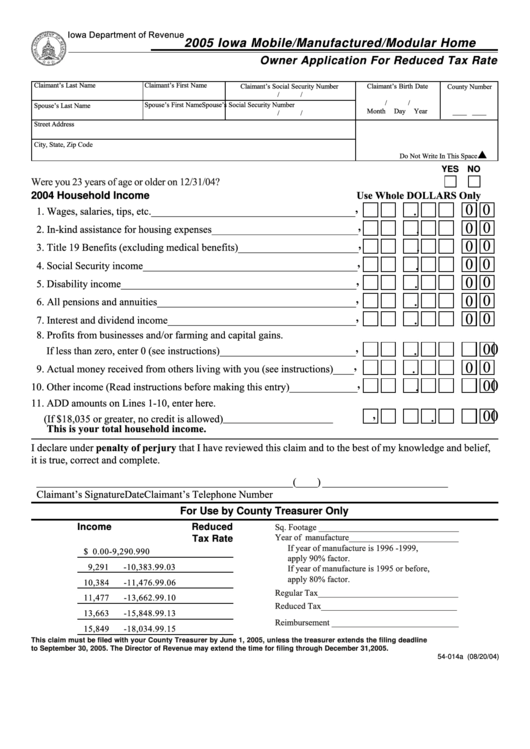

Form 54-014 - Iowa Mobile/manufactured/modular Home Owner Application For Reduced Tax Rate - 2005

ADVERTISEMENT

Iowa Department of Revenue

2005 Iowa Mobile/Manufactured/Modular Home

Owner Application For Reduced Tax Rate

Claimant’s Last Name

Claimant’s First Name

Claimant’s Birth Date

Claimant’s Social Security Number

County Number

/

/

/

/

Spouse’s First Name

Spouse’s Social Security Number

Spouse’s Last Name

Month

Day

Year

____ ____

/

/

Street Address

City, State, Zip Code

Do Not Write In This Space

YES NO

Were you 23 years of age or older on 12/31/04?..............................................................................................

Use Whole DOLLARS Only

2004 Household Income

0 0

,

1. Wages, salaries, tips, etc. _______________________________________

.

0

0

,

2. In-kind assistance for housing expenses ____________________________

.

0

0

,

3. Title 19 Benefits (excluding medical benefits) _______________________

.

0 0

,

4. Social Security income _________________________________________

.

0

0

,

5. Disability income _____________________________________________

.

0

0

,

6. All pensions and annuities ______________________________________

.

0

0

,

7. Interest and dividend income ____________________________________

.

8. Profits from businesses and/or farming and capital gains.

0

0

,

If less than zero, enter 0 (see instructions) __________________________

.

0

0

,

9. Actual money received from others living with you (see instructions) ____

.

0

0

,

10. Other income (Read instructions before making this entry) _____________

.

11. ADD amounts on Lines 1-10, enter here.

0

0

,

(If $18,035 or greater, no credit is allowed) _____________________

.

This is your total household income.

I declare under penalty of perjury that I have reviewed this claim and to the best of my knowledge and belief,

it is true, correct and complete.

________________________________________

_________

( ____ ) ________________________

Claimant’s Signature

Date

Claimant’s Telephone Number

For Use by County Treasurer Only

Sq. Footage ________________________________

Income

Reduced

Year of manufacture _________________________

Tax Rate

If year of manufacture is 1996 -1999,

$ 0.00

-

9,290.99

0

apply 90% factor.

9,291

-

10,383.99

.03

If year of manufacture is 1995 or before,

apply 80% factor.

10,384

-

11,476.99

.06

Regular Tax ________________________________

11,477

-

13,662.99

.10

Reduced Tax _______________________________

13,663

-

15,848.99

.13

Reimbursement _____________________________

15,849

-

18,034.99

.15

This claim must be filed with your County Treasurer by June 1, 2005, unless the treasurer extends the filing deadline

to September 30, 2005. The Director of Revenue may extend the time for filing through December 31,2005.

54-014a (08/20/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2