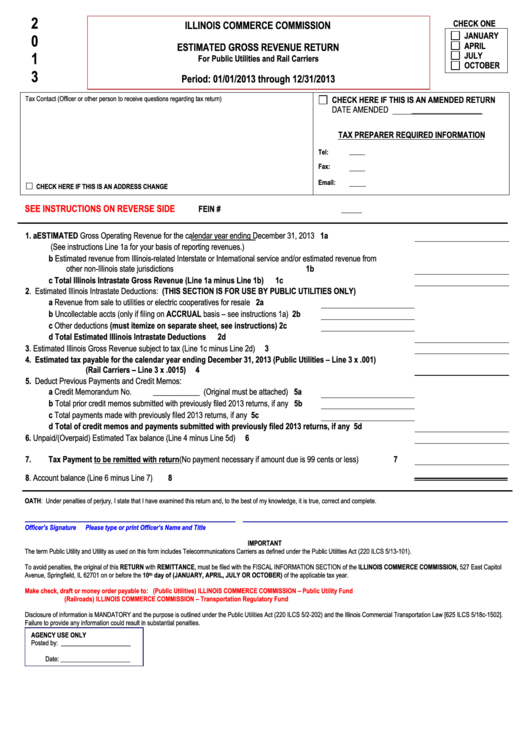

Estimated Gross Revenue Return Form - Illinois Commerce Commission - 2013

ADVERTISEMENT

2

CHECK ONE

ILLINOIS COMMERCE COMMISSION

JANUARY

0

APRIL

ESTIMATED GROSS REVENUE RETURN

1

JULY

For Public Utilities and Rail Carriers

OCTOBER

3

Period: 01/01/2013 through 12/31/2013

Tax Contact (Officer or other person to receive questions regarding tax return)

CHECK HERE IF THIS IS AN AMENDED RETURN

DATE AMENDED

__________________

TAX PREPARER REQUIRED INFORMATION

Tel:

Fax:

Email:

CHECK HERE IF THIS IS AN ADDRESS CHANGE

SEE INSTRUCTIONS ON REVERSE SIDE

FEIN #

1.

a

ESTIMATED Gross Operating Revenue for the calendar year ending December 31, 2013

1a

(See instructions Line 1a for your basis of reporting revenues.)

b

Estimated revenue from Illinois-related Interstate or International service and/or estimated revenue from

other non-Illinois state jurisdictions

1b

c

Total Illinois Intrastate Gross Revenue (Line 1a minus Line 1b)

1c

2.

Estimated Illinois Intrastate Deductions: (THIS SECTION IS FOR USE BY PUBLIC UTILITIES ONLY)

a

Revenue from sale to utilities or electric cooperatives for resale

2a

b

Uncollectable accts (only if filing on ACCRUAL basis – see instructions 1a) 2b

c

Other deductions (must itemize on separate sheet, see instructions)

2c

d

Total Estimated Illinois Intrastate Deductions

2d

3.

Estimated Illinois Gross Revenue subject to tax (Line 1c minus Line 2d)

3

4.

Estimated tax payable for the calendar year ending December 31, 2013 (Public Utilities – Line 3 x .001)

(Rail Carriers – Line 3 x .0015)

4

5.

Deduct Previous Payments and Credit Memos:

a

Credit Memorandum No.

____________ (Original must be attached) 5a

b

Total prior credit memos submitted with previously filed 2013 returns, if any 5b

c

Total payments made with previously filed 2013 returns, if any

5c

d

Total of credit memos and payments submitted with previously filed 2013 returns, if any

5d

6.

Unpaid/(Overpaid) Estimated Tax balance (Line 4 minus Line 5d)

6

7.

Tax Payment to be remitted with return (No payment necessary if amount due is 99 cents or less)

7

8.

Account balance (Line 6 minus Line 7)

8

OATH: Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct and complete.

Officer’s Signature

Please type or print Officer’s Name and Title

IMPORTANT

The term Public Utility and Utility as used on this form includes Telecommunications Carriers as defined under the Public Utilities Act (220 ILCS 5/13-101).

To avoid penalties, the original of this RETURN with REMITTANCE, must be filed with the FISCAL INFORMATION SECTION of the ILLINOIS COMMERCE COMMISSION, 527 East Capitol

Avenue, Springfield, IL 62701 on or before the 10

day of (JANUARY, APRIL, JULY OR OCTOBER) of the applicable tax year.

th

Make check, draft or money order payable to: (Public Utilities) ILLINOIS COMMERCE COMMISSION – Public Utility Fund

(Railroads) ILLINOIS COMMERCE COMMISSION – Transportation Regulatory Fund

Disclosure of information is MANDATORY and the purpose is outlined under the Public Utilities Act (220 ILCS 5/2-202) and the Illinois Commercial Transportation Law [625 ILCS 5/18c-1502].

Failure to provide any information could result in substantial penalties.

AGENCY USE ONLY

Posted by: ______________________

Date: ______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2