Delaware Form De2210-I - Instructions For Completion Of Form De-2210

ADVERTISEMENT

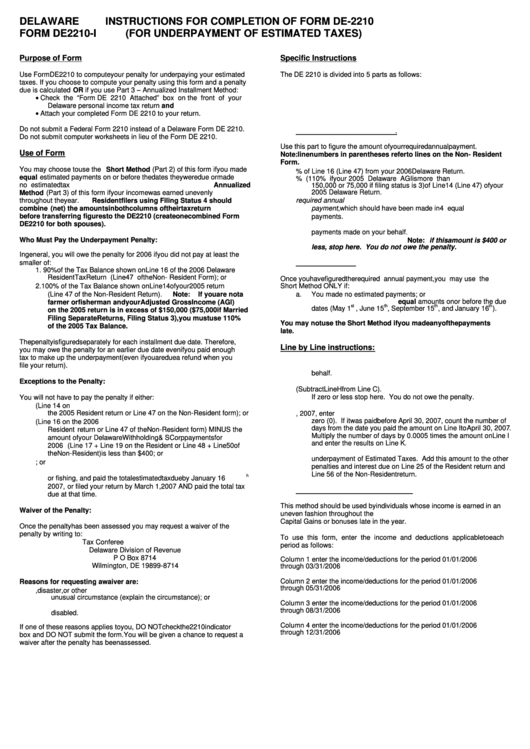

DELAWARE

INSTRUCTIONS FOR COMPLETION OF FORM DE-2210

FORM DE2210-I

(FOR UNDERPAYMENT OF ESTIMATED TAXES)

Purpose of Form

Specific Instructions

Use Form DE2210 to compute your penalty for underpaying your estimated

The DE 2210 is divided into 5 parts as follows:

taxes. If you choose to compute your penalty using this form and a penalty

1.

The Required Annual Payment

due is calculated OR if you use Part 3 – Annualized Installment Method:

2.

The Short Method

•

Check the “Form DE 2210 Attached” box on the front of your

3.

Annualized Income Installment Method

Delaware personal income tax return and

4.

Computation of the Over/Underpayment

•

Attach your completed Form DE 2210 to your return.

5.

Computation of the Penalty

Do not submit a Federal Form 2210 instead of a Delaware Form DE 2210.

1.

The Required Annual Payment.

Do not submit computer worksheets in lieu of the Form DE 2210.

Use this part to figure the amount of your required annual payment.

Use of Form

Note: line numbers in parentheses refer to lines on the Non- Resident

Form.

You may choose to use the Short Method (Part 2) of this form if you made

A.

Enter 90% of Line 16 (Line 47) from your 2006 Delaware Return.

equal estimated payments on or before the dates they were due or made

B.

Enter 100% (110% if your 2005 Delaware AGI is more than

no estimated tax payments.

You may choose to use the Annualized

150,000 or 75,000 if filing status is 3) of Line 14 (Line 47) of your

2005 Delaware Return.

Method (Part 3) of this form if your income was earned unevenly

throughout the year. Resident filers using Filing Status 4 should

C.

Enter the smaller of Line A or B. This is your required annual

combine (net) the amounts in both columns of their tax return

payment,

which

should

have

been

made

in

4 equal

before transferring figures to the DE2210 (create one combined Form

payments.

DE2210 for both spouses).

D.

Enter the total of your Delaware Withholding and any S Corp

payments made on your behalf.

Who Must Pay the Underpayment Penalty:

E.

Subtract Line D from Line C. Note: if this amount is $400 or

less, stop here. You do not owe the penalty.

In general, you will owe the penalty for 2006 if you did not pay at least the

smaller of:

2.

The Short Method.

1. 90% of the Tax Balance shown on Line 16 of the 2006 Delaware

Resident Tax Return (Line 47 of the Non- Resident Form); or

Once you have figured the required annual payment, you may use the

Short Method ONLY if:

2. 100% of the Tax Balance shown on Line 14 of your 2005 return

(Line 47 of the Non-Resident Return).

Note:

If you are not a

a.

You made no estimated payments; or

b.

You paid estimated tax in 4 equal amounts on or before the due

farmer or fisherman and your Adjusted Gross Income (AGI)

st

th

th

th

dates (May 1

, June 15

, September 15

, and January 16

).

on the 2005 return is in excess of $150,000 ($75,000 if Married

Filing Separate Returns, Filing Status 3), you must use 110%

You may not use the Short Method if you made any of the payments

of the 2005 Tax Balance.

late.

The penalty is figured separately for each installment due date. Therefore,

Line by Line instructions:

you may owe the penalty for an earlier due date even if you paid enough

tax to make up the underpayment (even if you are due a refund when you

F.

Enter the total of your Estimated Tax payments.

file your return).

G.

Enter Delaware Withholding and S Corp payments made in your

behalf.

Exceptions to the Penalty:

H.

Add lines F and G.

I.

Total Underpayment for the year (Subtract Line H from Line C).

If zero or less stop here. You do not owe the penalty.

You will not have to pay the penalty if either:

J.

Multiply Line I times 0.12.

1. You had no Delaware tax liability in the previous year (Line 14 on

the 2005 Resident return or Line 47 on the Non-Resident form); or

K.

If the amount on Line I was paid on or after April 30, 2007, enter

zero (0). If it was paid before April 30, 2007, count the number of

2. The tax liability minus non-refundable credits (Line 16 on the 2006

days from the date you paid the amount on Line I to April 30, 2007.

Resident return or Line 47 of the Non-Resident form) MINUS the

Multiply the number of days by 0.0005 times the amount on Line I

amount of your Delaware Withholding & S Corp payments for

and enter the results on Line K.

2006 (Line 17 + Line 19 on the Resident or Line 48 + Line 50 of

L.

Subtract Line K from Line J. This is your penalty for

the Non-Resident) is less than $400; or

underpayment of Estimated Taxes. Add this amount to the other

3. You were a Part-Year resident during 2006; or

penalties and interest due on Line 25 of the Resident return and

4. You derived at least 2/3 of your Gross Income from farming

Line 56 of the Non-Resident return.

h

or fishing, and paid the total estimated tax due by January 16

2007, or filed your return by March 1, 2007 AND paid the total tax

3.

The Annualized Installment Method.

due at that time.

This method should be used by individuals whose income is earned in an

Waiver of the Penalty:

uneven fashion throughout the year. Examples would be receiving large

Capital Gains or bonuses late in the year.

Once the penalty has been assessed you may request a waiver of the

penalty by writing to:

To use this form, enter the income and deductions applicable to each

Tax Conferee

period as follows:

Delaware Division of Revenue

P O Box 8714

Column 1 enter the income/deductions for the period 01/01/2006

Wilmington, DE 19899-8714

through 03/31/2006

Column 2 enter the income/deductions for the period 01/01/2006

Reasons for requesting a waiver are:

through 05/31/2006

1.

The underpayment was due to a casualty, disaster, or other

unusual circumstance (explain the circumstance); or

Column 3 enter the income/deductions for the period 01/01/2006

2.

In 2005 or 2006 you retired after age 62 or became

through 08/31/2006

disabled.

Column 4 enter the income/deductions for the period 01/01/2006

If one of these reasons applies to you, DO NOT check the 2210 indicator

through 12/31/2006

box and DO NOT submit the form. You will be given a chance to request a

waiver after the penalty has been assessed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2