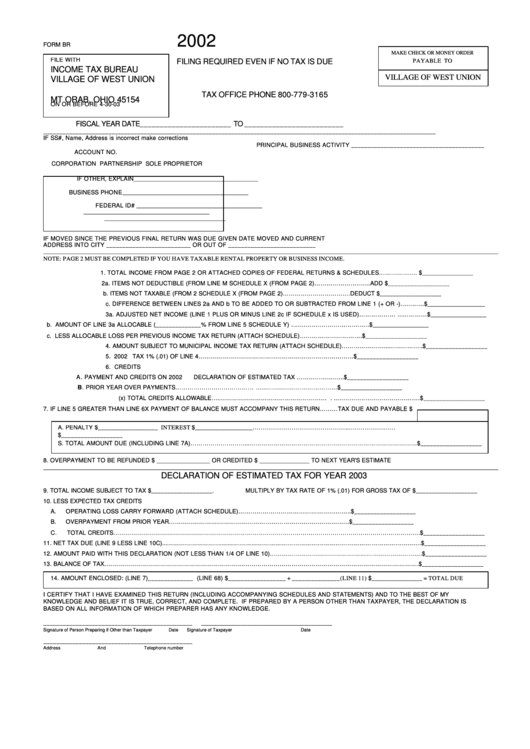

Form Br - Declaration Of Estimated Tax - Village Of West Union - 2002

ADVERTISEMENT

2002

FORM BR

MAKE CHECK OR MONEY ORDER

FILE WITH

FILING REQUIRED EVEN IF NO TAX IS DUE

PAYABLE TO

INCOME TAX BUREAU

VILLAGE OF WEST UNION

VILLAGE OF WEST UNION

P.O. BOX 268

TAX OFFICE PHONE 800-779-3165

MT ORAB, OHIO 45154

ON OR BEFORE 4-30-03

FISCAL YEAR DATE_______________________ TO _________________________

_________________________________________________________________________________________________________________________

IF SS#, Name, Address is incorrect make corrections

PRINCIPAL BUSINESS ACTIVITY _________________________________________

ACCOUNT NO.

CORPORATION

PARTNERSHIP

SOLE PROPRIETOR

IF OTHER, EXPLAIN

_______________________________________________

BUSINESS PH ONE

_______________________________________________

FEDERAL ID#

_______________________________________________

_______________________________________________

_______________________________________________

IF MOVED SINCE THE PREVIOUS FINAL RETURN WAS DUE GIVEN DATE MOVED AND CURRENT

ADDRESS INTO CITY __________________________ OR OUT OF ___________________________

__________________________________________________________________________________________________________________________________________________________________________

NOTE: PAGE 2 MUST BE COMPLETED IF YOU HAVE TAXABLE RENTAL PROPERTY OR BUSINESS INCOME.

1. TOTAL INCOME FROM PAGE 2 OR ATTACHED COPIES OF FEDERAL RETURNS & SCHEDULES………………. $___________________

2a. ITEMS NOT DEDUCTIBLE (FROM LINE M SCHEDULE X (FROM PAGE 2)………………….……ADD $___________________

b. ITEMS NOT TAXABLE (FROM 2 SCHEDULE X (FROM PAGE 2)…………………………….DEDUCT $___________________

c. DIFFERENCE BETWEEN LINES 2a AND b TO BE ADDED TO OR SUBTRACTED FROM LINE 1 (+ OR -)…………$___________________

3a. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2c IF SCHEDULE x IS USED)……………… ...…………$___________________

b. AMOUNT OF LINE 3a ALLOCABLE (______________% FROM LINE 5 SCHEDULE Y) …………………….…………..$___________________

c. LESS ALLOCABLE LOSS PER PREVIOUS INCOME TAX RETURN (ATTACH SCHEDULE)………………………….$___________________

4. AMOUNT SUBJECT TO MUNICIPAL INCOME TAX RETURN (ATTACH SCHEDULE)…………………...……………..$___________________

5. 2002

TAX 1% (.01) OF LINE 4……………………………………………………………………$___________________

6. CREDITS

A. PAYMENT AND CREDITS ON 2002

DECLARATION OF ESTIMATED TAX ……………….…..$___________________

B. PRIOR YEAR OVER PAYMENTS………………………………… …..………………………………$___________________

(x) TOTAL CREDITS ALLOWABLE….……………………………………………… . …………………………………….$___________________

7. IF LINE 5 GREATER THAN LINE 6X PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN………TAX DUE AND PAYABLE $

A. PENALTY $___________________ INTEREST $___________________…………………………………………..……………………..TOTAL

$___________________

S. TOTAL AMOUNT DUE (INCLUDING LINE 7A)………………………...…………………………………………………………………………$___________________

8. OVERPAYMENT TO BE REFUNDED $ ________________ OR CREDITED $ _______________ TO NEXT YEAR'S ESTIMATE

__________________________________________________________________________________________________________________________________________________________________________

DECLARATION OF ESTIMATED TAX FOR YEAR 2003

9. TOTAL INCOME SUBJECT TO TAX $___________________.

MULTIPLY BY TAX RATE OF 1% (.01) FOR GROSS TAX OF $___________________

10. LESS EXPECTED TAX CREDITS

A.

OPERATING LOSS CARRY FORWARD (ATTACH SCHEDULE)………………………………………………..$___________________

B.

OVERPAYMENT FROM PRIOR YEAR………………………………………………………………………………$___________________

C.

TOTAL CREDITS……………………………………………………………………………………………………………………………………….$___________________

11. NET TAX DUE (LINE 9 LESS LINE 10C)...……………………………………………………………………………………………………………….$___________________

12. AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN 1/4 OF LINE 10)………………………………………………………………….$___________________

13. BALANCE OF TAX…………………………………………………………….…………………………………………………………………………….$___________________

14. AMOUNT ENCLOSED: (LINE 7)______________ (LINE 68) $__________________ + _______________(LINE 11) $________________ = TOTAL DUE

_______________

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS

BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

______________________________________________

___________________________________________

Signature of Person Preparing if Other than Taxpayer

Date

Signature of Taxpayer

Date

______________________________________________

Address

And

Telephone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2