Consumer Use Tax Return - City Of Littleton

ADVERTISEMENT

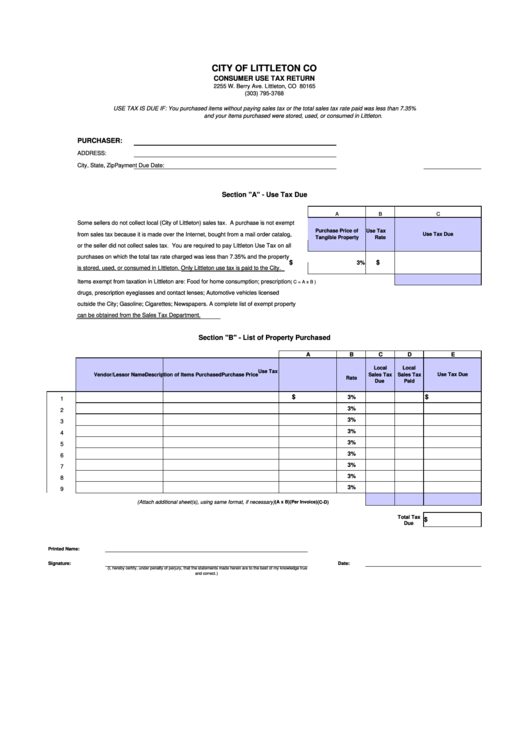

CITY OF LITTLETON CO

CONSUMER USE TAX RETURN

2255 W. Berry Ave. Littleton, CO 80165

(303) 795-3768

USE TAX IS DUE IF: You purchased items without paying sales tax or the total sales tax rate paid was less than 7.35%

and your items purchased were stored, used, or consumed in Littleton.

PURCHASER:

ADDRESS:

City, State, Zip

Payment Due Date:

Section "A" - Use Tax Due

A

B

C

Some sellers do not collect local (City of Littleton) sales tax. A purchase is not exempt

Purchase Price of

Use Tax

from sales tax because it is made over the Internet, bought from a mail order catalog,

Use Tax Due

Tangible Property

Rate

or the seller did not collect sales tax. You are required to pay Littleton Use Tax on all

purchases on which the total tax rate charged was less than 7.35% and the property

$

$

3%

is stored, used, or consumed in Littleton. Only Littleton use tax is paid to the City.

Items exempt from taxation in Littleton are: Food for home consumption; prescription

( C = A x B )

drugs, prescription eyeglasses and contact lenses; Automotive vehicles licensed

outside the City; Gasoline; Cigarettes; Newspapers. A complete list of exempt property

can be obtained from the Sales Tax Department.

Section "B" - List of Property Purchased

A

B

C

D

E

Local

Local

Use Tax

Vendor/Lessor Name

Description of Items Purchased

Purchase Price

Sales Tax

Sales Tax

Use Tax Due

Rate

Due

Paid

$

$

3%

1

3%

2

3%

3

3%

4

3%

5

3%

6

3%

7

3%

8

3%

9

(Attach additional sheet(s), using same format, if necessary)

(A x B)

(Per Invoice)

(C-D)

Total Tax

$

Due

Printed Name:

Signature:

Date:

(I, hereby certify, under penalty of perjury, that the statements made herein are to the best of my knowledge true

and correct.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1