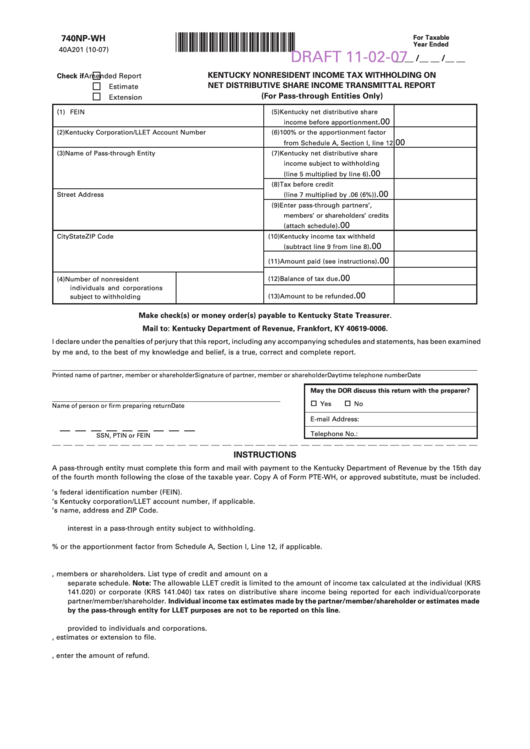

Form 740np-Wh Draft - Kentucky Nonresident Income Tax Withholding On Net Distributive Share Income Transmittal Report

ADVERTISEMENT

*0700010292*

740NP-WH

For Taxable

Year Ended

40A201 (10-07)

DRAFT 11-02-07

__ __ / __ __ / __ __

KENTUCKY NONRESIDENT INCOME TAX WITHHOLDING ON

Check if

Amended Report

NET DISTRIBUTIVE SHARE INCOME TRANSMITTAL REPORT

Estimate

(For Pass-through Entities Only)

Extension

(

1) FEIN

(5) Kentucky net distributive share

.00

income before apportionment

(2) Kentucky Corporation/LLET Account Number

(6) 100% or the apportionment factor

.00

from Schedule A, Section I, line 12

(3) Name of Pass-through Entity

(7) Kentucky net distributive share

income subject to withholding

.00

(line 5 multiplied by line 6)

(8) Tax before credit

.00

Street Address

(line 7 multiplied by .06 (6%))

(9) Enter pass-through partners’,

members’ or shareholders’ credits

.00

(attach schedule)

City

State

ZIP Code

(10) Kentucky income tax withheld

.00

(subtract line 9 from line 8)

.00

(11) Amount paid (see instructions)

.00

(12) Balance of tax due

(4) Number of nonresident

individuals and corporations

.00

(13) Amount to be refunded

subject to withholding

Make check(s) or money order(s) payable to Kentucky State Treasurer.

Mail to: Kentucky Department of Revenue, Frankfort, KY 40619-0006.

I declare under the penalties of perjury that this report, including any accompanying schedules and statements, has been examined

by me and, to the best of my knowledge and belief, is a true, correct and complete report.

Printed name of partner, member or shareholder

Signature of partner, member or shareholder

Daytime telephone number

Date

May the DOR discuss this return with the preparer?

Yes

No

Name of person or firm preparing return

Date

E-mail Address:

Telephone No.:

SSN, PTIN or FEIN

INSTRUCTIONS

A pass-through entity must complete this form and mail with payment to the Kentucky Department of Revenue by the 15th day

of the fourth month following the close of the taxable year. Copy A of Form PTE-WH, or approved substitute, must be included.

1.

Enter the pass-through entity’s federal identification number (FEIN).

2.

Enter the pass-through entity’s Kentucky corporation/LLET account number, if applicable.

3.

Enter the pass-through entity’s name, address and ZIP Code.

4.

Enter the number of nonresident individuals and corporations doing business in Kentucky only through their ownership

interest in a pass-through entity subject to withholding.

5.

Enter the total net distributive share income reported to nonresident individuals and corporations.

6.

Enter 100% or the apportionment factor from Schedule A, Section I, Line 12, if applicable.

7.

Enter the amount on Line 5 multiplied by amount on Line 6.

8.

Multiply the amount on Line 7 by 6 percent and enter here.

9.

Enter credits passed through to the pass-through partners, members or shareholders. List type of credit and amount on a

separate schedule. Note: The allowable LLET credit is limited to the amount of income tax calculated at the individual (KRS

141.020) or corporate (KRS 141.040) tax rates on distributive share income being reported for each individual/corporate

partner/member/shareholder. Individual income tax estimates made by the partner/member/shareholder or estimates made

by the pass-through entity for LLET purposes are not to be reported on this line.

10. Subtract Line 9 from Line 8. This should match the total amount of Kentucky income tax withheld on the PTE-WH forms

provided to individuals and corporations.

11. Enter the amount paid with original report, estimates or extension to file.

12. Subtract Line 11 from Line 10.

13. If Line 11 is greater than Line 10, enter the amount of refund.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1