4 Enter total number of packages of cigarettes

4

(from Schedule B, Column H) ..................

5 New York City cigarette use tax rate

(per standard package of 20 cigarettes)

...............

5

$1.50

6 New York City cigarette use tax due

.................................................................................

6

(multiply line 4 by line 5)

7 Total New York State and New York City cigarette use tax due

................................................

7

(add lines 3 and 6)

8 Penalty

.......................................................................................................................................

8

(see instructions)

9 Interest

.......................................................................................................................................

9

(see instructions)

10 Total amount due

................................................................................................................. 10

(add lines 7, 8, and 9)

11 Total amount enclosed

.......... 11

(attach your check or money order payable to Commissioner of Taxation and Finance)

Schedule A — New York State

Complete Schedule A if you purchased or otherwise acquired cigarettes for use in this state in packages that do not have the New York State

tax stamp affixed. Attach additional sheets if necessary.

Column

Column

Column

Column

Column

Column

Column

Column

A

B

C

D

E

F

G

H

Date

Name and address of supplier

Brand name

Mail order

Nature

Number of

Number of

Total

of use

standard

nonstandard

packages

of use

(mark an X in the

packages

packages

appropriate box)

(self-use,

(add columns

gift, etc.)

F and G)

(see Conversion

(20 cigarettes

per pack)

calculation on

page 2)

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Total

..................................................................................................................................................

(enter here and on line 1 above)

Certification: I hereby certify to the best of my knowledge and belief that this is a true, correct, and complete return.

Authorized signature

Official title

Date

Signature of individual or name of firm preparing this return

Preparer’s address

Date

Mail to: NYS Tax Department, Cigarette Tax, TTTB FACCTS - R & B Unit, Building 8, W A Harriman Campus, Albany NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4