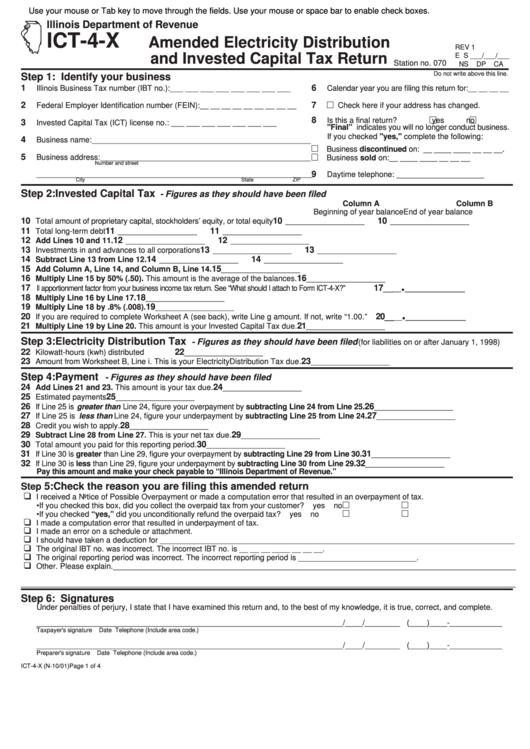

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

ICT-4-X

Amended Electricity Distribution

REV 1

and Invested Capital Tax Return

E S ___/___/___

Station no. 070

NS

DP

CA

Do not write above this line.

Step 1: Identify your business

1

6

Illinois Business Tax number (IBT no.):

___ ___ ___ ___ ___ ___ ___ ___

Calendar year you are filing this return for:__ __ __ __

2

7

Federal Employer Identification number (FEIN): __ __ __ __ __ __ __ __ __

Check here if your address has changed.

8

Is this a final return?

yes

no

3

Invested Capital Tax (ICT) license no.: ___ ___ ___ ___ ___ ___ ___

"Final” indicates you will no longer conduct business.

If you checked "yes," complete the following:

4

Business name:__________________________________________________

Business discontinued on: __ __ __ __ __ __ __ __.

5

Business address:________________________________________________

Business sold on: __ __ __ __ __ __ __ __

Number and street

_______________________________________________________________

9

Daytime telephone: ____________________

City

State

ZIP

Step 2: Invested Capital Tax

- Figures as they should have been filed

Column A

Column B

Beginning of year balance

End of year balance

10

10

10

Total amount of proprietary capital, stockholders’ equity, or total equity

__________________

__________________

11

11

11

Total long-term debt

__________________

__________________

12

12

12

Add Lines 10 and 11.

__________________

__________________

13

13

13

Investments in and advances to all corporations

__________________

__________________

14

14

14

Subtract Line 13 from Line 12.

__________________

__________________

15

15

Add Column A, Line 14, and Column B, Line 14.

__________________

16

16

Multiply Line 15 by 50% (.50). This amount is the average of the balances.

__________________

.

17

17__

Il apportionment factor from your business income tax return. See “What should I attach to Form ICT -4-X?”

__

______________

18

18

Multiply Line 16 by Line 17.

__________________

19

19

Multiply Line 18 by .8% (.008).

__________________

.

20

20__

If you are required to complete Worksheet A (see back), write Line g amount. If not, write “1.00.”

__

______________

21

21

Multiply Line 19 by Line 20. This amount is your Invested Capital Tax due.

__________________

Step 3: Electricity Distribution Tax

- Figures as they should have been filed

(for liabilities on or after January 1, 1998)

22

22

Kilowatt-hours (kwh) distributed

__________________

23

23

Amount from Worksheet B, Line i. This is your ElectricityDistribution Tax due.

__________________

Step 4: Payment

- Figures as they should have been filed

24

24

Add Lines 21 and 23. This amount is your tax due.

__________________

25

25

Estimated payments

__________________

26

26

If Line 25 is greater than Line 24, figure your overpayment by subtracting Line 24 from Line 25.

__________________

27

27

If Line 25 is less than Line 24, figure your underpayment by subtracting Line 25 from Line 24.

__________________

28

28

Credit you wish to apply.

__________________

29

29

Subtract Line 28 from Line 27. This is your net tax due.

__________________

30

30

Total amount you paid for this reporting period.

__________________

31

31

If Line 30 is greater than Line 29, figure your overpayment by subtracting Line 29 from Line 30.

__________________

32

32

If Line 30 is less than Line 29, figure your underpayment by subtracting Line 30 from Line 29.

__________________

Pay this amount and make your check payable to “Illinois Department of Revenue.”

5: Check the reason you are filing this amended return

Step

I received a Notice of Possible Overpayment or made a computation error that resulted in an overpayment of tax.

• If you checked this box, did you collect the overpaid tax from your customer?

yes

no

• If you checked “yes,” did you unconditionally refund the overpaid tax?

yes

no

I made a computation error that resulted in underpayment of tax.

I made an error on a schedule or attachment.

I should have taken a deduction for _________________________________________________________________________________

The original IBT no. was incorrect. The incorrect IBT no. is __ __ __ __ __ __ __ __.

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

Other. Please explain.____________________________________________________________________________________________

_________________________________________________________________________________________________________________

Step 6: Signatures

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

__________________________________________________________________

____/____/________ (____)____-____________

Taxpayer's signature

Date

Telephone (Include area code.)

__________________________________________________________________

____/____/________ (____)____-____________

Preparer's signature

Date

Telephone (Include area code.)

ICT-4-X (N-10/01)

Page 1 of 4

1

1 2

2