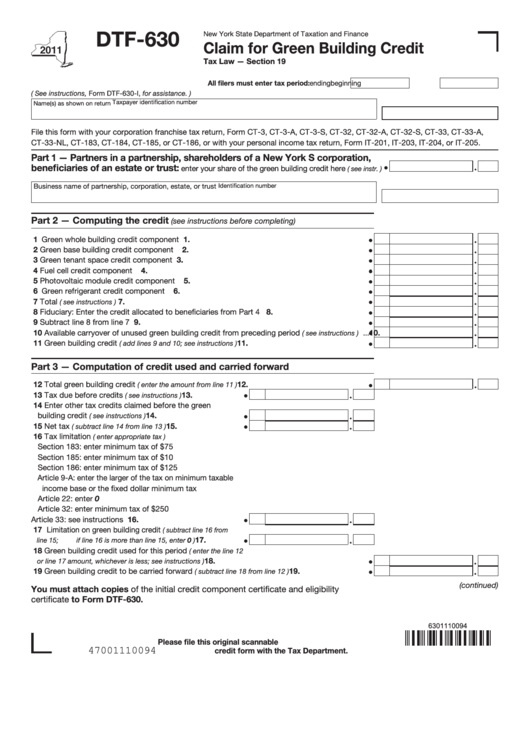

DTF-630

New York State Department of Taxation and Finance

Claim for Green Building Credit

Tax Law — Section 19

All filers must enter tax period:

beginning

ending

( See instructions, Form DTF-630-I, for assistance. )

Taxpayer identification number

Name(s) as shown on return

File this form with your corporation franchise tax return, Form CT-3, CT-3-A, CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-A,

CT-33-NL, CT-183, CT-184, CT-185, or CT-186, or with your personal income tax return, Form IT-201, IT-203, IT-204, or IT-205.

Part 1 — Partners in a partnership, shareholders of a New York S corporation,

beneficiaries of an estate or trust:

enter your share of the green building credit here

( see instr. )

Business name of partnership, corporation, estate, or trust

Identification number

Part 2 — Computing the credit

(see instructions before completing)

1 Green whole building credit component ....................................................................................

1.

2 Green base building credit component .....................................................................................

2.

3 Green tenant space credit component ......................................................................................

3.

4 Fuel cell credit component ........................................................................................................

4.

5 Photovoltaic module credit component ....................................................................................

5.

6 Green refrigerant credit component ..........................................................................................

6.

7 Total

7.

.................................................................................................................

( see instructions )

8 Fiduciary: Enter the credit allocated to beneficiaries from Part 4 ..............................................

8.

9 Subtract line 8 from line 7 ..........................................................................................................

9.

10 Available carryover of unused green building credit from preceding period

...

10.

( see instructions )

11 Green building credit

11.

............................................................

( add lines 9 and 10; see instructions )

Part 3 — Computation of credit used and carried forward

12 Total green building credit

............................................................

12.

( enter the amount from line 11 )

13 Tax due before credits

............................

13.

( see instructions )

14 Enter other tax credits claimed before the green

building credit

14.

.....................................

( see instructions )

15 Net tax

...................................

15.

( subtract line 14 from line 13 )

16 Tax limitation

( enter appropriate tax )

Section 183: enter minimum tax of $75

Section 185: enter minimum tax of $10

Section 186: enter minimum tax of $125

Article 9-A: enter the larger of the tax on minimum taxable

income base or the fixed dollar minimum tax

Article 22: enter 0

Article 32: enter minimum tax of $250

Article 33: see instructions ...........................................

16.

17 Limitation on green building credit

( subtract line 16 from

.....................

17.

line 15; if line 16 is more than line 15, enter 0 )

18 Green building credit used for this period

( enter the line 12

...................................................................

18.

or line 17 amount, whichever is less; see instructions )

19 Green building credit to be carried forward

....................................

19.

( subtract line 18 from line 12 )

(continued)

You must attach copies of the initial credit component certificate and eligibility

certificate to Form DTF-630.

6301110094

Please file this original scannable

47001110094

credit form with the Tax Department.

1

1 2

2