Form Rev-1096-I - Instructions For Completing Liquid Fuels And Fuels Tax Reports

ADVERTISEMENT

REV-1096-I MF (01-13)

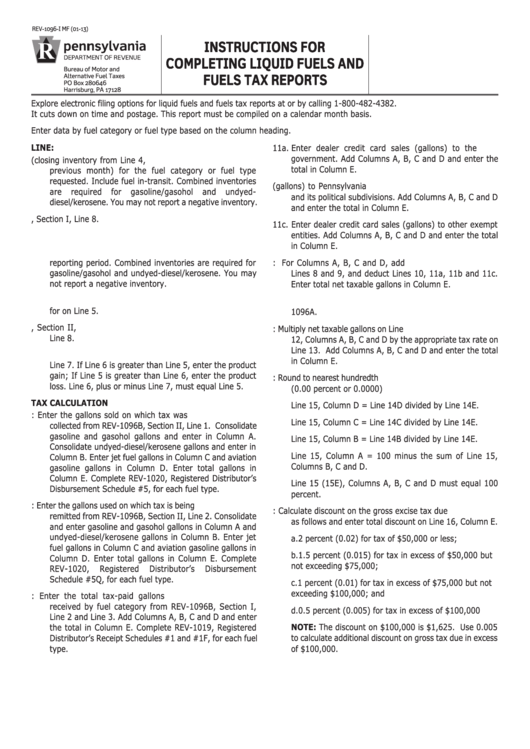

INSTRUCTIONS FOR

COMPLETING LIQUID FUELS AND

Bureau of Motor and

FUELS TAX REPORTS

Alternative Fuel Taxes

PO Box 280646

Harrisburg, PA 17128

Explore electronic filing options for liquid fuels and fuels tax reports at or by calling 1-800-482-4382.

It cuts down on time and postage. This report must be compiled on a calendar month basis.

Enter data by fuel category or fuel type based on the column heading.

LINE:

11a. Enter dealer credit card sales (gallons) to the U.S.

government. Add Columns A, B, C and D and enter the

1.

Enter opening inventory (closing inventory from Line 4,

total in Column E.

previous month) for the fuel category or fuel type

requested. Include fuel in-transit. Combined inventories

11b. Enter dealer credit card sales (gallons) to Pennsylvania

are

required

for

gasoline/gasohol

and

undyed-

and its political subdivisions. Add Columns A, B, C and D

diesel/kerosene. You may not report a negative inventory.

and enter the total in Column E.

2.

Enter total receipts from REV-1096B, Section I, Line 8.

11c. Enter dealer credit card sales (gallons) to other exempt

3.

Add Lines 1 and 2 and enter total inventory plus receipts.

entities. Add Columns A, B, C and D and enter the total

in Column E.

4.

Enter the physical closing inventory for the end of the

reporting period. Combined inventories are required for

12. Net Taxable Gallons: For Columns A, B, C and D, add

gasoline/gasohol and undyed-diesel/kerosene. You may

Lines 8 and 9, and deduct Lines 10, 11a, 11b and 11c.

not report a negative inventory.

Enter total net taxable gallons in Column E.

5.

Subtract Line 4 from Line 3 and enter gallons to account

13. The appropriate tax rate is printed in each column of REV-

for on Line 5.

1096A.

6.

Enter total disbursements from REV-1096B, Section II,

14. Gross Excise Tax Due: Multiply net taxable gallons on Line

Line 8.

12, Columns A, B, C and D by the appropriate tax rate on

Line 13. Add Columns A, B, C and D and enter the total

7.

Subtract Line 6 from Line 5 and enter the difference on

in Column E.

Line 7. If Line 6 is greater than Line 5, enter the product

gain; If Line 5 is greater than Line 6, enter the product

15. Percent of Gross Tax to Total: Round to nearest hundredth

loss. Line 6, plus or minus Line 7, must equal Line 5.

(0.00 percent or 0.0000)

TAX CALCULATION

Line 15, Column D = Line 14D divided by Line 14E.

8.

Taxable Sales: Enter the gallons sold on which tax was

Line 15, Column C = Line 14C divided by Line 14E.

collected from REV-1096B, Section II, Line 1. Consolidate

gasoline and gasohol gallons and enter in Column A.

Line 15, Column B = Line 14B divided by Line 14E.

Consolidate undyed-diesel/kerosene gallons and enter in

Line 15, Column A = 100 minus the sum of Line 15,

Column B. Enter jet fuel gallons in Column C and aviation

Columns B, C and D.

gasoline gallons in Column D. Enter total gallons in

Column E. Complete REV-1020, Registered Distributor’s

Line 15 (15E), Columns A, B, C and D must equal 100

Disbursement Schedule #5, for each fuel type.

percent.

9.

Taxable Use: Enter the gallons used on which tax is being

16E. Discount: Calculate discount on the gross excise tax due

remitted from REV-1096B, Section II, Line 2. Consolidate

as follows and enter total discount on Line 16, Column E.

and enter gasoline and gasohol gallons in Column A and

undyed-diesel/kerosene gallons in Column B. Enter jet

a. 2 percent (0.02) for tax of $50,000 or less;

fuel gallons in Column C and aviation gasoline gallons in

b. 1.5 percent (0.015) for tax in excess of $50,000 but

Column D. Enter total gallons in Column E. Complete

not exceeding $75,000;

REV-1020,

Registered

Distributor’s

Disbursement

Schedule #5Q, for each fuel type.

c. 1 percent (0.01) for tax in excess of $75,000 but not

exceeding $100,000; and

10. Tax-Paid Purchases: Enter the total tax-paid gallons

received by fuel category from REV-1096B, Section I,

d. 0.5 percent (0.005) for tax in excess of $100,000

Line 2 and Line 3. Add Columns A, B, C and D and enter

NOTE: The discount on $100,000 is $1,625. Use 0.005

the total in Column E. Complete REV-1019, Registered

Distributor’s Receipt Schedules #1 and #1F, for each fuel

to calculate additional discount on gross tax due in excess

type.

of $100,000.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2